DYOR: What it Means and How to Start

July 6, 2021

8 min

Cryptocurrencies are not all the same, which is why before choosing which ‘horse to bet on’, it is a good idea to read up on what project a cryptocurrency is a part of and what it was created for. This rule applies especially to new projects.

What DYOR means

DYOR is an acronym that stands for Do Your Own Research and is a mantra in the crypto sector, but also in the world of information in general. We know how easy it is to stumble upon fake news or inaccurate information. This is even easier in a highly multidisciplinary and internet-based field like cryptocurrencies and blockchain.

That is why it is important to develop critical thinking and not to buy any information you receive from just one source. For instance, do some fact-checking after you find out something while chatting with friends.

In this article, we look at where to find information from official sources and what aspects to consider in order to delve into and understand a cryptocurrency.

Sources of information

Searching for information on a cryptocurrency is less straightforward because it is a new market and does not yet have institutional data sources. The free or semi-free portals that offer this information do not always manage to follow the emergence of new projects in real-time to give a complete picture. It is not unusual for information to arrive first in social network communities, especially Telegram channels, which are a real goldmine.

That is why it is very useful to follow these kinds of gateways, especially for emerging and niche projects:

- The official project website or medium blog

- Channels or communities on social media such as Twitter, Reddit, Telegram, Discord: places for direct discussion with the team or parts of the community.

- Industry-focused news sites or newsletters

When researching, pay attention to these aspects

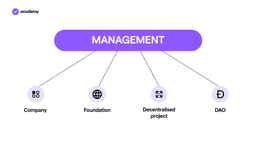

The Project’s management

- Companies

Any company can issue its own cryptocurrency, although the most common case is companies that include a cryptocurrency exchange among their products. Find out why the company has issued a cryptocurrency and what technology partners it works with.

Examples: Ripple, Tether. Among exchanges: Binance (BNB), Young Platform (YNG).

- Decentralised projects

The founders of the project are often unknown, or serve as a reference for the early stages of development. The protocol is simply released as open-source with a white paper. From then on, any developer can join the network and participate in it to improve its functioning.

Examples: Bitcoin, Monero, Chainlink

- Foundations

Non-profit organisations that improve and maintain the network, develop new services and finance the project. Often their aim is to migrate towards full decentralisation.

Examples: Ethereum, Litecoin, Tezos

- DAOs

The DAO is the most decentralised form of management if applied correctly. It is completely entrusted to smart contracts.

There are few examples of complete and successful DAOs that are capable of governing all aspects of a cryptocurrency, but the DeFi ecosystem is continuing to experiment.

Examples: MakerDAO, Dash.

You’ll often find companies behind decentralised projects, but they are usually hired by the foundation, the founders, or the DAO to develop the protocol or for marketing and research.

Read more about crypto governance and DAOs in this article.

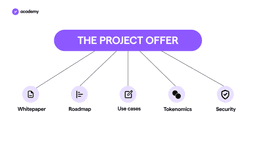

A Project’s Offer

- Whitepaper

It has become a tradition in the crypto world that each project gets introduced to the public for the first time with a whitepaper.

The whitepaper is a technical document that explains how the project works, demonstrating its feasibility and necessity. It often also contains the mission and background of the project, which is very interesting especially when we think of the historical whitepapers of Bitcoin and Ethereum.

- Development and Roadmap

We then look at the goals the founders set for themselves over time, how realistic and consistent they are, how ambitious they are. If the project already has a short history, we look at past developments and releases in the same light. If the first achievements of the project are qualitative, it can also be a guarantee for future prospects.

- Use cases

Often when we hear about a new cryptocurrency we get distracted by the who and the how, but we don’t immediately ask: why?

A major obstacle to the adoption of blockchain and cryptocurrency technologies is the difficulty of use and unfamiliarity with crypto topics. Often the use cases are mainly designed for developers, traders, arbitrageurs and industry enthusiasts, and the project communicates precisely to them, using very technical terms. So let’s ask ourselves if the project we are researching is doing anything to bridge this gap, both in terms of usability and popularisation.

Let’s also assess the competition: is there already a project offering the same use cases? In comparison, what are the pros and cons?

- Tokenomics

Tokenomics is an economic model based on the token project. The main aspect of tokenomics is the way tokens are distributed over time.

The initial distribution for example can be done via ICO, IEO or airdrop. The recipients of the distribution can be the founding team, investors in the project, those who worked on it and an initial community.

This gives an indication of e.g. the level of centralisation of the project.

The rate at which a token is distributed in the market over time is important for calculating the inflation rate and thus the long-term scarcity of the currency. Conversely, coin burning is used to decrease the number of tokens in circulation. This is a model that allows tokens to be removed in a controlled manner and to lower inflation.

Tokenomics is also about the use cases of the token, which influence the demand for the token in the market. For example, a token can be used for project governance, or for staking, or to pay network fees.

- Security

With the advent of DeFi, and the evolution of financial services on blockchain, it is increasingly important that protocols and smart contracts are foolproof.

Smart contracts replace the intermediary in any kind of financial service, and therefore cannot afford any contingencies.

This is why there are organisations that offer audits to certify that a project’s smart contracts and protocols are secure in any scenario.

Audit

In IT it is a process in which the code of a piece of software is examined with the aim of discovering any bugs, security violations or programming conventions before it is implemented.

Smart contract audits play a key role in assessing the technical risks associated with a decentralised application, but as a relatively new form of code, standards for smart contract audits are still in their infancy.

News and events

In order to understand the market and its prospects, it is also essential to stay up-to-date on a weekly or daily basis. This includes news that do not directly concern the cryptocurrency in question, but which may have an important influence on its development. For example:

- Radical changes in widespread foundational technologies. For example: Ethereum 2.0.

- News about the regulation of the sector in different territories. For example, in China and the US, changes and news about them are frequent. The complexity of the relationship between both countries and between the traditional system and the crypto world are such that it is worth staying up to date.

- Financial transactions such as partnerships, joint ventures or purchases that may affect the market, competition or the future of the project concerned. For example: the acquisition of Coinmarketcap by Binance.

- The expansion of giants in the crypto sector, which may stimulate the progress of the entire market concerned. For example: Facebook and the Libra project, later transformed into Diem. A similar phenomenon is the adoption of NFTs by music and sports celebrities.

- Conversely, the integration of elements of the crypto sector into the mainstream. For instance, the listing of Coinbase on NASDAQ.