Cognitive Bias: Know Yourself

October 13, 2020

7 min

A cognitive bias occurs every time we assess a situation not rationally but rather based on our own convictions.

If we aren’t aware of biases and can’t control them, we risk making the wrong decisions about our investments. Behavioural finance has identified these recurring patterns and helps us to tackle them.

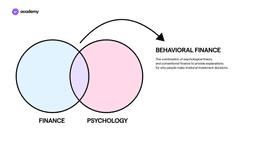

Behavioural Finance

Behavioural finance studies the influence of psychology on investors’ behaviour and the effects of these mechanisms on the markets. This field of study is based on the assumption that investors are not always rational, have limits to their self-control and are influenced by their own prejudices.

Cognitive Bias 1: Herding behaviour

When evaluating an investment, imitating the choices of acquaintances or friends can be very risky. Mind you, if someone gives you information or rather shows you their strategies, you’re right to welcome it, but every new input must be filtered through your own strategy, in line with your objectives and above all with your risk appetite.

Being a victim of the herd effect means that we tend to make an investment more easily if our acquaintances own that product or use it.

Herding behavior in trading

Trading is perhaps the type of investment most affected by this cognitive bias. Investors feel reassured when they know they are making the same trading decision that most people are. If a herding effect occurs, the price of the asset tends to rise sharply.

How FOMO can destroy markets and investors

Herding behaviour can result in FOMO. FOMO leads to an avalanche effect on the markets: investors buy en masse. The price thus skyrockets, but the value reached by the asset has no underlying asset, no economic or financial basis.

Investors are afraid of missing an opportunity and so they start investing. Instead of examining the fundamentals of the project or the reliability of the news, they invest because they believe that everyone else is making a conscious choice.

Learn to identify a bubble market

These assets can produce positive returns at first, but they are very dangerous. Those who invest only on the basis of the choices of others will suffer great losses. This means that they exploit a bubble, a very positive trend but inflated by the market. At the first signs of decline, however, the value drops because everyone rushes to sell.

Especially when we talk about very volatile markets, such an attitude is very dangerous. For example, when you buy a cryptocurrency, the value of a token can reach its maximum and collapse to its minimum within a few hours. Even the experts risk suffering from this.

A recent case occurred with Tesla shares, where the rise was due to a FOMO effect or with the SushiSwap token.�

Definition

FOMO is the acronym of Fear Of Missing Out, i.e. the fear of being left out of a collective event, of always falling behind others.

From panic buying to panic selling

In the context of investments, FOMO leads to “panic buying” or “panic selling” in which people buy or sell in large volumes for fear of “missing an opportunity to make a profit” or, on the contrary, falling victim to an unexpected collapse of the market.

Usually, panic buying occurs due to the increase in demand that causes a price increase. Panic selling has the opposite effect: the supply increases and the price gets lower. On a large scale, they can have dramatic effects on markets and, consequently, investors’ portfolios.

It is very important to research before making any financial decision. Use a method (we will give an example in the articles “Money Management Basics: Your Net Worth and Profit” and “Technical Analysis: Start With The Basics“) and continue using it according to the chosen strategy and objectives.

Cognitive Bias 2: The Denomination Effect

This behavioural pattern is typical in countries with economies still based on cash, like Italy.

Even if one €50 note is worth the same as ten €5 notes, we will be prepared to spend small-denomination cash rather than using the same amount of money in the form of a larger denomination note.

The same happens with investments. Those who approach an investment for the first time, whether it is a share or a cryptocurrency, tend to opt for an asset that costs less, based on an alleged “low risk of loss” that does not take into account any in-depth analysis or real prospects for profit.

The Denomination Effect on Cryptocurrencies

For example, speaking of cryptocurrency, this cognitive bias occurs when projects such as Ripple or Litecoin are chosen for a first purchase because they are apparently “cheaper” than Bitcoin or Ether.

However, these four cryptocurrencies have very different purposes and have equally different growth prospects. You can read the articles in “Cryptocurrency” where you will find insights on individual cryptocurrencies and their mission.

Keep a Rational Outlook

Just like cognitive biases, strong emotions are an obstacle to our rationality. We should never make investment decisions when we are too happy or too sad. It is easy especially in high-risk situations to get caught up in enthusiasm, sadness, anxiety or haste.

Loss Aversion

When one of our assets is not performing as desired, the emotional reaction to loss is often stronger than that of gain. Therefore, don’t start out overly optimistic when choosing your investment and don’t look only at the potential return when the risk is equally high.

This tendency to suffer the most from losses is responsible for the panic effect in crisis markets. The collapse of markets pushed investors to sell in order to avoid further losses.

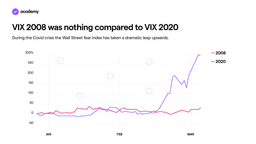

The Panic Effect In 2008 and 2020 Crisis

Fear has particularly affected the crises of 2008 and 2020. During these years, investors didn’t assess the pros and cons of their long-term decisions, but reacted emotionally to the present.

Another counterproductive attitude is to compulsively control your investment portfolio, especially if this affects your mood.

To avoid this behaviour, it is advisable to first determine when it is actually appropriate to control your assets and build a strategic plan accordingly. If, for example, your goal is long-term, it makes even less sense to control the performance of your portfolio on a weekly basis. The market needs its time!

Did You Know?

Daniel Kahneman and Vernon Smith won the Nobel Prize for Economics in 2002 “for integrating the results of psychological research into economic science, especially with regard to human judgment and decision theory under uncertain conditions”. For their work, they are considered to be among the founders of behavioural finance.