Beyond a Simple DEX: What Jupiter Is and How It Works

December 4, 2025

11 min

What is Jupiter and how does it work: the DeFi Super-app on Solana, managing every aspect of your on-chain life.

The Solana blockchain has rapidly established itself as one of the most “DeFi-friendly” networks in the Web3 landscape, acclaimed for its high speed and negligible transaction costs.

However, its rapid expansion has caused growing ecosystem fragmentation, forcing users to juggle countless separate protocols for their financial operations.

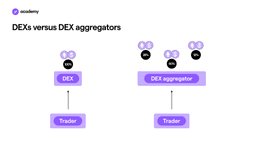

It is in this scenario of complexity that Jupiter (JUP) emerges. Starting as a simple DEX Aggregator – the flagship product ensuring users get the best market rate by routing liquidity across Solana’s leading exchanges – Jupiter is now transforming into a veritable “DeFi Super-App”.

By integrating a new perpetual exchange market, lend/borrow services, a prediction market, and much more, Jupiter aims for one goal: to make this Dapp the single, central access point for every aspect of financial life on-chain on Solana.

But what is Jupiter, and how does it work? Find out in this detailed guide.

What is Jupiter’s DEX Aggregator and How Does It Work?

Jupiter’s fame is intrinsically linked to its innovative DEX aggregator, the product that solved one of DeFi on Solana’s most annoying problems: liquidity fragmentation.

The Solana ecosystem hosts numerous decentralised exchanges (DEXs), such as Raydium, Orca, and Phoenix, each with its own liquidity pools. This means that, depending on the DEX used, the final price of a token and the relative slippage can vary significantly for the user.

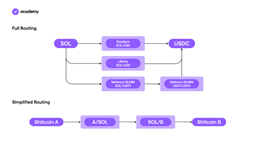

But how specifically does Jupiter’s DEX work? Jupiter acts as a hyper-efficient smart router. When a user initiates a swap request (for example, from SOL to USDC), the aggregator does not consult a single liquidity pool. Instead, it performs an instant scan across all connected exchange protocols to find the best exchange rate for the user.

In addition to this mechanism, there is split routing, which breaks a significant transaction into smaller sub-transactions, routing each through the most advantageous path (even if this means using multiple DEXs simultaneously), thus minimising price impact and overall fees.

This combination of factors offers the end user a series of significant advantages compared to using a “simple” DEX, including:

- Best Price Guaranteed: The primary function is to ensure the user always obtains the most competitive exchange rate available on the entire Solana network.

- Time Saving: The need to manually compare prices across platforms is eliminated, significantly optimising users’ time.

- Deep Liquidity: By combining the pools of all DEXs, Jupiter offers much deeper perceived liquidity, making it the ideal environment even for high-volume trades that would otherwise suffer high slippage on a single protocol.

In summary, the aggregator has made Jupiter the default liquidity portal for anyone operating on Solana, setting a precedent for an efficient and optimised user experience.

Do you want to delve deeper into the functioning of the Solana blockchain and understand why it is considered one of the most “DeFi-friendly” networks in the entire Web3 ecosystem?You can find out by reading the article “Solana: The Blockchain for Scalable Dapps”.

The Features Transforming Jupiter into a DeFi Super-app

The valid proof of Jupiter’s ambition lies in its rapid evolution beyond the function of an exchange aggregator. To merit the title of “DeFi Super-app”, the platform has integrated complex financial instruments that traditionally required navigating distinct protocols.

Let us therefore discover, one by one, these financial instruments integrated within Jupiter’s DeFi Super-app.

Jupiter Perpetual Exchange

One of the most significant and technically advanced integrations is undoubtedly the Jupiter perpetual exchange. But what are perpetual futures? They are derivative instruments that allow traders to speculate on the future price trend of assets like Bitcoin, Ethereum, or Solana using leverage, without having an expiration date (unlike traditional futures).

This functionality is crucial for a complete DeFi platform, as it directly bridges the historical gap in terms of derivative financial products compared to centralised exchanges (CEXs), whilst remaining completely decentralised (non-custodial).

Through the Jupiter perpetual exchange, users operate directly from their wallets, maintaining full custody of their funds and bypassing any KYC (Know Your Customer) requirements, thus making Jupiter the ultimate destination for expert traders on Solana.

If you want to discover more about what futures and perpetual DEXs are and how they work, the article “Futures: What Are They and How Do They Work?” is for you.

Jupiter Lend: Capital Management and Maximisation

A financial ecosystem cannot be called complete without tools for dynamic capital management. The introduction of Jupiter Lend addresses this need by creating an internal capital market:

- Lending: Users can deposit their cryptocurrencies (stablecoins or volatile assets) into dedicated lending pools. In return, they earn a passive yield from the interests paid by borrowers. This transforms idle assets into sources of constant income.

- Borrowing: Allows users to deposit an asset as collateral to borrow another asset. This functionality is essential for various financial strategies, such as accessing immediate liquidity for expenses or for additional investments without liquidating one’s positions (for example, selling SOL).

By integrating lending directly with trading, Jupiter creates a virtuous cycle in which liquidity is utilised, maximised, and reinvested within the same platform.

Jupiter Prediction Market

Following the significant adoption and success of major existing Prediction Markets like Polymarket,an apparentr and strong demand emerged from the Solana community for a native solution. To capitalise on this demand and further expand the ecosystem, the Jupiter team launched the Jupiter Prediction Market.

The inclusion of this product adds a dimension of decentralised speculation that transcends pure finance. In prediction markets, users bet, in a completely permissionless manner, on the future outcomes of specific events (for example, the year-end closing price of an asset or the result of relevant political/social events).

This product definitely fills a strategic market gap in the Solana DeFi landscape, significantly expanding Jupiter’s user base and attracting speculators and traders seeking a permissionless, non-custodial environment to operate prediction markets on Solana.

Additional Trading Features

To complete the offer and improve usability, Jupiter has recently integrated additional crucial tools that elevate the trading experience, further confirming its role as an absolute leader in the Solana DeFi market. These tools bring features typical of CEXs into a decentralised environment:

- Limit Orders: Allow users to set automatic trades that execute only when the price of an asset reaches a predefined level.

- Dollar-Cost Averaging (DCA): Allows automating purchases at regular intervals, reducing the impact of market volatility on the average investment.

All these features, encapsulated in a single user interface, are not a simple bundle of products, but the demonstration that Jupiter is building the definitive financial operating system within Solana.

The JUP Token: Tokenomics and Governance

Jupiter’s evolution into a Super-App is inseparable from its native governance token, JUP.

Tokenomics

Jupiter’s philosophy is based on a clear, transparent division: a total supply of 10 billion JUP, distributed in a perfectly equal manner between the community and the development team.

50% to the Community: Airdrops and Supporter Fund

Jupiter’s primary goal is to return value to those who believed in the project. For this reason, 5 billion JUP (50% of the total) have been allocated to the community, with a clear and scheduled distribution plan:

- Four-Phase Airdrop: A large part of these funds — 4 billion JUP — is destined for airdrops, distributed strategically across four annual rounds the team has nicknamed “Jupuary” (a pun on Jupiter and January). To date, the first two airdrops have been completed (January 2024 and January 2025), leaving two rounds scheduled for January 2026 and January 2027. This diluted release schedule, over time, is fundamental to maximising impact on the network and incentivising long-term loyalty.

- The Supporter Fund: The remaining billion is reserved for grants for future strategic supporters, a fund whose allocation will be entirely decided by the nascent Jupiter DAO (Decentralised Autonomous Organisation), a clear sign of decentralisation.

50% to the Team: Security and Sustainability

The team manages the remaining 5 billion JUP to ensure sustainability and future strategic vision:

- Team Vesting: A significant slice, 2 billion JUP, is destined for current members of the development team. However, this portion is subject to a 2-year vesting period, demonstrating the team’s long-term commitment.

- Strategic Reserve: Another 2 billion JUP constitute the strategic reserve for future team members, investors, and alignment with other ecosystem stakeholders. This reserve is also bound by a lock-up of at least one year.

- Immediate Liquidity: The last billion is dedicated to immediate liquidity provision needs.

Governance and Decision-Making Power

JUP serves as the primary governance token, granting its holders direct decision-making power over the evolution of the Jupiter ecosystem. Voting takes place on-chain through the Jupiter DAO, ensuring that the platform’s development and strategic direction are actively guided by users.

JUP holders vote on crucial issues, including:

- Treasury Management: Determination and strategic allocation of the DAO’s financial reserves.

- Product Development: Voting and approval of new features and protocols (via JIPs – Jupiter Improvement Proposals).

- Operational Parameter Regulation: Management of crucial parameters of the different integrated protocols (e.g., updating exchange fees or Perpetual Exchange parameters).

In summary, the JUP token is not just an asset; it is the key to users’ financial and decision-making sovereignty and is fundamental for attracting new capital and users, acting as a catalyst for innovation across the entire Solana ecosystem.

Conclusions

Jupiter’s journey is an emblematic example of rapid and strategic evolution in the Web3 landscape. Born as a simple DEX Aggregator, as this article shows, the project has quickly surpassed that initial role.

Today, thanks to its expansion into fundamental financial segments such as leveraged trading (Perpetual DEX), lending, and prediction markets, Jupiter has transformed into a complete financial ecosystem, directly addressing fragmentation on Solana by providing a unified access point for users.

Considering the breadth of its offering and its aggregation infrastructure, it is no exaggeration to say that Jupiter is laying the foundations to become the leading and indispensable portal for the entire on-chain experience on Solana.Its ability to unite liquidity and advanced tools fully justifies the title of “DeFi Super-App”, consolidating its position as market leader for the next generation of decentralised finance.