Active Strategies for Crypto Trading

March 16, 2021

12 min

Cryptocurrency trading can take many different approaches. In this article, we will try to outline the best-known ones, although each activity can be modulated and studied according to each person’s needs.

How long?

In the last two months, the Bitcoin bull run, followed by the altcoins, has once again highlighted the high volatility of the market. Such an environment makes it difficult to make quick and informed decisions. Keeping in mind what your goal is and what strategy you have chosen to get there can help you make the right decisions without unnecessarily exposing yourself to more risk than you are prepared to handle.

Before you start, you need to ask yourself: how much time do I have to dedicate to cryptocurrencies, studying the market, reading the news and learning how to study charts and price movements?

Time is a key factor. If you are short on time, it is advisable to choose a strategy that does not expose you to sudden risks in the short term.

Active Strategies and Passive Strategies

First of all, let’s make a macro division between passive and active strategies. In a nutshell, passive strategies consist of buying cryptocurrency and holding it in your wallet, while active strategies consist of trading your cryptos more frequently by following the price trend.

Passive strategies

Passive strategies take advantage of a medium- to long-term time frame and do not require continuous market monitoring. They are discussed in this article.

Active strategies

Active strategies (as the term implies) require active participation, i.e. entering and/or exiting positions when the time is right. But how do you recognise the right moment?

Technical and fundamental analysis can certainly help. However, not all active strategies have in-depth and continuous analysis as a prerequisite.

The One-Off Strategy

The Concept

The one-off strategy entails buying cryptocurrencies (either once or every so often) and holding them in your wallet for a long time, trusting that in several years their value will have increased.

Who’s it good for?

Considering the 3 strategies, the one-off strategy is the most suitable for those with little time and a very low risk appetite. People who are prone to anxiety and for whom money is a source of stress may also prefer this method.

The one-off strategy, in fact, is implemented over the long term. The long term tends to refer to a time span of at least 5-10 years.

Those who choose this strategy therefore have plenty of time to evaluate and make an unhurried decision. The objective is to achieve results in 5 to 10 years‘ time, so sudden reversals in market trends do not affect their positions.

Getting started

Study the cryptocurrency

Although it does not require any particular effort, the one-off strategy is inseparable from fundamental analysis which, put simply, consists of studying the cryptocurrency you are buying. As we know, each cryptocurrency is born with an entrepreneurial project behind it, whether for profit or not. What we need to ask ourselves before buying is:

- For what purpose was this cryptocurrency created?

- Who is the team behind the project? Is it reliable?

- What is the company or foundation that created the cryptocurrency? What impact will it have on the project?

- If news has come out in the industry news websites about it, is it positive or negative?

- How has the price of the cryptocurrency changed over its history? Does it show an overall positive trend? Does it have unexplained falls? Does it maintain an average price?

- What are the prospects for growth in the price of that cryptocurrency? Not all cryptocurrencies that seem to cost “little” can grow exponentially.

Setting a Budget

When defining your budget, you need to consider your general economic, family and work situation as well as any mortgages, instalments or fees you may have to pay.

Bear in mind that capital invested in the cryptocurrency market is risk capital. This means that the money you put into this market must be money you are willing to lose and, if you do, it must not in any way harm your economic stability.

With this in mind, one can decide how much money to devote to buying cryptocurrency.

Setting a Goal

First of all, it is important to establish a goal. What do you want to do with the cryptocurrencies you buy?

Long-term goals can change from one person to another, such as:

- Create a retirement fund

- Preserve capital from inflation

- Start a business

- Paying for a child’s expenses when they go to university

- Paying off a mortgage

By defining your goal, you will know when the time is right to redeem the cryptocurrencies you bought years ago.

Putting it into practice

Once you have selected the most promising cryptocurrencies according to your analysis, you can easily buy them on an exchange and store them in your wallet.

You can buy it/them:

- In 1 tranche, if you think it’s the perfect moment over the long period

- In 3-5 tranches, to buy at an average price

Dividing the capital into 3 or 5 tranches allows you to buy at 3 or 5 different prices, based on the average of the last few days or weeks. Beware of transfer fees, if you plan to deposit new funds each time you buy!

For more experienced traders, it is convenient to move your cryptocurrency to a hardware wallet (a specific USB stick). A hardware wallet is an offline cryptocurrency wallet that you can keep in your safe or a safe deposit box.

Benefits

The one-off strategy has quite a few pros:

- it allows everyone to participate in a new, albeit risky market

- market exposure does not become a source of anxiety

- you are not affected by short-term market volatility, i.e. the price change between today, tomorrow or the day after is not particularly relevant.

The Warrior’s Way

The Concept

The Warrior’s Way is similar to an accumulation plan or traditional savings. This strategy consists of buying cryptocurrencies in fixed amounts on a regular basis.

Who’s it good for?

As you can guess, method and consistency are at the heart of this strategy. You have to become a methodical saver.

For those who are afraid of earning too little to put money aside, the secret is to start with small, short-term goals. In this way, you will get into the habit and, over time, saving will become a natural (and healthy) activity for your finances.

This strategy is also ideal for those who are afraid of the future or who arrive at the end of the month with a negative balance. Learning to save is above all a way of living in peace and being able to control the income and expenditure of your wallet.

Getting started

In order to build up a saving routine, techniques can be chosen to help us combat our bad habits:

- Save in advance by setting aside a predetermined amount on the day you get paid. In this way you will be ahead of time, anticipating the lurking shopping cravings.

- Saving day by day: setting aside a small amount every day or every week.

Once you have established a recurring budget with which to buy cryptocurrency, all that remains is to:

- Study the cryptocurrency (see One-off Strategy)

- Define a short or medium-term goal (such as buying a car or phone, taking a holiday, getting a master’s degree, paying for a wedding dress, etc). The objective in this case can also be the “target” price. That is, you set the minimum price at which you are willing to sell. For example, you could buy Ethereum today and set a target price of $2,000. Only when Ethereum approaches or exceeds that price will you sell.

Putting it into practice

Some exchange platforms or applications give you the option of creating a savings plan, automating the withdrawal from your account and the purchase of cryptocurrencies. Alternatively, you can set up an automatic transfer to your bank on the day of the month or week set out in your savings routine. Then proceed to manually purchase the cryptocurrency directly on the exchange.

The end point of the Warrior’s Way is to sell when the cryptocurrency you own reaches the ‘target’ price. Or if you reach the amount you need to complete your target, e.g. you have saved enough to buy a new phone.

The process at this point is the same and opposite: sell in equal parts when the price approaches the target or when it has reached it. In this way, you can mitigate the risk of exiting at the wrong time (the price may rise again or fall suddenly).

Benefits

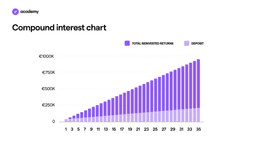

Repeated buying aims to reduce the impact of volatility on the purchase and thus the effects of a bad inflow on the overall portfolio. Dividing purchases into smaller amounts is likely to produce better results than buying the same amount in a single transaction.

You can find a great calculator for Bitcoin accumulation plans by visiting the international service at dcabtc.com. You can specify the amount, time horizon, frequencies, and get an idea of how various strategies will perform over time.

The Edleson Method

The Concept

This technique consists of buying a cryptocurrency for short-term financial gain, maximising the odds in one’s favour through short-term market inefficiency.

Who’s it good for?

As it is a rather complex activity requiring a deep knowledge of market mechanics, it is used by traders, experts or professionals.

Getting started

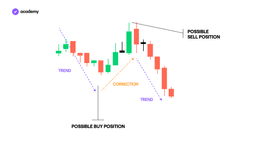

This strategy takes advantage of the ups and downs of the prices and in order to implement it, you need to be able to read the charts and the behaviour of other investors to understand whether it is time to liquidate or time to buy.

Study the cryptocurrency

The type of analysis to be carried out is called ‘technical‘, i.e. a pure study of charts and price trends. The issue is not so much the soundness of the company behind a cryptocurrency, but its potential for rapid and sudden growth.

Traders know perfectly well that such rapid rises are usually matched by equally rapid falls. So their skill lies in understanding and studying the exact moment of entry and exit of positions.

Putting it into practice

Trading is a matter of minutes, hours or days. The higher the volatility, the more compressed the period in which you enter and exit the market. The greater the gains, the greater the risk of losses.

That said, as you can easily imagine, the chances of making a wrong entry and losing some or all of your capital are much higher than with previous strategies.

We have dedicated an article to the various trading strategies which you can read here (coming soon).

Benefits

The advantages of this strategy are that you can earn small or large returns in a short period of time with which to buy back new cryptocurrencies. In fact, traders often use this method to generate new capital for reinvestment (also known as compound interest).

This strategy is potentially very profitable but also very dangerous. Not only because it is necessary to know the tools but also because it is difficult to maintain lucidity in bullish or bearish phases.

Conclusion

Which strategy is best? Which one is best for you? That is for you to decide. You can start by educating yourself about the markets, and then learn by doing. Over time, you will be able to determine which one best suits your financial goals, personality and trading profile.