Lido DAO (LDO): what it is and how it works

November 8, 2023

5 min

Lido DAO plays a key role in decentralised finance: most of the ETH blocked in liquid staking are in its protocol. Here is what LDO is and how it works in DeFi.

What is Lido DAO (LDO) and how did it come about?

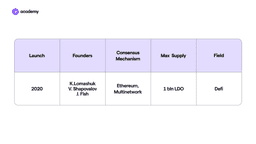

Lido DAO, also known as Lido Finance, was born in 2020 thanks to several personalities, including Stani Kulechov and Jordan Fish (a.k.a @cobie on Twitter). The latter is one of the official founders along with Konstantin Lomashuk and Vasiliy Shapovalov. The development was funded in 3 rounds, led by top VCs Paradigm and a16z.

So what is Lido DAO (LDO) and how does it work? The goal that started it all was to solve the limitations of staking on Ethereum, which at that time was preparing for the Merge, i.e. the migration to the Proof-of-Stake consensus system.

Fortunately, we now know that everything went well, but it was a very complex and delicate phase for the ecosystem, both technically and for the users.

In fact, all ETH in staking would be blocked until the Shanghai update, the date of which was not known at the time. Moreover, even today, that ETHs can be unstaked, they are still not liquid when in staking. Moreover, it is necessary to lock at least 32 ETH in the protocol, which is not an insignificant amount especially in times of bull market.

Thus, Lido introduced liquid staking, i.e. the possibility of making ETHs liquid, i.e. making them expendable, convertible and usable. Not only that: you can participate with any amount of ETH even smaller than 32, thanks to the pooled staking system.

The protocol was launched shortly after Ethereum’s Beacon Chain, in December 2020, and later developed compatibility also with the networks of the major blockchains. At least until 2022, in fact, Lido enabled the liquid staking not only of ETH and MATIC, but also of DOT, KSM, SOL, LUNA, which were then removed one by one by community vote.

In autumn 2023, on the other hand, support was approved for Arbitrum, Optimism and Cosmos, still under development.

After this historical definition, let’s move on to how Lido DAO works in practice.

How liquid staking works

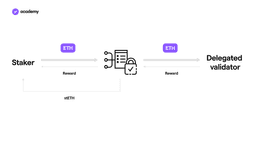

Via Lido’s protocol, you can stake ETH or MATIC and receive stETH or stMATIC tokens in return.

These ‘synthetic’ tokens are pegged 1:1 to ETH or MATIC and can be used in numerous DeFi services, such as Curve, Aave, 1Inch, Uniswap and so on. They can also be converted on various decentralised exchanges.

Users can deposit any amount of Ethereum or Polygon into Lido’s smart contracts, as these are then delegated to on-chain validators. As a result, the user will receive a portion of the validators’ staking reward which will be proportional to the coins blocked.

This system is called pooled staking, as the stakes of different users are placed in the same ‘pool’ and then delegated to different validators in order to amortise the risk.

The LDO token and governance

Since its first year of operation, Lido has been managed with a DAO, a decentralised governance system crowned by a governance token, LDO.

The DAO, made up of several committees, is in charge of setting key parameters for the functioning of the protocol, such as fees, managing node operators and their rewards. All LDO token holders can vote on these decisions. In addition, the organisation receives service fees through the Treasury, which in turn funds research, development, upgrades and incentive programs.

So what is LDO and how does it work? The token is a classic ERC-20 and its maximum supply is already fully in circulation, amounting to 1 billion tokens.

Roadmap and development of Lido DAO

Still closely following Ethereum developments, in this case the Shanghai/Capella update, Lido’s V2 came out in May 2023.

The new version made improvements with respect to decentralisation and the user experience. In particular, it has made it possible to withdraw stETH in ETH in a 1:1 ratio directly from Lido, and has optimised the system for validating and distributing rewards to node operators, i.e. those who maintain the staking system.

From the history of Lido, the significant role of decentralisation is clear. Security, however, is no less important: the protocol boasts numerous audits and in October 2023, the number of node operators acting as validators in the system increased from 31 to 38.

Returning to the original question, to those who ask what Lido DAO (LDO) is, we could simply answer that it is a key player in DeFi, as it promotes composability and liquidity, especially in the Ethereum ecosystem.