CBDC And Crypto: The Race For Digital Money

September 15, 2021

9 min

Central Bank Digital Currencies (CBDCs) are digital currencies issued by a central bank, as opposed to crypto. This term is used to refer to the digital version of legal tender fiat currencies.

The difference between CBDC and cryptocurrency

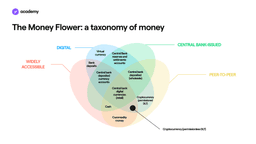

The Money Flower clearly shows how cryptocurrencies are fundamentally different as they are not issued by a central bank, however, both cryptocurrencies and CBDC can be both/either P2P and/or easily accessible depending on the underlying infrastructure.

CBDC is a type of currency openly inspired by Bitcoin, but at the antipodes of a cryptocurrency in ethical terms.

Cryptocurrencies, in fact, are usually decentralised, or tending towards decentralisation. CBDCs, on the other hand, are in the hands of a government that can issue new money at any time and decides how its circulation will work.

Many people wonder whether CBDCs pose a threat to cryptocurrencies. Precisely because they have two very different purposes and systems, they are not in competition. The actors at risk, depending on how the situation will evolve, are probably commercial banks and centralised stablecoins.

The interest from Central Banks

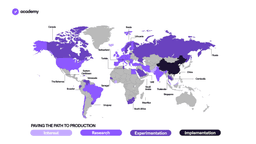

At least 40 governments around the world are working on researching or implementing technology to support this currency.

The advance of China, in particular, has stimulated the major central banks to take an interest in the issue so as not to fall further behind.

The pandemic has also underlined the need to digitise money, as well as the growth of the digital payments sector, which meets significant market demand. In some parts of the world, however, this need was already present for more urgent reasons, as is well known in the world of cryptocurrencies.

Banking services for many people are inaccessible both geographically and in terms of cost. Building a fully digital system accessible simply through the internet would allow millions of people to receive aid more easily and participate in the global economy.

The aim communicated by the central banks is to have a system without risk and without cost, for total inclusiveness.

On the other hand, there’s the question of protecting the monetary sovereignty of governments from possible private monopolies, such as Facebook‘s Diem, or from the interference of power players such as China.

Together with banks from around the world, the Swiss-based Bank of International Settlements (BIS) has established three key principles required by a CBDC:

- Coexistence with fiat and “other money”,

- Supporting monetary and financial stability,

- Promoting innovation and efficiency.

Where do we stand on CBDC?

China

China has already issued around 40 million dollars in e-CNY, the digital equivalent of the Yuan, which it has tested in a number of metropolises.

In China, it is the People’s Bank of China that issues the CBDC, which is merely distributed by commercial banks. In fact, the PBC controls and manages the e-CNY at all stages of its journey and tracks the transactions of each digital wallet.

In China, the e-CNY does not replace the physical Yuan, but sits alongside it, and is designed for domestic use. It is therefore a type of CBDC that is referred to as “retail“.

In general, there is also the possibility of creating a wholesale CBDC, which is intended for interbank, institutional and international transactions.

In September 2021, the president of the PBC announced that the use of blockchain or DLT for some applications of the digital yuan was being considered, while pointing out some of its shortcomings, most notably its scalability.

DLT

Distributed ledger technology is the set of technological infrastructures and protocols that allow immutable recording, validation and updating of data on a large and global network. All nodes in the network have the same copy of the database. The blockchain is the most advanced and widespread example of DLT, but several technologies are being developed.

Europe

After a technical experimentation phase, the European Union has started the investigation phase on how to implement a CBDC of the euro, which will last 2 years (until July 2023).

France has tested interbank and secondary market transactions using a permissioned blockchain, and is experimenting with wholesale CBDC transactions in conjunction with the Swiss National Bank.

Sweden is in the first phase of testing its e-Krona, a CBDC based on DLT, i.e. on a decentralised network. However, this is also a permissioned network, where the Swedish bank (Riksbank) acts as owner and decides who can participate.

The UK does not stay out of the discussion, and although it is in its infancy, it has done a good job in terms of communication.

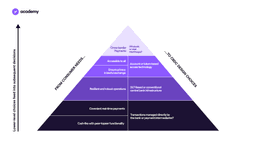

How will CBDC work?

The answer is still up in the air, but it can be broken down into a series of questions that illustrate how vast the issue is.

- Accessible, but centralised and less anonymous

If China has chosen to give full control to the Central Bank, a scenario involving payment intermediaries or commercial banks with partial control is also possible.

As things stand, the less control the Central Bank has, the more complex the system will be. Consequently, there will be more technical and usability problems to deal with.

- DLT or conventional bank infrastructure?

The Bank of England has listed the advantages of a CBDC based on DLT:

- Resilience: High availability and guarantee of digital currency built on a public ledger,

- Programmability: The use of smart contracts and tokens make the currency programmable,

- Access: The blockchain provides access to shared data to more individuals in a secure manner.

- Cryptography: Public-key cryptography could help to automatically verify that the party sending a transaction is authorised to do so.

Most of the banks experimenting with this currency have chosen a permissioned blockchain, whose main flaw is that an attack on a single participant could damage the whole network. Central banks could therefore consider a semi-permissioned or even permissionless solution.

However, as the president of the PBC pointed out, DLT and blockchain technology still has a few weaknesses to address.

- Account- or token-based system?

A digital currency can circulate in a token-based or account-based system. An account-based system validates transactions by verifying the identity of the account holder, while a token-based system verifies the authenticity of the object used to pay.

When I pay with banknotes in a physical shop, I am in a token-based system, where my identity is not relevant.

When I pay on an e-commerce with my payment card, on the other hand, I have to certify that it is me who is making the payment.

Bitcoin is both: it is account-based because I certify ownership of my wallet with the private key, but it is also token-based because the blockchain validates the authenticity of the transferred bitcoins.

The choice banks will have to make in this respect, therefore, involves the issue of privacy and security, but the world of cryptocurrencies shows us that there are many possible hybrid formulas.

What about offline payments?

This is another outstanding issue. Denying offline payments would be counterproductive in terms of inclusiveness.

For remote payments, there are currently no solutions, as far as we know, but Visa has recently proposed a solution for peer-to-peer private payments, which would be based on NFC or Bluetooth.

What would CBDCs change?

This depends on the technological choices that each government will make in this respect. So how much control the Central Bank will have, what kind of infrastructure will be used and all that we have listed in “How will CBDC work?”.

At present central banks do not print cash, usually, but only act as intermediaries for commercial banks. The latter are in charge of issuing cash in the form of both deposits and paper money.

The centralisation of power in the hands of central banks seems to be a real risk since it would allow an easier and faster implementation of this new system.

Once again, it depends on whether governments will approach the project as an investment for long-term improvement, or for immediate benefits.