Sky Protocol: What It Is and How It Works

December 9, 2025

9 min

Sky Protocol evolves MakerDAO with USDS stablecoin and SKY token. Discover innovative features for a decentralised DeFi ecosystem

Decentralised Finance (DeFi) was shaped by pioneers like MakerDAO, a project that, besides introducing the concept of decentralised governance, launched Web3’s first successful decentralised stablecoin, DAI.

For over a decade, MakerDAO established itself as a backbone of DeFi: its assets, the DAI stablecoin and the MKR governance token, represented a model of stability and security in a constantly evolving world.

However, new challenges posed by the current DeFi landscape pushed the project’s governance towards an ambitious renewal plan, culminating in the transformation of MakerDAO into Sky Protocol, marking a new chapter in its evolution.

According to sources close to the project, this transformation is not a simple rebranding. Sky Protocol (or Sky) is a complete reorganisation of MakerDAO’s underlying architecture aimed at optimising the protocol for the next decade of growth and mass adoption.

As stated by founder Rune Christensen:

“Sky represents the complete transformation of Maker and encompasses all the experience the organisation has gained over the years.”

What is Sky Protocol?

What is Sky Protocol? Sky Protocol is an autonomous, decentralised monetary system that represents the evolution of the MakerDAO project. The pillars underpinning this project are essentially three:

- Decentralised Stablecoin (USDS): USDS is the stablecoin at the base of the Sky project. It is pegged to the dollar, issued through an over-collateralisation mechanism, and backed by a series of strategic assets. It is built to offer intrinsic stability and trust, without depending on central authorities.

- Decentralised Governance (SKY): Protocol management is entrusted to holders of the SKY governance token (the successor to MKR). They exercise complete control over the entire system, voting on critical parameters such as interest rates, accepted collateral types, and risk management mechanisms, whilst also benefiting from a share of the platform’s profits.

- Multi-chain Architecture: To overcome liquidity fragmentation limits, Sky Protocol has decided to operate on an expanded network of blockchains (such as Ethereum, Base, Arbitrum, Optimism, and Unichain), maximising the accessibility, efficiency, and scalability of USDS.

Sky Protocol is thus born as the evolution of its predecessor MakerDAO, following its main guidelines but simultaneously developing a new product that is even more modern, secure, and interoperable.

USDS: The Next-Generation Decentralised Stablecoin

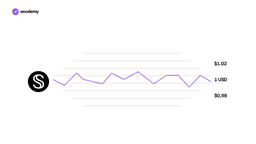

Sky Dollar (USDS) positions itself as the enhanced and advanced heir to DAI. Its fundamental objective is to maintain perfect stability with the US dollar, replicating its value on a 1:1 basis (peg), in a completely decentralised and public manner.

What distinguishes USDS from the more well-known centralised stablecoins (like USDT and USDC) is precisely its 100% decentralised and transparent nature, achieved through the collateralised debt position (CDP) mechanism, commonly known as a Vault.

What are Vaults?

Vaults are fundamental Smart Contracts that operate as digital safes within the Sky Protocol ecosystem. Their primary function is to allow users to mint the USDS stablecoin by locking a cryptocurrency as collateral (or guarantee) in the Vault.

“Crucial for the security and stability of the system is the over-collateralisation mechanism: the value of the deposited guarantee is always higher than the value of the USDS generated. This requirement ensures that USDS is constantly backed by a superior value, making it secure and stable.”

Since the entire process occurs via open-source smart contracts, the whole ecosystem is publicly verifiable, ensuring maximum transparency and eliminating any dependence on centralised authorities or entities.

What advantages does a decentralised model offer over a centralised one?

The main advantage consists of eliminating dependence on a single authority.

A 100% decentralised stablecoin offers its users access to a stable representation of the dollar without incurring any potential risk deriving from the presence of a centralised entity, such for example:

- Censorship Resistance: This is the fundamental characteristic of a decentralised system, in which no single authority or central entity can arbitrarily or authoritatively block, confiscate, or prevent the movement of a user’s funds, unlike in centralised systems.

- Transparency: The protocol’s functioning and guarantees (collateral) are visible and verifiable by anyone on the blockchain.

In summary, decentralisation transforms a financial resource into an incorruptible public service, requiring no trust in intermediaries.

SKY: The New Governance Token

What is the SKY token and what is it for? The SKY token was introduced as a new fundamental asset for the governance and security of Sky Protocol, officially replacing MKR. The transition from MKR to SKY is facilitated through an upgrade that users can execute from the dedicated interface on the official sky.money website.

Administration Power

Imagine the SKY token as the voting shares of a decentralised bank. Whoever owns SKY holds the fundamental decision-making power over the entire system, exercising that authority through the Sky voting portal.

Just like a board of directors, SKY token holders have the power to vote on existing proposals or to present new initiatives to modify the protocol’s functioning.

Their central decision-making powers include:

- Technical Evolutions: SKY token holders can vote on how and when to implement improvements or changes to the underlying software via specific updates.

- Economic Management: They define the system’s key rates:

- The stability fee which is the commission required to mint the USDS stablecoin.

- The Sky Savings Rate (SSR) is the passive interest rate earned by those holding USDS in savings.

Profit and Collateralisation: The Staking Engine

Beyond administrative functions, SKY token holders benefit from a share of the protocol’s profits generated by the Staking Engine.

The Staking Engine is a fundamental module of the Sky Protocol and offers SKY holders several advantages:

- Rewards and Profits: By staking their SKY tokens in the Staking Engine, users receive rewards from a portion of the application’s profits.

- Collateralisation and Lending: Through the Staking Engine, users can create one or more positions to generate and borrow USDS (the protocol’s stablecoin) using staked SKY tokens as collateral.

Distinctive Features of Sky Protocol

Maintaining its pioneering, avant-garde nature, Sky Protocol has introduced innovative features in this latest update that clearly distinguish it from its predecessor and competitors.

With the clear objective of ensuring an increasingly efficient, secure, and interoperable protocol, the governance of Sky Protocol has launched two key innovations: the Sky Savings Rate (SSR) and SkyLink.

Sky Savings Rate (SSR)

Their philosophy perfectly summarises the concept: “Get rewarded for saving, without giving up control”.

The Sky Savings Rate (SSR) is the successor to MakerDAO’s Dai Savings Rate (DSR). It is a crucial mechanism that offers USDS holders an interest rate directly on their tokens, eliminating the need to lock them into third-party platforms.

This interest rate is primarily derived from stability fees, thereby creating a further incentive for USDS holders to maintain and grow their capital within the protocol.

SkyLink

If bridging problems have historically compromised DeFi security and interoperability, SkyLink is Sky Protocol’s answer to this challenge.

SkyLink is a native, crucial cross-chain bridge designed to securely integrate USDS and SKY across different blockchains, including Layer 1 and Layer 2 (such as Ethereum, Base, Arbitrum, and Optimism).

The goal is not simply to move tokens, but to create a veritable universal liquidity layer. By enabling secure, native transfers, Sky Protocol eliminates reliance on vulnerable third-party solutions, positioning USDS as the ideal asset for fluid, frictionless liquidity across the entire multi-chain ecosystem.

Conclusions

Sky Protocol represents a clear evolution over the MakerDAO protocol. Its unique technical characteristics — such as the Sky Savings Rate (SSR), SkyLink, and the Staking Engine — combined with its 100% decentralised nature, position it as one of the most interesting and genuinely cyberpunk (or natively trustless) projects in the entire Web3.

The SKY token, which, as we have seen, represents in turn an evolution of MKR, offering holders greater opportunities in both governance and yield, represents a further significant step forward compared to the old token, thus opening the doors to a new slice of even more demanding investors.

However, it will be the crucial challenges, such as regulatory ones and the effective aggregation of Real World Assets (RWA), that determine its final success. In this context, Sky Protocol’s decentralised governance is the winning asset that positions it as the leading protocol for decentralised stablecoins and the entire Web3.