The Meaning of ICOs in Crypto History

September 17, 2020

8 min

Finding funds to finance your project is perhaps one of the most difficult challenges.Anyone who has been following the events of the crypto world for a few years will surely have already heard of ICOs. Even if it is a form of funding now replaced by alternative instruments such as IEOs, it is a fundamental concept in the history of cryptocurrency.

What is an ICO?

ICOs are a form of fundraising mainly used by startups that want to carry out a project. In an era where everything is digitised, even ideas can be tokenised and turned into reality.

ICO

The acronym ICO stands for “Initial Coin Offering” and it is an initial offer to the public in the world of cryptocurrency. This kind of crowdsale is used to launch projects and is carried out on a blockchain.

How ICOs work

First of all, the startup or company that opens an ICO creates its own token (a type of cryptocurrency).

Secondly, it presents its project to investors through a Whitepaper, a kind of brief business plan.

Within the project, the token has a precise function. For example, it gives the right to a service on the product that the company is going to develop, or to a part of the future dividends of the company.

Once the company launches the ICO, it begins to raise funds by selling its token in exchange for the investment. Anyone can participate in an ICO, financing it either in fiat currency (euro, dollar and any legal currency) or with other cryptocurrencies (usually bitcoin and ether).

The Whitepaper defines the relationship between fiat currency and the ICO token. It is customary to set a favourable exchange rate for early investors. For example, the first week of ICO the ratio can be 1000€ = 1 token, while the following week 1500€ = 1 token.

The value of the token

In a way, the ICO token represents a unit of value that the investor is “purchasing” and which he expects to resell in the medium to long term in order to achieve large profit margins. In fact, the value of the token has a good chance of increasing exponentially if the project is successful.

Once launched on the market and listed on an exchange, the token can be bought and sold like any other cryptocurrency. From that moment its price follows the market rules.

So the ICO is basically the crypto version of crowdfunding. Unlike the IPO, i.e. the “Initial Public Offering” from which it derives its name, the ICO does not provide for the sale of shares but of value, expressed in tokens.

The subscription of a smart contract – today – guarantees that value. Smart contracts are contracts written on a blockchain which, by their nature, constitute a form of binding guarantee.

The role of ICOs in the crypto industry

ICOs have been truly revolutionary: they triggered a moment of great experimentation, providing a powerful acceleration to the development and consolidation of the entire sector.

The most famous and most important one is certainly the ICO of Ethereum. In 2014 Vitalik Buterin managed to raise $18.4 million in a month.

With the success of Ethereum, ICOs have become the de facto method of financing the development of a crypto project through its token.

Pre-Ethereum ICOs

Mastercoin

J. R. Willett launched the first ICO in 2013, the project was called Mastercoin and raised $600,000 (4,740 bitcoins). Mastercoin was the starting point for Omni Layer, a protocol still widely used today, for example by Tether. The Mastercoin token, however, except during the 2017 bubble, when the token went from 4 to 123 dollars, was not very successful.

Another feature worth mentioning was the transparency of this ICO. Willet was very explicit in his document clearly showing the risks. He stated that it was an experiment and that there was a possibility of losing all the money invested.

The first ICO was much clearer than many other IPOs that have led to stock market scams in the traditional financial system.

After Mastercoin there were substantially 4 other ICOs (in the period 2013-2014) before Ethereum’s revolutionary one.

- Next coin raised $16.8 million. The main feature was that the project launched the basis for the first proof-of-stake as a consensus mechanism.

- CounterParty peaked at $1.8 million to $240 million.

- MaidSafeCoin still holds the 135th place on CoinMarketCap (July 2020) and was born with the proposal to create a SAFE network (“Secure Access For Everyone”). The SAFE network is not a blockchain, but a decentralised communication and data storage network.

- Swarm, on the other hand, has failed, so much so that very little information can be found about it.

How did ICOs change the crypto world?

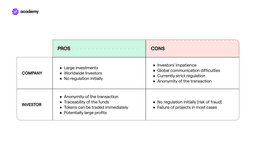

Company

The main advantage for a company launching an ICO is that the world immediately becomes a potential investor. An ICO can raise money from anyone anywhere in the world. A possibility that traditional investment methods never had.

Furthermore, by selling tokens and not shares the founders are able to maintain control of the company. Avoiding excessive dilution they don’t risk compromising the future of the project. In addition, as well as having no transaction costs, the funds are sent 100% directly to the project team.

Investor

From the investor’s point of view, a significant advantage is the greater liquidity of the investment.

ICO tokens as soon as an exchange lists and places them on the market are immediately expendable. At any time, the investor can sell the tokens and get a return on his investment, earning a margin if the token price has risen.

The Limits of ICOs

ICOs exploded in 2017, quickly setting in within a year and a half. Certain circumstances led to their rapid rise and inevitable decline.

The lack of a regulatory framework put companies in a position to operate quickly, without subjecting them to time and bureaucratic constraints. The absence of due diligence and a guarantor meant that an ICO was launched and completed within months.

This freedom of action allowed many startups or micro-corporations to raise large amounts of capital (millions of dollars), even if what they were proposing was only an idea on a Whitepaper.

Investors were mainly attracted by the high yield possibilities which, looking back, we now know did not occur often. ICOs also ensured the anonymity of the investor, which was in fact a potential disadvantage for the company.

On the other hand, the company’s wallet was traceable because its public address, to which the funds arrived, was guaranteed by the blockchain. However, this traceability was lacking for payments in fiat currency. It’s no secret that many founders, once the ICO was closed down, would disappear with all the money they collected.

Leaving the ICO world with a reputation that is hard to redeem.

Conclusion

Thanks to ICOs, companies were able to raise millions of dollars over a few days. In 2017 they reached $5.6 billion. Even though the numbers seem impressive due to the crypto boom, if you compare them to 2018, they are nothing. In fact, in just 4.5 months, ICOs raised $6.3 billion.

Ethereum made the biggest contribution. Thanks to its protocol anyone can create a proprietary token in a simple, safe and guaranteed way by the ERC-20 protocol itself. Just in 2018, the Ether reached its maximum value of $ 1,365.31, bringing value to all ERC-20 tokens.