The Global Market: Wealth Distribution Worldwide

October 6, 2021

9 min

In the table below you can see the size of all global markets starting with silver, the smallest. Be prepared for huge, almost unimaginable figures.

In this article we will analyse each entry in this table, to understand the distribution of wealth across different levels and sectors, and get a broad perspective on the world economy.

Currencies and Commodities

In the first half of the ranking, we find Silver and Cryptocurrencies as the smallest markets. Further down the list are Gold and Coins & Notes, as in physical currency.

The fact that the cryptocurrency market is among the smallest is not surprising. In fact, despite repeated booms, the sector is in its infancy when compared to other markets and financial assets.

Companies, currencies, real estate and even derivatives have a history that can be traced back to antiquity. Cryptocurrencies, on the other hand, only found their technological beginnings in the 1990s and the first real cryptocurrency was born in 2009. It couldn’t even be considered a market then, not until 2017.

The total value of the cryptocurrency market is expressed through the Market Capitalisation of the first 12,282 cryptocurrencies, which is currently estimated at $2,167 billion.

Commodities, on the other hand, have been discussed on Young Platform Academy, in particular as possible safe-haven assets.

Broad Money and Narrow Money

Narrow Money and Broad Money are two kinds of monetary aggregates, unlike “Coins and notes”, also include money in the form of deposits, other types of assets and in electronic form.

According to the ECB’s definitions, the narrow monetary aggregate (M1) comprises banknotes and coins in circulation and current account deposits. All legal tender and banks’ required reserves at the central bank constitute the so-called monetary base, also referred to as M0. In general, M1 is the total of all money that has to be accepted as means of payment.

The intermediate aggregate (M2) comprises M1 and other highly liquid assets with a certain value in the future, but whose conversion into M1 may be subject to some restrictions. They include deposits with an agreed maturity of up to two years and deposits redeemable at up to three months’ notice.

The broad monetary aggregate (M3) comprises, in addition to M2, a number of instruments issued by various monetary financial institutions with a high degree of liquidity and price certainty, such as money market fund shares and bank bonds with maturities of up to two years. The European Central Bank pays particular attention to the monetary aggregate M3 in its analyses, because it includes all liquid instruments and is more stable than M1 and M2.

The United States: a Whole Nother Story

The United States is the richest country in the world. It is home to 39% of the world’s wealth.

That is why it deserves a separate paragraph and its own entries in the table.

The Federal Reserve alone, the US central bank, has as much as 8 trillion in assets. By contrast, the US deficit amounts to 3 trillion.

The deficit is the difference between expenditures and revenues in the government budget. When expenditures exceed revenues, the deficit rises and the government is forced to borrow. When the government borrows to cover the deficit, it generates the national debt, which we will discuss later.

The Fortune 500 also concerns the United States. It is in fact an annual list compiled and published by Fortune magazine that ranks 500 of the largest companies in the United States based on total revenue for their respective fiscal years. The list includes public and private companies that make their financial statements available.

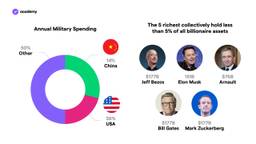

Let’s move on to global military spending, which slightly exceeds the silver market. The United States “excels” in this field, followed immediately by China. Together they account for half of all military spending worldwide. The figure speaks loud and clear

Japan between Wealth and Debt

In 2021, the top 6 countries with the largest debts are:

- Japan

- Sudan

- Greece

- Eritrea

- Suriname

- Italy

Debt is usually measured by the debt-to-GDP ratio, expressed as a percentage, and indicates, in particular, the possibility that the government has of repaying its debt. The higher this percentage is, the less chance it has.

Japan has been in the lead for several years. The country’s debt-to-GDP ratio first exceeded 100% in the 1990s and in 2010 it became the first advanced economy to reach 200%. But wasn’t Japan an advanced economy?

Precisely because of this, in the 1990s Japan saw the biggest financial bubble in history, which involved its entire domestic market, causing severe deflation (price rises). This situation was managed by the central bank with extraordinary monetary policies that aggravated the situation.

These included the lowering of the interest rate to 0%, which gave a huge incentive to borrow, thereby increasing the national debt.

However, debt does not mean actual poverty. In fact, despite its massive debt, Japan has the third highest number of millionaires and is one of the richest countries in the world.

Global Stock Market

On the global stock market, it is possible to buy equity or shares in public companies.

Companies make shares available on the market when they become so large that they need continuous capital to maintain their business, so much so that private investors are not enough.

The New York Stock Exchange (NYSE) (31.5%) and the NASDAQ (14.5%), both based in New York, make up 46% of the stock market.

This is followed by Shanghai, Japan, Hong Kong, Europe, Shenzhen, London, Toronto and India.

Real Estate

The value of global real estate includes residential, commercial and agricultural properties in order of importance. It thus encompasses the value of all existing properties.

Derivatives: the engine that drives the global market

“In my view, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.” – Warren Buffett

Derivatives are financial instruments in the form of a contract that derive their price from an underlying asset. Derivatives include, for example, futures and swaps.

They are contracts between two parties in which one party chooses to profit from the growth of an asset, while the other will profit from the depreciation of the asset.

This underlying instrument can be a share, a bond, but also a currency, commodity or even an interest rate.

The width of this market is partly due to the fact that it can cover any type of instrument or asset, its notional value is so large that it exceeds any existing market, and even the world’s wealth. How is this possible?

As you can see from our reference table, the value of global derivatives can be measured by market value or notional value. The difference is substantial, so much so that its market value only slightly exceeds that of gold.

The market value considers the price of a single unit of the financial instrument. It is thus the result of the sum of all derivative prices on the global market.

Notional value, on the other hand, represents prices multiplied by all the units of the instruments on the market, thus bringing together all supply and demand, in other words all open positions on exchanges and brokers. This is why the notional value is much higher.

What does this mean for cryptocurrencies?

There are so many considerations that can arise from this ranking, but as usual, we focus on the topics close to us, namely cryptocurrencies.

The way in which wealth is currently distributed around the world may suggest the most interesting opportunities for the cryptocurrency sector.

The United States, as a concentration of wealth, is the most obvious place to find large amounts of capital, and the country is known for its fervent entrepreneurship, which encourages the growth of the sector within the global market. On the other hand, the SEC and other regulators have their walls up.

The issue of debt, meanwhile, can be linked to DeFi, which is increasingly developing alternative solutions in the field of financial services and, above all, in order to apply for loans on favourable terms that are independent of bank interest rates.

Finally, the numbers show us that derivatives are an excellent opportunity for DeFi, which is producing the first forms of derivative assets on blockchain.