Is Bitcoin’s price predictable? The Power Law explained

December 24, 2024

12 min

According to the Bitcoin Power Law Theory, Bitcoin (BTC) doesn’t follow conventional financial or economic principles but adheres to power laws, making its price more predictable.

The “Bitcoin Power Law Theory, developed by Giovanni Santostasi, a physicist and researcher, suggests that Bitcoin behaves more like a city or an organism than a financial asset. Its price trends and the overall growth of its ecosystem are governed by power laws, which introduce regularity, cyclicality, and a remarkable level of predictability.

Understanding Power Laws

Power laws, expressed mathematically as y=axn, are commonly found in nature and social phenomena, such as the growth patterns of cities or nations. A system follows a power law when its output continuously becomes input, creating an iterative process.

For instance, consider a geographical area where a pandemic spreads among the population. Initially, the number of infected individuals is small. However, the spread accelerates exponentially as those infected (output) infect others (input). This iterative process—where the output becomes the input for the next phase—follows a power law. In simple terms, the spread isn’t constant but grows exponentially unless mitigated by interventions like vaccines or containment measures.

Similarly, the Bitcoin network demonstrates such iterative dynamics. Parameters like the current hash rate influence future hash rates, and existing users encourage new users to join the network.

The Bitcoin ecosystem and Power Laws

Bitcoin’s ecosystem growth trajectory resembles the graph of a controlled pandemic, which expands following a power law but stabilises with interventions. Specifically, Bitcoin’s ecosystem appears to grow over time with a power exponent of three.

Let’s explore why this matters without diving too deeply into the specifics for now.

Power Law Theory applied to Bitcoin

According to its creator, the “Bitcoin Power Law Theory” is capable of predicting Bitcoin’s price with extreme precision. However, reaching this component requires a step-by-step approach, reasoning through the feedback cycle that determines the value of a single Bitcoin.

We can assume that Bitcoin’s value has increased proportionally to the square of the number of users who have adopted it. This trend is described by a fundamental principle governing the growth and influence of networks, known as Metcalfe’s Law. Coined by Robert Metcalfe, co-founder of Ethernet and a pioneer in computer networking, the law posits that the value of a network is proportional to the square of the number of connected users or devices.

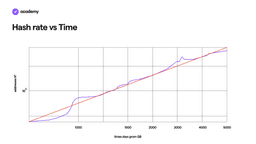

Over time, another causal relationship has become evident: Bitcoin’s value increases proportionally to the “square” of the resources dedicated to mining.This is theoretically understandable if we recognise that BTC’s price growth attracts more miners, drawn by the potential profits the activity offers.

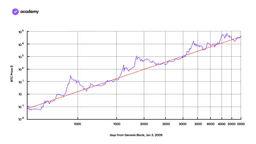

As a result, this scenario increases the hash rate — the global computational power devoted to the network. Moreover, this correlation can be verified through historical data analysis, as evidenced by the following graph supporting this theory.

A fundamental challenge resolved by Bitcoin’s design

Now, let’s address a hypothetical problem that could have impeded Bitcoin’s growth if Satoshi Nakamoto hadn’t resolved it. The progressive hash rate growth we just described could have unsustainably reduced the time required to mine a block, effectively preventing Bitcoin from functioning.

For example, a rapid hash rate increase could have reduced the block time to 10 seconds, leading to a surge of Bitcoin issuance by approximately one hundred times the normal rate.However, thanks to a mechanism known as difficulty adjustment, Bitcoin’s blockchain periodically recalibrates mining difficulty, maintaining the block extraction time at around ten minutes despite increasing hash rates. This mechanism creates a balance: as more miners join the network, the difficulty — i.e., the computational effort required to mine a block — rises.

The role of security in network growth

In the Bitcoin ecosystem, more computational power means greater security. According to Giovanni Santostasi’s theory, this increased security would, in turn, drive growth in the number of active network users. Although supported by data underpinning the Bitcoin Power Law Theory, this cause-and-effect relationship is somewhat harder to grasp.

In essence, security indirectly influences the number of BTC users and, consequently, the total number of active wallets. If the system weren’t secure, no one would invest in it.

The progressive adoption of Bitcoin continually demonstrates this principle. New individuals are drawn to this global monetary system precisely because it has never suffered technical issues, malfunctions, or attacks.

Più potenza di calcolo, nell’universo Bitcoin, significa più sicurezza, una caratteristica che a sua volta, secondo la teoria di Giovanni Santostasi, provocherebbe una crescita degli utenti attivi sulla rete. Questa relazione di causa effetto è un po’ più ostica da comprendere, benché sia comunque verificata dai dati che sostengono la Bitcoin Power Law Theory. In ogni caso, si può spiegare dicendo la sicurezza influisce indirettamente sul numero di utenti che utilizzano BTC e quindi sul totale dei portafoglio attivi, poiché se il sistema non fosse sicuro nessuno ci investirebbe.

Bitcoin Power Law Theory and network growth

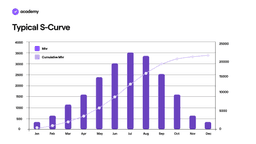

As previously mentioned, the power law theory applied to Bitcoin reveals a specific growth pattern for its network, expanding according to powers with an exponent of three. An analysis of Bitcoin’s user growth from a graphical perspective shows a trajectorydistinct from the classic exponential or “S-curve” often used to describe the adoption of new technologies, such as smartphones.

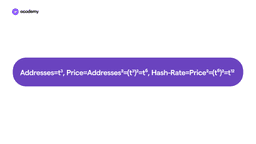

According to Giovanni Santostasi, Bitcoin’s user base does not follow a typical “S-curve” due to the earlier containment phenomenon: the difficulty adjustment mechanism. Here is how the equation for the growth of Bitcoin’s ecosystem appears, according to the Bitcoin Power Law Theory:

The implications of the Bitcoin Power Law Theory

Everything discussed in the previous section regarding the power law applied to various parameters of Bitcoin’s blockchain leads to several significant consequences. The most surprising and relevant of these, often overlooked, pertains to a concept known as scale invariance.

Definizione: Scale invariance is a system property that remains unchanged when multiplied by a common factor. In other words, the pattern that describes them remains the same regardless of the numerical values reached. For example, think of a fractal: no matter the distance from which it is observed, it is always possible to recognise the underlying pattern. This property is common in systems governed by power laws.

According to the Bitcoin Power Law Theory, Bitcoin’s price — along with all the metrics discussed in the previous section — is subject to scale invariance. This means these metrics will continue to grow as they have in the past or at least follow the same pattern. It does not matter that Bitcoin’s price has risen from well under a dollar to over $100,000.

Bitcoin as a fractal

Like a fractal, a pattern that perpetually repeats itself, Bitcoin’s growth would be predictable, systematic, and analyzable. The same holds true for its hash rate, adoption levels, and the number of active wallets.

But there’s more! According to Professor Giovanni Santostasi, even the recent capital inflows into the Bitcoin market, spurred by the approval of spot ETFs, were, in a sense, predicted by this theory. Not qualitatively, of course, but quantitatively, as they were essential for the system to grow invariantly concerning scale. In other words, Bitcoin’s trajectory appears predetermined, and barring catastrophic events, it is unlikely to deviate.

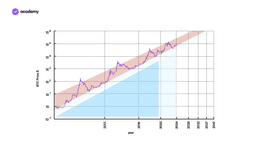

Scale invariance over 15 years

Bitcoin’s price has demonstrated scale invariance for 15 years, growing by several orders of magnitude expressible in powers of 10. This growth has brought it to its current value of approximately 105. The next checkpoint, which envisions Bitcoin reaching the next order of magnitude — 106 or one million dollars — is expected, according to the Bitcoin Power Law Theory, to occur within the next 10 years.

Logarithmic measurement of Bitcoin’s growth

The content of this section may be challenging to grasp, even according to Giovanni Santostasi himself, the first to propose this theory. This is mainly because it involves measuring Bitcoin’s price on a logarithmic scale, which is less popular and familiar than a linear one. However, this approach has demonstrated a degree of reliability in the past.

For instance, a researcher named Harold Christopher Burge successfully predicted Bitcoin’s recent price movements using these principles, as evidenced by a graph published in September 2019.

How Bitcoin “bubbles” work

Bitcoin critics emerge at the end of every cycle, often describing the cryptocurrency as a “bubble” ready to burst at any moment. And, in a way, they’re not entirely wrong. According to the theory we’re analysing, Satoshi Nakamoto engineered Bitcoin to collapse and rise again cyclically.

The nature of Bitcoin’s cycles

Bitcoin’s price growth, as previously mentioned, is intrinsically linked to increasing security. When security peaks during a given cycle, it boosts overall confidence, which quickly escalates — fueled by BTC’s rising value — into the temporary FOMO (Fear of Missing Out) characterising the most explosive phases of bull markets. During these periods, the price rises rapidly, only to crash just as quickly, or even faster, when the “bubble” bursts, bringing the market back to equilibrium.

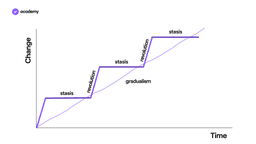

This type of growth, known in English as punctuated evolution, was theorised by Darwin to explain the evolutionary process of animal species. It involves long periods of stagnation, marked by slow growth abruptly interrupted by bursts of activity.

Why did Satoshi Nakamoto design this growth pattern?

To understand why Satoshi might have anticipated this growth pattern, we must reference Moore’s Law — the idea that global computational power doubles approximately every two years — and connect it to the difficulty adjustment concept discussed earlier in this article.

Moore’s Law would have given miners an outsized advantage without this automatic regulation. Computational power would quadruple every four years, yet mining Bitcoin would remain just as “computationally easy.”

Thanks to the gradual difficulty increases linked to the halving process, this doesn’t happen. Miners remain precariously balanced on the “razor’s edge of profitability.” Only those with the most efficient equipment can continue mining profitably.

This dynamic ensures the highest possible level of security, which, as we’ve seen, attracts new users and fosters a healthy FOMO that ultimately drives Bitcoin’s growth. In essence, even the so-called “bubbles” are, according to the Bitcoin Power Law Theory, essential to Bitcoin’s evolution

A Theory, not absolute truth

As reiterated throughout this article, the Bitcoin Power Law Theory is precisely that — a theory. It should not be viewed as absolute truth, capable of predicting Bitcoin’s price to the penny. That said, it is, in our view, one of the most fascinating frameworks we have ever analysed, and we felt compelled to summarise and simplify its content.