Derivatives in Traditional Finance and DeFi

September 27, 2021

9 min

Estimated to be worth hundreds of trillions of dollars in traditional finance, the derivatives markets are, by a significant margin, the largest market globally in terms of trading volume. Thanks to Decentralised Finance (DeFi), these powerful instruments are now universally accessible, circumventing the need for intermediaries, geographical boundaries, or restrictive legal covenants.

What exactly are derivatives?

A derivative instrument, or simply a ‘derivative’, is a type of sophisticated financial tool. Essentially, it’s a contract between two parties that derives its value from an underlying asset.

This sort of contract, in its simplest form, amounts to a bet on the future price movement of that specific underlying asset. One party wagers on the asset’s value increasing, whilst the other bets its value will drop. The eventual profit or loss for each party hinges on the difference between the agreed-upon price in the contract and the asset’s actual price upon expiration.

In most cases, this underlying instrument consists of stocks, bonds, or currencies (such as the euro or the dollar), but it also increasingly includes cryptocurrencies like Bitcoin and Ethereum. Beyond these, interest rates and commodities—such as crude oil or gold—can also serve as the basis for a derivative.

But what is the main advantage of dealing in derivatives compared to the spot market (where you buy or sell the asset immediately)? The benefit of a derivative is two-fold: you can take a position betting on the downside of an asset, and, crucially, it doesn’t require you to physically hold goods that might be cumbersome to manage (imagine storing barrels of oil!).

Futures, forwards, and swaps

The principal derivative instruments you’ll likely have heard of are forward contracts, which are distinctly divided into futures and forwards.

These contracts grant the two parties a specific quantity of the underlying asset based on a delivery price and a predetermined expiry date. As before, one party speculates on a price rise, and the other on a fall.

The key distinction is that forwards are negotiated outside of regulated markets (often known as Over-The-Counter, or OTC), whereas futures are highly standardised and traded on regulated exchanges. This standardisation means that with futures, you can typically only negotiate the price.

You’ll also frequently hear mention of swaps. These are contracts that govern the exchange of cash flows or liabilities between two parties, where these liabilities stem from two different financial instruments. These exchanges usually take place OTC—that is, privately between the two parties, without the direct supervision of a broker or an exchange.

Trading derivatives for hedging purposes

Hedging is the process of reducing risk through offsetting positions.

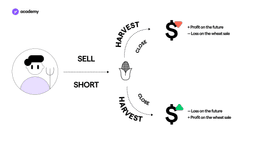

Let’s take a farmer who cultivates wheat as an example. The price of grain fluctuates on the market like any other good, depending on supply and demand.

There is always the risk that, at harvest time, the price of wheat might drop, making it uneconomical to sell.

To counter this risk, the farmer can sell a wheat futures contract “short” (a term meaning to bet on a price fall) for the quantity he expects to harvest. In other words, he’s betting on the depreciation of wheat.

At the time of the harvest, the farmer closes his position. If the price of wheat drops, the farmer receives a profit from the futures contract, thus offsetting the potential lost income from the spot market. Conversely, if the price of wheat rises, the farmer loses the money wagered on the futures, but simultaneously gains a significant profit from selling his actual harvest at the high market price.

This strategic move not only helps avoid challenging trading years but also makes the overall business trajectory far more predictable.

Trading derivatives for speculation

In this context, derivatives make it easy to speculate on the price of assets that would be inherently complex to handle in their original form, such as gold or oil.

Furthermore, derivatives allow for the use of financial leverage. Investing with leverage is typically only possible via a broker and is considered a very high-risk method of trading.

- Selling with leverage is known as ‘going short’, and it means betting on the depreciation of an asset.

- Buying with leverage is known as ‘going long’, and it means betting on an asset’s price increasing.

Leverage requires the trader to deposit only a minimum fraction of the market position they actually wish to be exposed to. The broker provides the capital for the remaining portion of the position.

However, the profit or loss will be calculated based on the entire position, not just the amount the trader deposited. This means that once the position is closed, the percentage gained or lost will be far higher than the initial outlay. In this scenario, more than ever, maximum gain equals maximum risk.

The most significant danger occurs when the price rapidly moves in the opposite direction to your bet. When this happens, the position’s value will start to turn negative. Suppose your collateral (your initial deposit, or ‘margin’) can no longer cover the impending loss. In that case, the broker will be compelled to liquidate the position—that is, automatically cancel any open order on the contract and cover the loss using your remaining balance.

Derivatives in decentralised finance

In the traditional financial system, derivatives—whether traded OTC or via an exchange—always require the presence of a trusted intermediary to oversee and guarantee the contract. This means that access to such instruments depends on both the regulatory body of your country and the internal policies of the financial institutions involved.

DeFi, however, eliminates these hurdles. Decentralised derivatives allow trading without the intervention of a central authority, offering direct and global access to instruments that were until recently reserved for professional traders or large-scale investors.

With weekly volumes now exceeding 100 billion dollars, the DeFi derivatives market is experiencing explosive growth. This segment is solidifying its position as a key component of the ecosystem, enriching the range of alternative financial products and attracting the interest of a growing number of investors looking for new opportunities.

For derivatives to function without a centralised entity, three key technological elements are essential:

- Smart Contracts: These operate just like any decentralised application.

- Oracles: These are needed to receive real-time information on the prices of the underlying assets.

- Tokenisation: This involves turning the derivative into a blockchain-compatible token that is both fungible and programmable. Derivatives in token form on a blockchain are referred to as synthetic assets.

Consequently, synthetic assets can only be developed on blockchains that offer these three functionalities in an efficient and scalable manner.

Perpetual futures: a crypto innovation

After years of research, the BitMEX exchange introduced a revolutionary financial instrument in 2016, designed specifically for the cryptocurrency sector: perpetual futures.

This product was engineered to suit the unique nature of crypto markets, which are active 24 hours a day, 7 days a week, without interruption. Unlike traditional futures contracts, perpetual futures have no expiry date, allowing traders to keep their positions open indefinitely.

Since their debut, perpetual futures have garnered significant interest among users, quickly becoming a cornerstone of modern crypto trading. Their introduction marked the beginning of a truly innovative market, profoundly different from the established models of traditional finance.

To delve into the specifics of how perpetual futures operate and all their intricacies, we highly recommend reading our dedicated article: Futures: What they are and how they work. — A complete guide to this innovative, authentically “made in crypto” instrument.

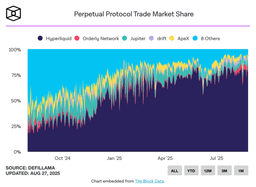

The king of DeFi derivatives – Hyperliquid

Which platform is leading the charge in DeFi derivatives? In recent years, the Hyperliquid protocol has established itself as the sector leader in decentralised finance for trading derivative contracts.With a market share surpassing 70% of the total volume, Hyperliquid provides its users with streamlined processes and a trading experience comparable to centralised services, whilst simultaneously guaranteeing the security, transparency, and autonomy that only decentralisation can genuinely offer.

As a result, its native token, Hype, is seeing remarkable growth, fuelled by the rapid expansion of the derivatives market. In a short space of time, Hype has positioned itself among the top 15 cryptocurrencies by market capitalisation, consolidating its relevance within the industry.

To explore the functioning and technical characteristics of Hyperliquid further, we refer you to our dedicated article: “Hyperliquid: exchange decentralised or blockchain?”