Bitcoin: fake news and misconceptions

November 26, 2021

6 min

For a long time, Bitcoin has served as an excellent scapegoat for everything that happens online and in the grey area of finance. This is because it is not understood as an innovation, and is instead misunderstood as the game of some mysterious hacker.

Let’s refute these simplistic narratives one by one.

Cyber criminals and cryptolockers do not need Bitcoin

One of the most important and widespread clichés is that hackers all over the world, when carrying out their cybercrime operations, use it as a means of payment for their ransom.

The classic operation is the cryptolocker, a type of computer virus called ransomware that encrypts all data on the victim computer and locks it up completely. Criminals then demand payment of a ransom to unlock the victim’s computer, and it is estimated that about 3% of users actually pay.

The first ransomware was discovered in 1989, even before the advent of e-mail. It was distributed via floppy disk and the ransom was paid in dollars, by sending the sum to an office located in Panama.

So cryptolockers are certainly not a recent invention and are not directly linked to Bitcoin. If they are used as a means of payment, it is because some authorities often do not yet have the expertise to track transactions on the blockchain, and criminals usually perform multiple transactions to complicate the tracking.

Bitcoin is actually only pseudonymous, but there are some coins that are completely anonymous instead, such as Monero.

Bitcoin and the gaffe of the Deutsche Welle newspaper

In 2015, the German newspaper Deutsche Welle published a scoop article in which they wanted to prove that terrorist attacks had been financed with Bitcoin because wallets linked to ISIS had been found.

The truth soon came out and it was shown that there was no correlation between wallets, terrorist attacks and ISIS. The newspaper and the author of the article publicly apologised on Twitter, though the tweet was then removed). They blamed a technical error on the part of the editorial team, which added some ambiguous terms, thus causing a misinterpretation on the part of readers and also of other media outlets that reported the news.

To date, it is not possible to prove or rule out that there may be a correlation between terrorism and Bitcoin, but what is absolutely certain is that the dollar has been used for decades to finance this type of operation.

Europol itself has denied in a report the financing of ISIS through Bitcoin, and there is no evidence or reports from the police.

Bitcoin does not facilitate money laundering

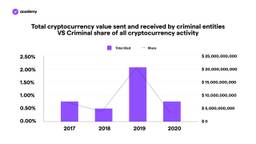

Another popular misconception about Bitcoin, often fuelled by central banks or financial institutions with interests opposed to decentralisation, is that it is used for money laundering or self-laundering.

Assuming that any technology can be used correctly or illegally, however, this does not affect the goodness of the technology itself. Bitcoin is based on a distributed ledger that is freely available to anyone, but the only way to actually trace the identity of the person making the transactions is by tracking the IP address or other unique identifier of the digital identity.

These features make Bitcoin extremely transparent to the authorities, so it is certainly not the ideal tool for money launderers. Fiat currencies are much better suited for this purpose because traceability is heavily obscured by legal loopholes, off-shore jurisdictions or front men of various kinds (corporations, individuals, foundations and NGOs), in fact almost all money laundering today is done through bank accounts or e-wallets based on fiat currency.

Bitcoin doesn’t help tax evasion

Alongside the narrative about money laundering, there is also the one about tax evasion. Certainly, in some countries with poor tax laws and controls it is possible to exploit the blockchain for this, however it is very complicated and risky.

When we talk about tax evasion, we generally refer to capital gains tax, which affects capital gains from financial investments, but we also refer to tax evasion on business or physical income.

The problem is that in order to effectively evade taxes, you would have to be able to spend bitcoin on goods and services that you use on a daily basis, and this is rare as few companies currently accept payments via this instrument. In any case, even if bitcoin were to become a widespread means of payment used on a daily basis tomorrow, transactions would still be traceable by tax institutions.

Cash, on the other hand, it’s by far the best option because it offers total anonymity of transactions and possession. Furthermore, it is more convenient (and in fact extremely used by tax evaders) to exploit jurisdictions and tax havens that guarantee the obfuscation of information related to one’s identity.

Bitcoin is not a Ponzi scheme

One of the myths that have persisted since Bitcoin’s inception is that it is a sophisticated Ponzi scheme.

A Ponzi scheme has no real value to offer, all interest from investors is based on hype and greed. In addition, to prevent the scheme from collapsing, its creators use a pyramid investment structure in which newcomers to the scheme pay a fee to guarantee the gains to investors who joined before them.

The top of the pyramid represents the creators of the scheme and the base of the pyramid represents all the people who entered last. So you are not investing in a business or a financial instrument, you are paying scammers.

This is not the case for Bitcoin. Bitcoin’s blockchain is a payment technology, and its cryptocurrency is also used by many as a safe-haven asset. Its innovative proposition, its scarcity and its growing adoption even at the institutional level justify its market price.

Furthermore, unlike Ponzi schemes, there is no pyramid structure because cryptocurrency is able to sustain itself in a decentralised manner. An exponential influx of people and capital is not necessary to finance the accomplices and avoid collapse.