Tokenomics: How a Cryptocurrency’s Economics Works

September 17, 2021

8 min

Tokenomics is the economics of tokens, that nascent field that studies the economic models of cryptocurrencies in their ecosystems. In other words, it is the application of monetary policy principles to blockchain native assets.

The tokenomics of a project is key to understanding its level of decentralisation and its potential for growth.

The difference between Token and Coin

To some, the difference between token and coin may not be clear yet.

A coin (or layer 1 token) is a cryptocurrency native to the blockchain on which it is based, e.g. bitcoin for Bitcoin or ether for Ethereum.

A token (or layer 2 token), on the other hand, is based on a blockchain external to its main system. For example, all ERC-20s are tokens that use Ethereum’s blockchain, but feed their own network, not Ethereum’s.

Tokenomics concerns both of these types of cryptocurrency, and the aspects it deals with are:

- Supply and value

- Distribution

- Inflation or deflation

- Use cases

Supply and Value

Market capitalisation (market cap) gives us a more accurate impression of what the actual value of a currency is. The market cap is the product between the price of the currency and its circulating supply, and thus expresses the total market value of a cryptocurrency.

So two coins with the same price do not necessarily have the same value.

Another value to check is Fully Diluted Valuation, which gives us a perspective on what the market capitalisation might be if all coins were in circulation.

Finally, the maximum supply tells us whether the currency will be able to increase its inflation indefinitely, or whether a limit has already been set to prevent the loss of purchasing power.

These values can be checked on sites such as CoinGeko or CoinMarketCap, but the most accurate sources are block explorers, i.e. sites that allow you to view the data of a blockchain and its tokens in real time. Blockchair, for example, is a very useful block explorer aggregator, as it brings together 17 of the most popular blockchains.

Distribution and Allocation

By staying on these sites, we can also control the distribution of the token among its owners.

On Etherscan just search for the ERC-20 token and then select “Holders” to see all the wallets with their balances. For Bitcoin just go to btc.com, select the coin from the top menu and then click on Addresses. For Polkadot you can find them here.

If too many tokens are in too few wallets, there is a risk that these whales will sell everything at any time, causing the price to fall.

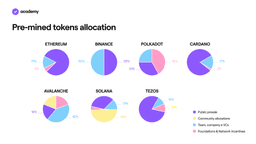

The distribution and allocation of tokens are key tokenomics metrics to understand the level of decentralisation and fairness of the project. Let’s not only look at how they are distributed now, but also their allocation at launch.

A fair launch usually sees a small community start mining the currency, or earning it through a meritocratic incentive scheme (BTC, DOGE, LTC).

Messari defines a fair launch as one that is publicly announced without any pre-mined tokens.

Moreover, a report of theirs from February 2021 shows that the top 20 fair-launched coins have a positive performance compared to e.g. ERC20 tokens.

These include Bitcoin, Litecoin, Yearn.Finance and SushiSwap.

A controversial type of launch is characterised by a pre-mined supply of tokens. A portion of this may be sold in a private phase, before being released publicly, to get the funds needed to build the protocol. Usually, another significant chunk of the pre-mined tokens is allocated to investors and the founding team. Instead, a usually smaller portion of the supply is dedicated to an ICO or IEO, i.e. a public sale.

Each cryptocurrency finds its place on the spectrum between centralisation and decentralisation depending on how its tokens are allocated.

A particular example of tokenomics is Dogecoin, which was initially distributed through mining, but we now see a clear concentration of tokens in one wallet. It is not clear who this wallet belongs to, but the hypothesis that seems most likely is that it belongs to the Robinhood exchange.

Fun Fact

According to incentive theory, human behaviour depends primarily on the desire to receive rewards or approval that reinforce and motivate. Incentives play a crucial role in the token economics, motivating users to participate in value exchanges in blockchain networks.

Inflation and Deflation

The supply and how tokens are distributed over time also determine the inflation of a cryptocurrency.

Inflation

The progressive increase in prices. When excessive, it is called hyperinflation and implies a decrease in the purchasing power of money. Hyperinflation is a situation that occurs when too much paper money is printed or too much new digital fiat money is issued.

Limited-supply Model

Under this umbrella we find Bitcoin, Litecoin and Bitcoin Cash.

All these coins have a defined maximum supply and their controlled inflation rate is based on mining and halving.

Bitcoin is the best example to start with. Its maximum supply is 21 million, and the distribution of BTC over time is monitored by halving every 4 years. This allows it to maintain a “healthy” inflation rate.Its deflation on the other hand can be caused by sending bitcoin to wallets without a known private key or by a loss of wallets, however these are very rare cases.

Inflationary Model

Coins that adopt this model of tokenomics are usually utility tokens, and include Polkadot and Solana.

In this case, there is no maximum supply. Some set an annual limit, others rely on a release schedule, and others choose to determine supply based on demand data.Some projects, such as Dogecoin, justify this lack of a limit by stating that their aim is price stability, not price increase.

Proof-of-Stake based blockchains in particular use staking to distribute new currency in the market in a meritocratic way. Excessive inflation can be kept in check through a burn programme, while mass selling is avoided because participants are incentivised to hold their cryptocurrencies to continue receiving rewards.

Ongoing Model Conversion: Ethereum

With the update of 4 August 2021, following the proposal known as EIP-1559, Ethereum began its gradual conversion from a mining-based tokenomics model to a staking-based one.

Ethereum started as an inflationary model, as mining always creates new Ether coins and there is no defined maximum supply. With the 2021 update, the burn process began, i.e. the methodical removal of coins from circulation.

When Ethereum 2.0 is completed, the model will be similar to that of any Proof-of-Stake blockchain. The coin burn will continue, while the generation of new coins will only occur through staking and will be at least halved.

Dual-token Model

In a few but relevant cases, tokenomics is based on two tokens in the same blockchain. Famous examples are MakerDAO with MKR and DAI, or Terra with LUNA and UST (and other stablecoins).

It is usually a combination of a value token, such as a stablecoin, and a utility or governance token. The purpose of this model is usually to support DeFi applications, such as decentralised lending.

Use Cases

Speaking of DeFi, an increasingly relevant component of tokenomics is the usefulness of the token in question.

Numerous decentralised applications are flourishing, each powered by different tokens. These dapps are the use cases we are referring to.

The use case, if successful, is a factor that fuels demand. Staking and participation in governance can also be use cases with a positive incentive.

Of course consider that when we are dealing with utility tokens, or tokens used in many dapps, their economics will be more complex.

Legal aspects of Tokenomics

A last but not least thing to observe in order not to risk being defeated by tokenomics, is to make sure that the project is immune to legal attacks by regulators. This means that the token must not be a security, i.e. it must be a share of the company issuing it. If it is, it must have gone through the necessary procedures and have permits from local authorities, such as the SEC in the US.

On this site you can find the major cryptocurrencies rated from 1 to 5, where 5 indicates a high probability of being equivalent to a security.