Bitcoin and the Austrian School of Economics

September 20, 2021

7 min

The conceptual foundations of Bitcoin can be found in the Austrian School of Economics, a strand of libertarian thought that criticised the monetary system and government intervention in the economy.

What is the Austrian School of Economics

The Austrian school is fundamentally different from other economic schools because it places the human being, in all his complexity, at the centre of its theories.

The economy is not a machine, predictable and linear, but a great sea of individuals making decisions.

“The only constant in economics is change”, Friedrich von Hayek

According to their theories, it is the interventions of states and banks that exacerbate the business cycles and pump up inflation. One intervention after another allegedly accumulated a series of unintended consequences that unbalanced prices and caused recessions with a snowball effect.

From the very beginning, the Austrian movement has been against the tide, so much so that the name “Austrian School” is a legacy of the derogatory name that German economists used to refer to Menger’s disciples.

Money according to Austrians

In particular, Austrians attack the monetary policy based on mere trust, emptied of any underlying asset with a real value.

According to them, the value of a currency cannot be decided arbitrarily, but must be based on something, it must be perceived by people. Usually people perceive value in something scarce, and with constant inflation money is less and less scarce.

Just think of the history of money. Money has changed many times over the centuries, it has had different basic premises, different forms. Initially, there was no government dictating by which means value could be exchanged. Money was born out of people, out of their practical needs.

This is what Menger tells us, describing money in evolutionary terms. Money is born through trial and error, through innovation, gradually. Something can be money in one place and not in another. Sound familiar?

In “Denationalisation of Money” (1976), von Hayek proposes that it should not be central banks, but rather commercial banks that issue interest-free certificates (currencies) that are traded freely in the market, so that their price naturally stabilises and the most stable currency wins. There is a fine line between decentralisation and denationalisation.

Another idea of this school, carried out by Murray Rothbard, is to reinstate the right of property in the realm of money. According to this idea, banks do not clearly distinguish who has real control and ownership over what money. There is little information and much ambiguity.

Finally, a key concept: entrepreneurship. Israel Kirzner, a direct pupil of Menger, writes about this concept, which is loved by the Austrians. Entrepreneurship is an entirely human and unpredictable quality that has no place in the traditional view of economics. It does not follow rules, because its requirement is precisely to break them, in order to actually innovate. It is entrepreneurship that makes the market evolve.

What more enterprising project than a completely new currency?

The Austrian School and Bitcoin

Ironically, it was the European Central Bank itself in 2012 that recognised the close link between Bitcoin and the Austrian School in its first (highly critical) research on cryptocurrencies.

If only the fathers of this school were alive today, they would be very appreciative of the cryptocurrency market and especially Bitcoin, which responds perfectly to their principles listed above.

As a matter of fact:

- Bitcoin cannot be controlled by the state

- Bitcoin has controlled and pre-determined inflation, which makes it scarce

- Bitcoin is based on blockchain and is programmable, therefore it has value.

- Bitcoin’s price is decided by the free market, without intervention or censorship.

- There is no confusion about how many there are or who they belong to.

If, on the other hand, they knew how CBDCs were shaping up, they might not be so happy.

We would like to stress that not all supporters of the Austrian School recognise the value of Bitcoin (yet), as it is not a tangible asset and is based on complex technology.

It is still difficult for many to conceive the value of something that has no physical form, and that is both a currency and a payment system.

Fun Fact

The name “Dollar” has a remote origin in Bohemia, in the 16th century. In a town called Joachimsthal in German, silver coins called Joachimsthaler, or “thaler” for short, were minted. This term travelled to become “dollar”. Not only that, coincidentally “thal” means mining.

The Global Financial Crisis

2008 is a key year for both Bitcoin and the Austrian School. Mainstream economists had failed to spot the signs of an economic bubble about to burst, leaving the world at the mercy of the consequences.

In this situation, the Austrians found a new voice, warning the world of the danger of using means such as Quantitative Easing and lowering interest rates in response to the crisis. This could have the effect of exacerbating the economic bubble and inflation.

Quantitative Easing

An unconventional method of creating new money used by central banks in times of economic crisis. With QE, a central bank offers to buy long-term securities on the market to increase liquidity.

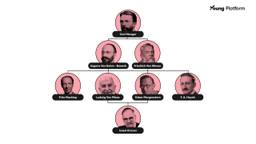

Among them, the best-known face is US politician Ron Paul.

Ron Paul is a conservative Republican who has run for president three times, in ’88, 2008 and 2012. He is a rather out-there figure who has sparked a movement of true fans, who have been part of the first generation of online memes.

In one of his latest statements, Paul reconfirmed his support for Bitcoin, which he believes should be able to compete freely with the dollar so that everyone may use the currency they want.

The 2020 crisis

Even in this crippling crisis, the measures taken (at least by the ECB) have been Quantitative Easing and lowering interest rates. Precisely what the Austrian School instructs us to avoid.

In fact, the ECB has launched the Pandemic Emergency Purchase Programme (PEPP), aimed at reinforcing the Quantitative Easing already in place. This implies an increase in inflation, which is presented by the EU as temporary damage, but which is beginning to alarm some.

After the black swan event that was the pandemic, the prospect of a paradigm shift, in which the objective of managing crises is replaced by that of avoiding crises and recessions altogether, is increasingly attractive. These seem to be the natural consequence of a system based on borrowing and debt.

Black Swan Event

The black swan theory is a metaphor describing an event that comes as a surprise, has a major effect, and is often inappropriately rationalised in retrospect with the benefit of hindsight. For example, the appearance of an abnormal, unpredictable value, therefore far from expectations.

Bitcoin and the theories of the Austrian School can provide us with a starting point to rethink the monetary system. Remember that the Austrian School has nothing against capitalism, so it does not aim to upset the whole economic system from its roots. It is the banking institution that they are questioning.