Creating a Well-Balanced Crypto Portfolio

September 13, 2021

8 min

Creating a crypto portfolio is a fundamental step, a bit like creating a character in a role-playing game. Each metric, value, characteristic, will determine its performance and management.

How to decide which cryptocurrencies to buy and how many, in fact, is one of the first questions everyone should ask themselves before jumping headlong into the market.

Diversified or focused?

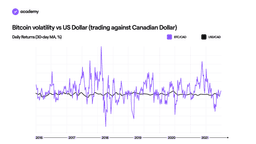

Diversification in finance means owning several assets, or in this case several cryptocurrencies, in such a way that the risk of one is cushioned by the other. This is usually a good practice to minimise losses due to volatility.

The opposite of a diversified portfolio is a focused portfolio, i.e. with 1 or at most 2 assets. If they both collapse, there is nothing to compensate for the loss. On the plus side, you have to monitor it much less and there is no need for long days of preventive study or maintenance.

However, a distinction must be made between a crypto-only portfolio and a portfolio that combines financial instruments with cryptocurrencies.

A purely crypto portfolio will have a much higher risk rate, as compared to traditional financial assets they are much more volatile and generally risky.

This is the first decision to make: what level of risk to start from?

In this article, we will talk about a portfolio consisting only of cryptocurrencies.

Why include cryptocurrencies?

Many investors choose to turn to cryptocurrencies for various reasons.

- Because they believe they are growing in popularity and therefore in order to anticipate trends and appreciation of this technology.

- To protect themselves from the inflation of fiat currencies or to avoid the high fees of financial instruments.

- To be able to use DeFi services such as staking and yield farming, features that generate periodic rewards when certain cryptocurrencies are used. Compared to the interest of traditional services, the return rates are much higher, also due to a matter of risk.

How many cryptocurrencies?

Consider that the more cryptocurrencies you own, the more time you will have to spend studying, monitoring and managing them. Evaluate according to the time you have available or want to devote to your portfolio.

With altcoins, for example, news can come out at any moment that impacts your previous strategy for them.

Conversely, the more established projects like bitcoin are, the less you have to worry about them.

Generally, the average buyer chooses to hold between 2 and 6. Also, consider that you need to rebalance your portfolio on a regular basis. This may also involve a change in the number of cryptos, because if you see a very poor performance from one currency, you can sell it in exchange for one that looks like a winner in the long run.

Which cryptocurrencies?

To make this second major choice, it is first necessary to have an overview of the categories according to which cryptocurrencies can be classified.

- Consolidated or speculative – whether they have a very high market capitalisation or not, respectively.

- Coin or token/stablecoin – whether they are cryptocurrencies at the centre of a dominant ecosystem, or whether they only have utility within a specific context.

- Depending on the sector or ecosystem they fall into

Consider that a coin can belong to a category today and change it tomorrow.

Only holding Bitcoin: the safest choice

Regarding the first distinction, Bitcoin is the queen of established cryptocurrencies.

So much so that many, perhaps exaggerating, consider it the only one. Others now also consider Ethereum to be an established currency, while the more positive ones consider as established those above 50 billion in market capitalisation, which at the moment also includes Solana.

What we certainly need to be more careful about, are the trends and hype surrounding certain new coins or even memecoins. Certainly, with a lot of timing and luck, they can bring gains, but the risk is high.

Coming back to Bitcoin, the proof of its “safety” is the lower volatility compared to altcoins. We see this every day just by comparing its performance with that of Ethereum. Many now consider it a store of value to accumulate over the long term.

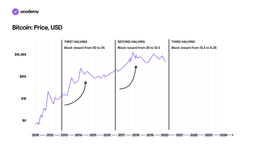

However, there are also those who adhere to the theory that Bitcoin’s growth cycle does not depend on a recognised market value, but on a purely mechanical factor, namely halving. Halving allegedly creates a gradual deflationary effect for bitcoin, thus keeping its value high.

What about Utility Cryptocurrencies?

A small part of your cryptocurrency portfolio can also be dedicated to “utility” assets. We are talking for instance about stablecoins, which can be a store of value and liquidity that can be easily used in any crypto service.

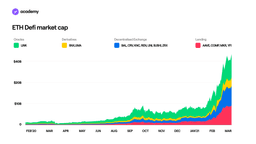

All DeFi lending protocols accept stablecoins, with which you can receive rewards from yield farming.

For the same reason, it is conceivable to devote a small space to the governance or utility tokens that power these protocols, both in order to use them and because their usefulness stimulates market demand.

The Field and Ecosystem perspective

Keeping in mind the question of market demand, we can also take a field perspective, if we particularly believe in a cryptocurrency application.

For example, if you are very familiar with the smart contract field, you will have a greater sensitivity that will lead you to support one project over another.

If, on the other hand, your passion is Ethereum and you think it is the winning ecosystem, you may choose to support the protocols based on its blockchain that you think are most valuable.

The strategy to apply

Once you have identified the cryptocurrencies you want to include, based on their market capitalisation and possibly their utility, choose the percentage to be allocated to them.

This should be done based on the risk you are willing to take. Only include what you are willing to lose.

Each cryptocurrency must have a specific reason to appear in your portfolio in a certain amount.

If you can’t justify the presence of a currency in your plan, do more research and review your plan. You can test the soundness of your decision by simulating an elevator pitch.

Having identified your currencies, purposes and percentages, let’s move on to the associated strategy.

You need to be clear about how long you will keep each asset in the portfolio.

Let’s take some purely hypothetical examples to illustrate the concept:

- Long term – You may want to buy and hold bitcoin until the next halving and then wait for a good time to sell a percentage of it

- Medium to long term – You may want to periodically accumulate ADA until the upgrade to Basho is complete and sell it all

- Short term – You may have the skills and time to handle daily altcoin trading?

Always keep in mind

- To monitor and rebalance your portfolio, because the crypto market changes frequently

- Don’t let your emotions guide your choices

- Don’t let others guide your choices unless that’s their job

- Do Your Own Research.