Fear and Greed Index: meaning and calculation

August 20, 2023

11 min

Finding out the meaning of the Fear and Greed Index is the first step if you want to learn more about market psychology. It is in fact a financial indicator that attempts to estimate the prevailing sentiment, i.e. the attitude and emotions of investors towards a particular asset at a given time. So let’s start by analysing the emotions that the Fear and Greed Index takes into account.

What does the Fear and Greed Index measure?

To determine the meaning of the Fear and Greed Index, let’s start with the emotions it gauges. Defining them will help us understand what it means for investors, traders, and for you personally.

According to the theory of market cycles, price movements oscillate in a continuous cycle consisting of 4 phases, like the 4 seasons: accumulation, run-up, distribution and run-down.

A phase of rising prices (bull market) is always followed by a period of falling prices (bear market). Not all market participants are familiar with these cycles, and it is not predictable when one of these phases begins or ends.

For this reason, investors react in irrational ways to price fluctuations, in turn influencing their performance. The stronger the emotions that drive investors, the stronger the impact on price.

There are primarily two emotions that drive investment choices and that lie at the ends of a spectrum: fear and greed.

Of course, there are many others that colour the phases of market cycles, such as disappointment, enthusiasm, FOMO, doubt and so on. Behavioural finance studies these and other psychological effects that are activated during the market experience. However, fear and greed, being the two extremes, are easier to detect.

Fear usually peaks during bear markets, especially following sudden drops that last a long time or pile up one after the other.

Just the opposite, greed is fuelled by the bull market, whose upward momentum foments investors’ enthusiasm and ambition to reap maximum profits.

Let us take a moment to explore these two sentiments, to better appreciate the Fear and Greed index meaning for the market.

What are fear and greed?

First of all, what is the meaning of Fear? This is a feeling that lurks behind a lot of negative behaviour and takes many forms: fear of losing one’s possessions, of making mistakes, of the unknown, of the future, insecurity, anxiety. The most positive nuance of fear is caution, which can be valuable to an investor, yet at the extreme end of the Fear and Greed Index ‘fear’ means ‘irrational and uncontrolled attitude’.

Greed is more specific than fear, and is defined as “the strong desire for more wealth and power than an individual needs”. Not to be confused with avarice, which is instead the tendency to withhold and defend one’s wealth.

This feeling has two sides: on the one hand it has a selfish, materialistic root, it leads to eternal dissatisfaction and because of the strong adrenalin charge it induces in our brain, it can cause addiction.

On the other hand, some scholars argue its importance for human survival, as an evolutionary trait that promotes self-preservation. In this regard, the figure of Gordon Gekko, the protagonist of the 1987 film ‘Wall Street’ who argues that ‘Greed is good’, is iconic. This provocative character, however, was intended as a warning about the consequences of greed. For if it ends up dominating our lives, it can bring great harm and unhappiness.

Some scholars, including Lola Lopes, believe instead that it is a different spectrum that drives markets, that between fear and hope. In this configuration, if fear drives investors to ask: “how bad can it get?”, hope changes the perspective: “how good can it get?”.

To confirm this thesis, we observe that even outside finance, the terms have literally opposite meanings. Moreover, while greed is a sentiment that finds a place in certain psychological profiles, hope is innate in most people, and is common to the greedy, the needy, the ambitious, and the dreamers.

In rebuttal, however, we point out that the term ‘hope’ fails to describe that feeling of ‘blind optimism’ that would correspond to the opposite of extreme fear; ‘greed’, on the other hand, better captures that tinge of irrationality that typically emerges in a financial market in turmoil.

Moreover, let’s remember the main meaning of fear and greed index and the sentiments it measures. What we are interested in observing for the purposes of investing or trading are extreme feelings, therefore dangerous for the lucidity and rationality required in this context.

What this index attempts to estimate is clear, but how does one reduce complex human feelings to a number? Let us see with some examples of real indices.

Fear and Greed Index calculation

When we ask about the meaning of the Fear and Greed Index, we have to realise that there is not just one in practice, but there are a few main ones. The two most famous indices in traditional finance are the VIX, the volatility index of the CBOE (Chicago Board Options Exchange), and the CNN Fear & Greed index. In the crypto market, on the other hand, we have the crypto index developed by Alternative.me.

CBOE volatility index (VIX)

The VIX is based on two assumptions:

- That the S&P500 index is representative of the stock market. This index in fact represents the performance of the 500 largest US companies.

- That volatility is directly proportional to fear. Think about it: fear leads to instinctive and therefore immediate reactions, such as ‘sell now’, the typical action that drives price volatility.

The VIX represents the market’s expectations of the short-term relative strength of the S&P500 index (SPX). In simpler terms, it indicates the price at which investors are willing to trade the SPX in the immediate future, thus providing a fairly accurate estimate of what will happen in the stock markets in the near future.

In particular, the value of the VIX is derived directly from the prices of options on the SPX index with short-term expiry, thus generating a 30-day projection of volatility.

Generally, the VIX and the price of the SPX go in opposite directions, but there have been exceptions. Usually, however, when the S&P500 goes up, volatility and fear go down; when the shares of the top 500 fall, volatility and fear go up.

Historically, the value of the VIX has fluctuated between extremes of 9 and 82 points. Generally, values below 20 indicate stability and security, while those above 30 speak of fear and risk.

CNN Fear&Greed Index

What is the meaning of Fear and Greed Index, however, according to CNN? The approach used by these analysts is more ‘holistic’ than that of the CBOE. It is in fact based on 7 market indicators, including the VIX itself. It is not necessary to understand them all, but we list them below for completeness and to provide more concreteness:

- Stock price momentum – The performance of the S&P500 index relative to its 125-day moving average (MA).

- Stock price strength – To calculate this, one compares the number of stocks that have reached highs against lows in the last 52 weeks on the New York Stock Exchange (NYSE).

- Stock price breadth – This indicator involves analysing the trading volume of rising and falling stocks on the NYSE.

- Put and call options – The buy/sell ratio of derivative contracts called ‘options’ is calculated by comparing the trading volume of bearish put options with that of bullish call options.

- Market volatility – The CBOE volatility index (VIX) is used to assess investors’ anxiety.

- Demand for safe haven assets – The performance of stocks versus bonds is assessed, as investors typically seek bonds in times of uncertainty.

- Junk bond demand – The spread between the yields of low-risk/reward bonds and high-risk/reward bonds (junk bonds) is assessed.

Each of these seven indicators is assigned a value between 0 and 100, the average of which constitutes the value of the Fear and Greed Index.

In general, extreme fear means that investors are pessimistic and the market might be oversold. Conversely, extreme greed indicates that the market may have been overbought.

What is the meaning of Fear and Greed Index for cryptocurrencies instead? We’ll see right away by looking at the main index currently available.

Crypto Fear and Greed Index

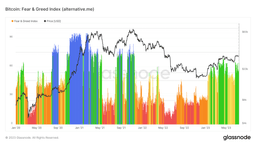

Introduced in 2017 by the website Alternative.me, the index aims to assess the prevailing sentiment in cryptocurrency markets, based on Bitcoin‘s performance.

The crypto index also operates on a scale of 0 to 100, with 0 representing extreme fear, 50 indicating neutral sentiment and 100 indicating extreme greed. To assess sentiment, the index uses several data sources, which we summarise below:

- Volatility of Bitcoin – compared to average values of the last 30/90 days

- BTC Market momentum/volume – compared to average values of the last 30/90 days

- Social Media – counts the number of posts on various Twitter hashtags and their interaction rate

- Bitcoin’s dominance – the rise generally indicates fear, and vice versa.

- Trends – analysis of Google Trends searches related to BTC.

Let us now see the meaning fo Fear and Greed Index in practice and how it can help investors become aware of these emotions and avoid them, or exploit them for their own gain.

How to use the Fear and Greed Index

If one decides to include the Fear and Greed Index in one’s analysis and investment strategy, one should always remember that it should be read in conjunction with other indicators that confirm its signals.

Furthermore, it should be considered that this index reacts to events in the short term, especially in the volatile crypto market. If one does not possess the necessary trading and technical analysis skills to use this value as an indicator, it can still be useful to look at its chart to get an idea of current sentiment and understand one’s own attitude, before acting irrationally.

Fun Fact

Warren Buffett believes that one should act in exactly the opposite way of how the market is acting. According to the investor, one should be ‘fearful when others are greedy and greedy only when others are fearful’. However, he does not use the Fear and Greed index, but the Market Cap/GDP ratio to detect excessive buying or selling, a ratio now known as the ‘Buffett indicator’.

However, there are other ways to avoid being influenced by the psychological effects of market fluctuations.

As Morgan Stanley’s analysts advise, it is best to first ‘exclude irrelevant information and noise, and resist the impulse to follow the crowd’, concentrating instead on diversifying one’s portfolio as appropriate to the market phase.

Another method of not letting yourself be influenced is to enter the market in a constant and measured way: by buying small amounts on a regular basis, you will statistically obtain a worthwhile average expense. Trying to follow the market is an example of unfulfilled greed: there is no right time to invest.

So, for the beginners, what is the meaning of the Fear and Greed Index? For starters, you can see it as a constant reminder not to get caught up in emotions, and not to follow the crowd.