Pendle: what is it and how does it work?

March 21, 2025

21 min

What is Pendle and how does it work? The DeFi platform that invented the yield market

Decentralised finance (DeFi) has transformed the way investors manage capital by introducing advanced tools to optimise digital asset strategies. Among the most innovative protocols in this space is Pendle, a multi-chain DeFi platform that allows the yield of an asset to be separated from its principal value. This mechanism opens the door to a wide range of yield farming strategies, from simple to highly sophisticated.

At the heart of Pendle lies the concept of yield tokenisation—the process of splitting invested capital from the returns it generates. In practice, an interest-bearing asset is divided into two components:

- Principal Token (PT): Represents the nominal value of the asset, excluding any yield.

- Yield Token (YT): Represents the yield generated up until contract maturity.

This idea is not entirely new. Traditional finance uses a similar mechanism called bond stripping, where the capital of a bond is separated from its coupon payments so each can be traded independently. Pendle adapts this concept for DeFi and extends it with additional features, such as interest rate swaps, which allow investors to exchange variable yields for fixed ones, or vice versa.

So, what exactly is Pendle (PENDLE), and how does it work in practice? Let’s break it down with a simple example.

How does Pendle work?

To understand how Pendle operates, let’s use a simple bond investment as an example.

Suppose you deposit £1,000 in a bond that guarantees a 3% annual return. After one year, you would normally receive £1,030.

With Pendle, this same investment is split into two separate assets:

- Principal Token (PT): Represents the £1,000 principal value.

- Yield Token (YT): Represents the £30 yield generated over the year.

This separation gives users greater flexibility. They can:

- Hold both PT and YT until maturity.

- Sell one of the tokens to gain immediate liquidity.

- Speculate on future yield performance.

Later in this article, we’ll explore the different strategies that arise from this split.

Why asset separation matters in DeFi

This mechanism is especially valuable in the DeFi ecosystem, where assets generate yield in very different ways. For example:

- With Lido Finance’s stETH, rewards from liquid staking increase the number of tokens over time.

- With Compound’s cDAI, the token quantity stays constant, but its value rises as interest accrues.

Pendle “standardises” these differences through tokenisation, making every type of yield fungible and tradable.

The Tokenisation process

Pendle’s tokenisation workflow follows three steps:

- The Underlying Asset (UA) is deposited into the protocol.

- It is converted into a Standardised Yield Token (SY), using the new ERC-5115 standard, which ensures compatibility across assets.

- The SY is then split into:

- Principal Tokens (PT) – representing capital.

- Yield Tokens (YT) – representing returns.

Once created, PTs and YTs can be held, traded, swapped, or integrated into advanced yield farming strategies.

Principal Token (PT) and Yield Token (YT) explained

To truly understand what Pendle is and how it works, we need to look at its most distinctive feature: the separation of assets into Principal Tokens (PT) and Yield Tokens (YT). This mechanism sets Pendle apart from most yield farming platforms.

As mentioned earlier, tokens within this DeFi ecosystem behave dynamically. Here’s how they work in detail:

Principal Token (PT)

The Principal Token (PT) is issued at a discounted price and gradually converges toward the nominal value of the underlying asset.

This process is similar to zero-coupon bonds, which do not pay periodic interest but are sold below par and redeemed at full value at maturity.

For example:

- If an asset offers a 3% annual yield, the PT might initially trade at 0.97.

- As maturity approaches, the PT gradually rises until it reaches 1.00.

In short: PT = the capital portion of your investment, steadily appreciating over time.

Yield Token (YT)

The Yield Token (YT) behaves in the opposite way. Since it represents future yield, it starts witha maximum value and gradually decays to zero at maturity.

At the beginning, the YT entitles the holder to the entire expected yield. But as time passes, the remaining claimable interest decreases—making the token progressively less valuable.

This dynamic is comparable to derivatives with fixed expiry dates, where time decay (theta) plays a crucial role in pricing.

Why it matters

At first glance, PTs and YTs may seem simple. However, when combined, they unlock a wide range of advanced DeFi strategies—from fixed yield to leveraged yield farming—that make Pendle one of the most innovative and flexible protocols in the decentralised finance ecosystem.

What can you do with Principal Tokens (PT) and Yield Tokens (YT)?

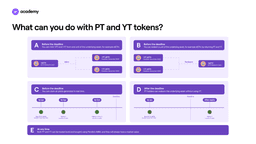

The tokens introduced in the previous section — Principal Tokens (PT) and Yield Tokens (YT) — are highly versatile within the Pendle ecosystem. Users can mint, redeem, trade, or hold them, both before and after a contract reaches its maturity date.

Before Maturity

Minting PT and YT:Before maturity, users can convert an underlying asset (UA), such as stETH, into PT and YT. For example, depositing 1 stETH on Pendle generates 1 PT stETH + 1 YT stETH with the same expiry date. These tokens can then be traded, held, or used in yield farming strategies.

Redeeming the underlying asset: Holders of both PT and YT can combine them at any time before maturity to redeem the original asset. For instance, 1 PT stETH plus 1 YT stETH can be redeemed for 1 stETH. This feature allows investors to recover their capital without waiting until contract expiration.

Claiming yield with YT: A Yield Token represents the yield an asset can still generate. This means YT holders can claim rewards throughout the lifetime of the contract. For example, owning 10 YT stETH at the start of the year entitles the holder to returns until maturity, when the YT value drops to zero. This enables investors to earn yield without holding the underlying asset.

After maturity

Once a contract matures, PT holders can redeem the underlying asset on a 1:1 basis, without needing YT. For example, 10 PT stETH can be redeemed for 10 stETH. By maturity, YT becomes worthless since the yield period has ended. This means PT holders receive a guaranteed fixed return, regardless of market fluctuations—making this one of the most popular strategies on Pendle.

At any time

Both PT and YT can be freely traded on Pendle’s automated market maker (AMM), without waiting for contract maturity. Investors may purchase PT to lock in a fixed return or buy YT to speculate on future yields. Their value is determined by market supply and demand, ensuring continuous liquidity and creating opportunities for arbitrage and advanced trading strategies.

Investment strategies on Pendle

Understanding what Pendle is and how it works goes beyond knowing that the protocol can split a yield-bearing asset into multiple tokens. The real value lies in how investors can use these tokens within different strategies, tailored to varying risk profiles and financial objectives. Let’s explore some of the most common approaches.

Fixed Yield Strategy

One of the most straightforward strategies on Pendle is the fixed yield strategy, which allows investors to lock in a guaranteed return at maturity—regardless of market fluctuations. This is achieved by purchasing Principal Tokens (PT), which are issued at a discount compared to the underlying asset (UA) and gradually increase in value until they reach parity at maturity.

Example:Suppose an investor wants to secure a fixed return with stETH, Ethereum’s liquid staking token. If the expected staking yield for stETH is 6% annually, the investor could purchase 100 PT stETH on Pendle at a discounted price—say 94 stETH. At the end of the contract, these PT can be redeemed at a 1:1 ratio with the underlying asset, in this case 100 stETH, generating a gain of 6 stETH.

(Note: Percentages here are for illustrative purposes only. Pendle contracts typically last less than a year, so the actual rates on the platform may vary.)

Risks of the Fixed Yield Strategy

While attractive for its predictability, this strategy does involve certain risks:

- Opportunity cost: If staking yields on platforms like Lido Finance increase significantly during the contract period, PT holders may regret their choice, as they would have earned more by keeping their stETH staked directly.

- Smart contract risk: Like all DeFi protocols, Pendle carries risks tied to potential exploits or vulnerabilities in its code.

Leveraged Strategies with PT

Another advantage of PT is that they can be used as collateral on money markets such as Aave. This enables investors not only to secure a fixed return but also to borrow additional assets against their PT holdings. Those borrowed assets can then be reinvested, opening the door to leveraged yield farming strategies that amplify potential gains.

Solo Yield Buy – Speculating on returns

While the Fixed Yield Strategy focuses on locking in a predictable return, the Solo Yield Buy strategy is designed for investors who want to speculate on the future yield of an underlying asset (UA).

When purchasing Yield Tokens (YT), traders are exposed solely to the passive return generated by the UA, without directly owning the principal capital. Unlike Principal Tokens (PT), which gradually increase in value until maturity, YTs follow the opposite path: their value diminishes over time, reaching zero once the contract expires.

In practice, buying a YT entitles the holder to collect the yield generated by the UA up until maturity. However, once the contract ends, the YT itself becomes worthless, since the yield period has ended. This means profitability depends on one key condition: the total yield earned must exceed the price paid for the YT at the time of purchase.

The Role of Implied APY

To determine whether purchasing YT is advantageous, investors must consider the implied APY—the rate of return that the market expects for a given asset. This value is derived from the pricing relationship between PT and YT and reflects the collective expectations of traders.

- High implied APY:

- PT becomes cheaper, as investors favour YT for its higher expected returns.

- YT becomes more expensive, driven by greater demand for future yield.

- Low implied APY:

- PT becomes more expensive, since it offers a comparatively attractive fixed rate.

- YT becomes cheaper, as expected future returns are lower.

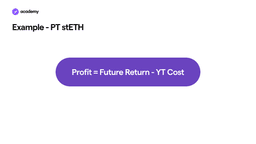

Profit Formula for YT Positions

The potential profit from a YT investment can be summarised as:

Where:

- Future Yield is the average return generated by the UA until maturity.

- YT Cost is the purchase price at which the market values the future yield.

If Future Yield > YT Cost, the investor makes a profit. If it is lower, the position results in a loss.

When to use the Solo Yield Buy Strategy

This approach is best suited for scenarios where you expect the yield of an asset to outperform market expectations. For instance, if you anticipate an increase in Ethereum staking rewards, purchasing YT stETH could be a highly profitable play.

A Practical Example

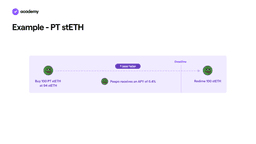

We know the concepts above may sound complex, but everything becomes clearer with a real example.

Imagine that next year the maximum staking yield on stETH is projected at 5%. However, the market is pricing an implied APY of 4.2%, meaning that the cost to purchase 1 YT stETH is 0.042 stETH. Remember: the price of a YT is always linked to the implied APY.

Scenario 1: Higher-than-expected returns

Marco believes Ethereum staking rewards will increase. He decides to buy 100 YT stETH for 4 stETH in total.Until the contract expires, those 100 YTs entitle him to collect the returns generated by 100 stETH.

- If the staking yield reaches 5%, Marco will earn 5 stETH at maturity.

- His profit is 5 – 4 = 1 stETH, which translates to a 25% APY on his initial investment.

Scenario 2: Lower-than-expected returns

If, instead, the staking yield drops to 3%, Marco will only earn 3 stETH. Since he paid 4 stETH to buy the YTs, he incurs a loss compared to his initial outlay.

Advantages of Buying Yield Tokens (YT)

- Exposure to yield at a lower cost: Instead of buying the full underlying asset, you only purchase the right to its yield. This allows exposure to larger positions with less capital.

- No exposure to asset price risk: If the price of stETH falls, YT holders are unaffected, since they are only exposed to yield, not the principal.

- Buy YT with stablecoins: On Pendle, you can purchase YT directly with stablecoins or other crypto assets, without needing to hold the UA.

- Leverage yield without liquidation risk: By accumulating more YT, investors can leverage returns without the risk of liquidation that typically comes with margin trading or derivatives.

Risks of Yield Tokens (YT)

- Time decay: Unlike PT, which gains value as it approaches maturity, YT loses value every day until expiry. If actual yields fall short, investors risk a loss.

- Inverse relationship with PT: Since PT and YT split the same UA, when PT prices rise, YT prices tend to fall.

- Reliance on implied APY: If the market overestimates future returns and real yields are lower, YT value can collapse.

Key Takeaway

Buying Yield Tokens (YT) can be profitable when you believe the underlying yield (UA) will outperform market expectations—or when YT is priced attractively relative to forecasts. However, this strategy comes with risks and requires careful analysis of implied APY versus actual yield potential.

Final thoughts on PT vs. YT: which one should you choose?

The decision between buying Principal Tokens (PT) or Yield Tokens (YT) ultimately depends on your expectations about future returns:

- If you expect yields to decrease: Buying PT is the safer bet. You lock in a fixed return and shield yourself from the downside of falling yields.

- If you expect yields to increase: Buying YT gives you exposure to rising interest rates and allows you to capture higher returns.

This choice is closely tied to the inverse relationship between PT and YT:

- When PT prices rise, the market is anticipating lower future yields—making YT less valuable.

- When YT prices rise, the market expects yields to grow, which reduces the appeal of PT.

For seasoned investors, this dynamic creates opportunities for swing trading between PT and YT. By shifting positions in line with market sentiment, traders can optimise their returns and take full advantage of Pendle’s unique yield-splitting mechanism.

Pendle’s AMM: How does the yield market work?

To fully understand how Pendle works, we need to examine one final piece of the puzzle: the Automated Market Maker (AMM) that powers trading between Principal Tokens (PT) and Yield Tokens (YT).

Unlike traditional AMMs on Uniswap or Curve, which follow the classic formula x · y = k, Pendle has built a custom AMM tailored specifically to its ecosystem and the unique mechanics of its tokens.

The AMM is designed around the relationship between PT, YT, and the underlying asset (UA), leveraging their inverse proportionality. As mentioned earlier:

- If the price of PT increases, the value of YT decreases.

- If the price of YT increases, the value of PT decreases.

This happens because both tokens represent fractions of the UA’s yield. When the market assigns more value to PT, YT automatically becomes less attractive, as the expected yield is lower.

The key formula governing Pendle’s AMM is:

Where:

- UA (Underlying Asset): the total value of the asset deposited.

- SY (Standardised Yield Token): the token that combines PT and YT before they are split.

- PT price: the current market value of the Principal Token.

- YT price: the current market value of the Yield Token.

This formula ensures that PT + YT always equals the value of the underlying asset. If an investor buys PT, the price of YT decreases, and vice versa, maintaining equilibrium through supply and demand.

Pendle AMM vs. Traditional AMM

The difference between Pendle’s AMM and protocols like Uniswap or Curve lies in time sensitivity. PT and YT exist only until their contract maturity date.

- As PT approaches maturity, its value converges to 1, aligning with the UA.

- As YT approaches maturity, its value drops to 0, since no yield remains.

Pendle’s AMM dynamically manages this lifecycle, maintaining liquidity and ensuring fair pricing for both PT and YT holders all the way to expiry.

This innovation makes Pendle’s AMM one of the most advanced in DeFi, designed not only for trading tokens but also for optimising yield strategies within a time-bound ecosystem.

Yield trading on Pendle: maximising profits with swing trades on returns

Beyond the strategies we’ve already discussed, Pendle introduces another powerful opportunity: Yield Trading. This involves switching exposure between Principal Tokens (PT) and Yield Tokens (YT) to optimise profits based on changes in expected returns—and, therefore, the implied APY.

The logic is simple: market fluctuations between PT and YT create profit opportunities for traders who can anticipate future yields.

- When implied APY is high: PT is cheap, YT is expensive → it’s advantageous to buy PT and lock in a favourable fixed return.

- When implied APY is low: PT is overpriced, YT is cheap → it’s advantageous to buy YT and capture higher potential yield.

Example of yield trading

Suppose the expected average yield on stETH is 4%. However, due to a temporary correction in Ethereum’s price, the market—reflected through supply and demand on Pendle’s AMM—is pricing an implied APY of just 3.5%.

A trader could:

- Buy YT stETH at a discounted price, betting on a recovery in yields.

- If the effective yield climbs back to 4.5%, the price of YT rises, generating a profit.

- The trader can then sell YT and rotate into PT, holding until maturity to secure a fixed return.

This strategy turns Pendle into a dynamic marketplace, where traders can swing between PT and YT to take advantage of shifts in implied APY.

Yield farming and LPing: providing liquidity to Pendle’s AMM

Pendle isn’t only about trading yields—it’s also a yield farming platform for liquidity providers. Unlike traditional DEXs, liquidity pools on Pendle are composed of PT + SY (Standardised Yield Tokens). This design makes sense in light of Pendle’s AMM: since PT automatically converts back into SY at maturity, impermanent loss trends to zero as contracts expire.

Liquidity Providers (LPs) on Pendle earn in four ways:

- Returns from the underlying asset (UA).

- Returns from PT, which appreciates over time.

- Swap fees from PT–YT trades.

- Pendle incentives paid in PENDLE tokens.

Because PT and YT are inversely correlated and tied to implied APY, LPs must actively manage their positions and risk exposure.

Additionally, like many DeFi platforms, Pendle rewards usage with points programs linked to protocol activity and deposits. While this is an important aspect of the ecosystem, it falls outside the scope of this article, which focuses on explaining what Pendle is and how it works.

The Pendle token (PENDLE) and the governance model

The PENDLE token is not only the native asset of the protocol but also a cornerstone of its governance system. Through a vesting mechanism and its vote-escrowed version, vePENDLE, the protocol incentivises long-term commitment and active participation in decision-making.

The Vesting Model: From PENDLE to vePENDLE

Pendle adopts a Curve-inspired vesting system, where PENDLE can be locked to generate vePENDLE (vote-escrowed PENDLE).

- The maximum vesting period is two years.

- Locking 1 PENDLE for one year = 0.5 vePENDLE.

- Voting power decays linearly until the lock expires.

This model rewards users who commit for the long term, granting them both greater governance influence and enhanced rewards.

Utility of the PENDLE Token

The PENDLE token serves multiple purposes within the ecosystem, both for liquidity incentives and governance rights:

- Liquidity incentives – PENDLE rewards Liquidity Providers (LPs) who supply assets to protocol pools.

- Boosted farming yields – vePENDLE holders can increase farming rewards in chosen pools, similar to Curve’s boosting model.

- Governance voting – vePENDLE holders vote on how PENDLE emissions are allocated across liquidity pools. More vePENDLE = more influence.

- Bribing mechanism – Users can delegate their voting power in exchange for rewards, enabling DAOs or protocols to incentivise vePENDLE holders to support their pools.

- Fee redistribution – 80% of protocol fees are distributed to vePENDLE holders, with 10% going to the treasury and 10% to the team. This distribution model may evolve to fund long-term development.

Why PENDLE Matters

The PENDLE token represents the final layer of innovation in the protocol. By combining yield tokenisation with a governance-driven incentive model, Pendle creates a DeFi ecosystem that appeals to both professional traders and newcomers.

With a growing community, constant protocol updates, and deeper integrations across DeFi, Pendle is positioning itself as a key player in the future of decentralised finance.