What are Decentralised Prediction Markets?

July 28, 2021

8 min

Imagine a world where price forecasts are made accurately, the weather is predicted realistically, and news is verified, making fake news just a memory.

This scenario could become a reality, thanks to the emergence of decentralised prediction markets (DPM).

Prediction markets are based on the �“wisdom of the crowd” principle. This is why they are the perfect application of blockchain technology, which itself depends on the distributed participation of users.

What are prediction markets?

A market is simply a group of people buying or selling things to each other.

The item being bought and sold can be a physical good, as well as a financial instrument. In the prediction market, on the other hand, people buy and sell predictions about events.

Predictions can be about any event: the weather, financial forecasts, the outcome of elections or sports.

The accuracy of prediction markets is very high, but scholars do not yet have a complete picture of how they work. For now, one study found that prediction markets were able to predict political outcomes more accurately than official polls.

Another study found that trading in orange juice futures could predict the weather more accurately than professional weather institutions. Yes, you read that right, in fact, orange juice production is highly dependent on the weather.

How a prediction market works

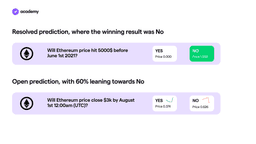

A single market consists of a prediction or question about the future, in which you can bet for Yes or No, or at least for option A or option B.

Choosing Yes will pay $1 if the event occurs. If it does not occur, then it will pay nothing, and you should have chosen No to receive $1.

The price of a share in a prediction market is equal to the probability of the event occurring. If Yes shares cost $0.60, then the market believes there is a 60% probability that the event or outcome will occur.

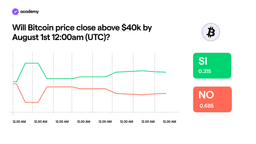

According to the example below, there is a 31% chance that Bitcoin will exceed 40k before August 1st.

Suppose you bet that the roll of a six-sided die produces a 6. The probability of this is 1/6, or about 17%. Yes shares then cost $0.17 and No shares cost $0.83. For five dollars, you could buy 30 Yes shares or 6 No shares.

Your expected payout is the number of shares multiplied by the probability. So for example 30 Yes * (1/6 probability of winning) = $5.

The limits of centralised prediction markets

Some examples of centralised prediction markets are Intrade, BetFair, and the Iowa Electronic Market. The latter is one of the pioneers of prediction markets.

It was established in 1988 and was used to predict who would win the presidential election. From 1988 to 2004, the Iowa Electronic Market provided more accurate predictions than the polls 3 times out of 4 elections.

The centralisation of prediction markets, however, presents some problems.

It’s a closed system

Much like traditional financial markets, traditional prediction trading is limited by strict regulations, capital controls and national borders. Therefore, market participants and regulatory agencies can exercise their power to determine who is allowed to participate and to select the events they can bet on.

This limits the number of outcomes on which traders can speculate, removing the ability to create their own markets. In addition, there is a persistent risk that prediction markets can be easily closed by regulatory agencies, which discourages participation.

Can be censored

In centralised markets, limits are placed on bets in order to lower the level of risk traders can take. This prevents participants from placing very high bets if they are sure of an outcome.

High costs

Participating in centralised prediction markets is very expensive as you have to pay trading, deposit and withdrawal fees, while the market takes a share of your profits. This is a deterrent for very active traders as the high fees erode their potential returns.

Decentralised prediction markets

The adoption of blockchain technology in prediction markets not only eliminates these problems, but also confers multiple other benefits that encourage participation, a key factor in predictions.

Blockchain-based markets are public, peer-to-peer networks where any interested participant can enter and bet on their predictions. This open and censorship-resistant nature also allows anyone to create their own markets based on the events of their liking.

Moreover, the only expenses are the network fees needed to keep the protocol secure. These are usually quite small and therefore traders get to keep a substantial part of their winnings.

The rise of decentralised prediction markets

Decentralised prediction markets have emerged in recent years, providing participants with more efficient, cost-effective and secure platforms for trading. Augur, Gnosis and Polkamarkets are some of the leading platforms on the market today.

Ethereum first allowed prediction markets to realise their full potential through smart contracts, but other blockchains today also provide a smart contract framework and language for development.

Smart Contract

An agreement that has been encoded and stored in the blockchain network (on each participant’s database). It defines the conditions on which all parties using the agreement agree. Then, if the required conditions are met, certain actions are triggered.

Decentralised prediction markets are smart contracts that determine who gets paid when certain predefined conditions occur. In other words, they are dApps that replace centralised market control with code and encryption.

Decentralised prediction markets are in their infancy, but they have the potential to revolutionise trading and investing.

Augur

Augur was created in 2014 by the Forecast Foundation and launched with an ICO in 2015 raising $5 million. Augur is an Ethereum-based protocol that allows users to create their own prediction markets.

On Augur it is possible to deposit liquidity in a given market and receive fees in return, so the platform gives access to ample liquidity for trading. Augur currently hosts mostly sports predictions. Its cryptocurrency is REP, and it allows you to participate in the resolution of disputes that may arise over certain predictions.

Gnosis

Gnosis an Ethereum-based protocol for the DeFi prediction market.

Gnosis was founded in 2015 by Stefan George and Martin Koppelmann. Gnosis was launched with an ICO on 24 April 2017 raising $12.5 million of Gnosis (GNO), its cryptocurrency.

The Gnosis platform uses information from capital markets and data science to allow users to predict events or build their own decentralised prediction applications. Gnosis also offers platform users a multi-signature wallet.

The decentralised prediction marketplace based on the Gnosis protocol is Omen, online from 2020.

Polkamarkets

Polkamarkets, a newcomer to the forecasting market, is based on the Polkadot network and provides forecasts mainly on Esports, Crypto Futures, Sports and Politics.

More than just a prediction market, Polkamarkets will have important entertainment features. These include NFT-based gamification, integration of live streaming for Esports & Sports predictions, and daily cryptocurrency price markets. To complement this environment, there will also be a live chat feature and virtual events, forming a fertile ground for new online communities.

Conclusion

Prediction markets represent a variety of views and have proven to be a useful forecasting tool. Even companies like Google use prediction markets. The current economic, cultural and political environment has increased the demand for prediction markets and they have slowly moved from the private to the public domain.

The availability of data from multiple sources should improve estimation methods and avoid the problem of data manipulation. However, as prediction markets become more widespread, the effectiveness of the markets will improve and ethical and human biases will be corrected.