What is leverage trading: the formula for investing loans

April 28, 2023

7 min

Here we’re going to answer all your questions about leverage trading: what is it in finance, and what does it mean in business economics? Then we’ll go over advantages and risks, with the help of a few historical examples.

What is leverage trading: meaning and formula

So what is leverage trading?. In short, it is a mechanism that multiplies the purchasing power of one’s capital, in order to increase potential profits (at the risk of greater losses), by adding borrowed money to the initial investment. It is possible, however, to extend the meaning of leverage to the economy at large, where it represents an index to assess the debt of a company.

If applied to trading, leverage could improve the return on one’s funds by contracting a debt with a broker, but in simpler words, what is leverage? There are brokers who provide additional money to trades by pledging the trader’s deposits as collateral, in addition to charging service fees.

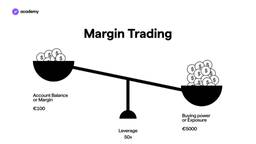

In mathematical terms, therefore, this is the leverage formula: total investment / capital owned. The latter is called ‘margin‘ and serves as collateral for credit: as we shall see later, it must maintain a certain ratio to the total value of the investment.

The meaning of leverage trading, therefore, is synonymous with ‘margin trading‘: the small investor increases their exposure to the market, contributing a reduced percentage to the entire position. Given the greater availability of (borrowed) capital, therefore, the trader not only has the opportunity to earn higher returns, but can also:

- Immobilise less money;

- Access more expensive financial instruments;

- Distribute the margin between different trades, diversifying the investment;

- Making profit in low volatility situations.

We must not ignore, however, the risks associated with this mode of trading: in addition to possible gains, it also multiplies potential losses; this is why many speak of a double-edged sword to explain what leverage is. Basically, both positive and negative returns are amplified: the risk is high, so it is not a suitable tool for beginners. However, even experienced traders often lose money from leveraged trades: the right time to invest does not exist, it is a rule for everyone.

How leverage trading works: a practical example

Let’s better understand what leverage trading is by simulating its use in a trade. Imagine you want to invest €1,000 in a single stock, but you only have a margin of €200: you could borrow the missing €800 from a broker, using a leverage of 1:5 (1000/200=5).

In this example, the margin is 20% of the total investment, calculated by inverting the leverage formula, and the potential profits would be fivefold. So, if the share price increased by 3%, you would make a profit of €30 by leveraging: if you had only invested your €200, you would have made €6.

The meaning of leverage trading, however, also has a negative side: just as it can multiply your potential return, it makes your losses exponential. Thus, if the share value were to fall by 3%, you would lose EUR 30 instead of only EUR 6. In this regard, when the value of the margin falls below a critical threshold, the so-called ‘margin call‘ is triggered. Basically, to prevent the position from being liquidated by the broker, the trader is obliged to deposit more capital.

To the initial margin, therefore, must be added the maintenance (or variation) margin: funds needed to cover the loss in value of the initial deposit, which must maintain a certain minimum level. Margin calls have different limits, depending on the trader and the regulations, but there is always a stop out level that implies a forced exit from the market. This corresponds to a price for the asset invested in and functions just like a stop loss.

The European Securities and Markets Authority (ESMA), in particular, has laid down some rules for leverage trading to protect traders from excessive losses. In addition to obliging brokers to explain what leverage is and to inform about the risks involved, the regulations focus on CFDs (Contracts for Difference), a type of derivative product. They impose, first of all, the automatic closure of positions at 50 per cent of the minimum margin requirement, but also define maximum leverage ratios according to the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-core currency pairs, gold and the main stock indices ;

- 10:1 for other commodities and non-core stock indices;

- 5:1 for individual shares and other instruments not mentioned;

- 2:1 for cryptocurrencies.

Fun Fact

the major currency pairs, according to ESMA, are all those that trade two fiat currencies between: US dollar (USD), euro (EUR), yen (JPY), pound (GBP), Canadian dollar (CAD) or Swiss franc (CHF).

Leverage beyond trading

We have discovered what leverage trading is and its meaning in trading, but the same concept also has an application in business economics. In this case, leverage calculates the weight of debt on a company’s total investments. In practice, it quantifies the dependence on third parties for its activities, i.e. the financial burden it will have to bear.

In this approach of fundamental analysis , the leverage formula would be this: equity capital + loans/equity. If the value of the ratio is equal to 1, the company has no debt, so it only uses internal resources to finance itself. Conversely, when the result is between 1 and 2, the money received from third parties is still in balance with its own; finally, debt exceeds equity (or risk capital) when the value of leverage exceeds 2.

The definition of leverage is well illustrated in today’s debt-based economy: it is less expensive to raise capital through borrowing (especially long-term borrowing) than through issuing shares. Indeed, the interest rates to be paid are generally lower than the minimum returns (dividends) to be distributed to shareholders. However, when the financial leverage of a company is too high, and thus the debt too high, the risk for creditors increases: in order to obtain further loans, it will be necessary to promise higher interest rates.

In general, leverage exposes the economy to systemic risk: the more players are involved in lending relationships, the greater the likelihood that a liquidation will cause a chain reaction. The 2008 crisis, for instance, arose from the excessive leverage exposure of credit institutions on the real estate market: the huge volume of investments rested on too little real capital.Now that you know what leverage is, knowing its meaning and formula, you may want to look into its combination with shorting, a trading strategy, or its use in Forex, the market where leverage trading is common. In general, before investing, you should define your risk profile: leverage trading may not suit your objectives. If your ultimate goal is savings, for instance, test recurring buying or Dollar Cost Averaging.