What is Profit and Loss (P&L) and how is it calculated?

April 14, 2023

8 min

If you take a deeper look into what P & L is, you will find out that it is widely used in business management and business economics. However, to make the most of it, the first step is to understand the meaning of P & L.

It is also possible to apply it to other areas, such as cryptocurrency trading. In fact, there is a specific function on Young Platform that automatically counts the profit and loss on all trades made. Let’s find out together how P & L is calculated and why it is important in managing our finances.

What P & L is in finance

In any sort of economic activity, it is good practice to record income and expenditure, i.e. what are the costs and the gains of our activities are. The difference between income and expenditure flows determines net profit, which can of course also be negative. A simple but effective tool that is widely used for this purpose in business economics and management is Profit&Loss (P & L):

Profit&Loss (P & L)

Profit&Loss (P & L) is a financial instrument summarising revenues, costs and all expenses incurred during a specific period of time. The result can be either a profit or a loss

Starting from a basis of business economics and the original meaning of P & L, you can also apply this concept to cryptocurrencies. Indeed, it will allow you to understand how your assets are performing and possibly how to optimise your operations.

With regard to the activity of buying and selling cryptocurrencies, the variables to be taken into account (in addition to the risks arising from market fluctuations) are the following:

- Costs – these are mainly variables such as trading commissions, the price of training (if any) or charges for purchasing hardware or software to facilitate trading. On Young Platform’s Academy you can find a section dedicated to trading with free training content.

- Expenses – these are fixed and recurring expenses, including for instance electricity bills, possible hardware rental, server maintenance costs for earning, and internet subscriptions

- Revenue – this category includes everything received, e.g. from trading, earning services, mining or more generally from Yield Farming rewards

How is P & L calculated?

Now that you understand what P & L is, and what variables are to be taken into account to calculate it, the next step is to understand how to write a report or statement and thus how P & L is calculated.

There are mainly two mutually exclusive Profit and Loss methodologies applicable to any economic activity, including cryptocurrencies:

- Cash principle – the 3 elements that make up P & L (costs, expenses and income) are only recorded when the outgoing or incoming money transactions actually occur. For example, for earnings, income will only be recorded once rewards are actually collected. For trading, the gain/loss will be recorded as soon as you close your positions;

- Accrual principle – with this methodology, the 3 elements of P & L are recorded as soon as we become aware of future income/expenses. Basically, as soon as we know for sure that we will have expenses or income in the future, we can then enter the corresponding amounts in the P & L calculation. For example, if we are mining, we can record the costs of the electricity bill as soon as we know how much we will have to pay and without waiting for the bill to be issued by the operator;

The choice of which methodology to adopt is not trivial and depends on many factors. Usually, smaller companies use the cash principle because it is easier to manage, while larger companies use the accrual principle because they have more resources to devote to accounting. Similarly within trading, or concerning cryptocurrencies in general, it makes more sense to use the cash principle if the activities carried out are few and simple. Conversely, if your activities are more varied and more complex, it could make sense to use the accrual principle.

How to read P & L in a financial statement

It is not enough to know the principle behind which P & L calculation is carried out. Conducting a correct reading and interpretation of a P & L statement is equally important. It allows you to know how things are going, so that you can make any improvements and especially, you can understand in which sections you need to intervene.

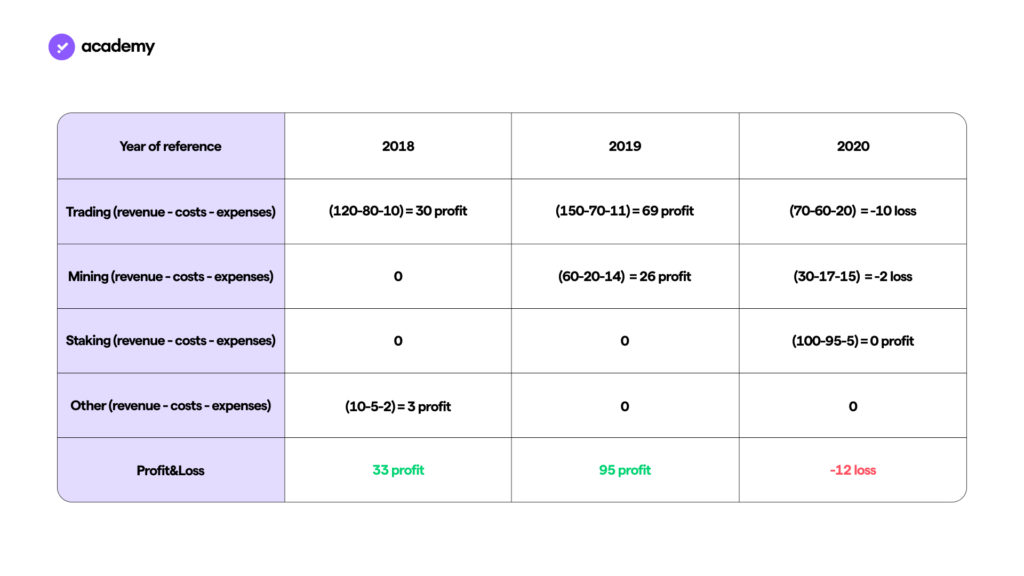

A financial statement is mainly composed of values referring to comparable time periods. For example, in trading it is useful to compare P & L from year to year, or from quarter to quarter, so that you can immediately see if your strategy requires balancing.

Here are the basic steps to read a P & L statement correctly:

- Find your sources of revenue – the first thing to do is to understand where your revenue is coming from. If you’re undertaking several activities at once, such as trading and Yield Farming, you will need to separate the two;

- Find your net income – the next step is to find out how much you actually earned. For trading, you will need to subtract the various costs and expenses from the successful outcome of all trades. For earning services, you will need to subtract all costs incurred from the rewards earned. Of course, you may also find yourself in a loss situation, but the formula will always be: Profit (or loss)= revenue – costs – expenses;

- Identify areas for improvement;

- Take action – make the necessary improvements, if possible.

Here is an example of a P & L statement, a simplified profit and loss account:

P & L on Young Platform

The meaning of P & L in trading is similar to that found in business economics, but it is applied in a different, much more specific way. In this regard, on the Young Platform exchange you have the opportunity to take advantage of the Profit and Loss functionality free of charge, in the Analytics section.

This type of P/L only concerns your buying and selling transactions on Young Platform and allows you to understand, in real time, what the performance of your cryptocurrencies is and to monitor the performance of your assets, so as to help you with your strategies.

The calculation of the P & L in Young Platform trading is done automatically, based on two pieces of data:

- The current Market Value of your Wallet, i.e. the balance in Euro of the cryptocurrencies you have purchased ;

- The Purchase Price, i.e. the cost you paid to get what you have in your wallet.

This is the formula: %P&L = (Portfolio Value – Purchase Price) / Purchase Price

Another interesting figure is the average purchase price of a cryptocurrency, i.e. the average of all purchase prices of a single coin.

For example, by setting up recurring purchase for Ethereum on Young Platform, you may have bought ETH 3 times in the last 3 weeks; the P/L will then calculate the average of the 3 prices. Let’s say the first purchase was at €1500, the second at €1800 and the third at €2000, during a period of a strong uptrend.

Average price = (1500 + 1800 + 2000) / 3

You would have an average purchase price of €1767 (approximated by excess). If the price of Ethereum fell below this level, you would lower the average purchase price on your next purchase. If, on the other hand, the price of ETH were to rise above €1767, you would make a profit overall by selling the coins.

In this respect, the calculation of Profit and Loss for recurring purchases over time makes it clear that the right time to invest does not exist: it is impossible to ‘time’ the market.

Now that you know the meaning of P & L (Profit and Loss), you will have realised that it can be a valuable ally in business management, but also in all those activities typical of the crypto world. The P & L calculation on Young Platform is fully automated and allows you to constantly evaluate the performance of your assets, saving you time!