Money Management Basics: Your Net Worth and Profit

October 19, 2020

7 min

Before choosing which financial instrument to buy and with what strategy, you need to determine your monthly net worth and profit.

In this article, we will see all the basic money management steps to take before investing. This will allow us to invest without risking compromising our economic serenity.

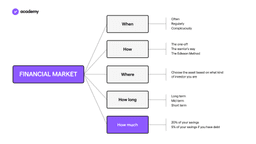

In the next articles, instead, we will answer all the other questions that come with who approaches an investment for the first time.

Where to invest and for how long? Lesson “Set Goals For Your Future“.

When to invest and with what strategy? Lesson “Compound Interest and Other Strategies“.

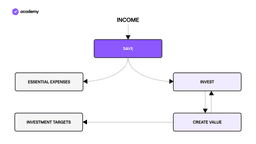

Money Management Cycle

The phases of a virtuous cycle of money are:

- Having an income: what is my net worth?

- Saving: how much is my capital?

- Investing: how much capital can I invest?

- Generating value: What investment strategy should I choose?

- Monitoring: What is the method for monitoring my returns?

HOW MUCH: How much should I invest?

Step 1 – What is my net worth?

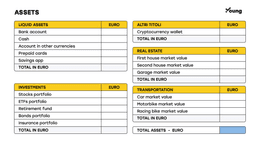

To get an accurate picture of your finances, you first need to calculate your net worth. The net worth expresses your actual capital.

- Assets are the goods you have at your disposal: cash, real estate, receivables, bank account, shareholdings, etc..

- Liabilities are debts. Therefore, money that we have but that needs to be repaid: mortgage, friends’ loans, debit cards, etc..

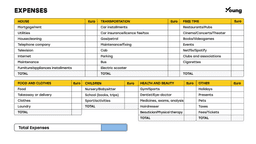

To carry out an accurate calculation you can use an excel sheet or a paper chart. Below you will find the main asset and liability items that you can customise according to your needs. Try filling in all the items to calculate your balance sheet.

Assets minus liabilities equals your net worth. This exercise allows us to monitor how much debt weighs in relation to our total assets, with a view to reducing it over time.

Step 2: How Much Is My Capital?

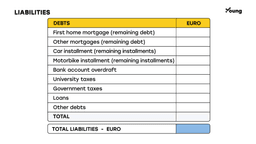

After that, you need to have a periodic overview of your available capital. To do this, we recommend that you identify your cash flow or profit. Your profit is the difference between your income and your expenses. Your income and expenses need to be classified according to their source or destination.

Also in this case we offer some items that have to be customized according to the specific situation of each one.

Calculate it on a monthly basis or as often as you feel most comfortable depending on your lifestyle. In this way, you will get your monthly profit, in other words, what you can save. Thanks to the expenses classification, you can identify your strengths and weaknesses and thus understand how to optimise your cash flow.

If the items in your balance sheet and cash flow statement are complex or there are doubts about taxes, market values, etc., we recommend that you consult an accountant or other experts.

Account Management

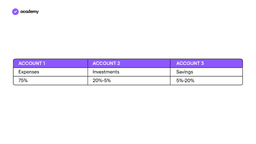

Some prefer to split expenses, savings and investments into 2 or 3 separate accounts. The separation of accounts makes it easier to monitor income and expenses and to keep track of your movements also on a psychological level.

However, it may be easier for beginners to get familiar with accounting through the management of a single account.

We recommend that interest rates and fees be taken into consideration when choosing your accounts. Check out also foreign accounts and fully digital banks.

Step 3: How Much To Invest?

At this point, you should define what percentage of your capital should be allocated to investments. The capital must be that sum which cannot cause economic damage if entirely lost.

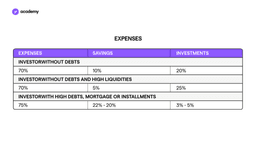

There are many factors involved in determining how much capital to invest. Certainly, the main ones are age, income and family situation. However, we can draw general guidelines that apply to most people.

The simplest measure on which to calculate this percentage is on a monthly basis. However, you can use any frequency you choose to calculate your cash flow.

Normally, you would invest about 20% of your monthly cash flow only if you are not in debt. Mortgages, car, motorbike, household appliances or furniture instalments are considered a form of debt. In this case, it is recommended to stay between 3% and 5%. Debt represents a fixed part of your present and future capital, that makes it more difficult to deal with unforeseen situations. This is why the percentage that you can invest should be much lower.