Bitcoin vs Bitcoin Cash (BCH): was the Hard Fork worth it?

June 27, 2022

10 min

What is Bitcoin? Bitcoin Cash supporters believe they have a better answer than Satoshi Nakamoto, thanks to a modification of the original code. This led to a split in Bitcoin’s blockchain, a hard fork that gave birth to Bitcoin Cash. These two cryptocurrencies respond to different ideals and technical characteristics although they share a basic code structure: Let’s dive into the differences between Bitcoin and Bitcoin Cash.

What is Bitcoin? The decentralised currency

If you’re here, you may already have a solid understanding of what Bitcoin is, but you may not know that the idea of creating a decentralised, Peer-to-Peer and cryptography-based currency was imagined by others before Satoshi Nakamoto, the anonymous creator of the ‘Digital Gold’. In fact, one of the earliest projects dates back to 18 June 1996, formulated by the National Security Agency (NSA) in a theoretical paper. The paper focused on the problem of double spending, the robust security needed to create a digital currency, and how to make it decentralised. However, this research was not followed by a concrete implementation, perhaps due to the limitations of the technology of the time.

Fact

The SHA-256 algorithm, created by the NSA, is the basis of Bitcoin’s encryption. The generation of private keys, however, is done via an original elliptic mathematical curve (libsecp256k1).

We know that Satoshi Nakamoto later created Bitcoin in an attempt to solve the problems that arose with the 2008 financial crisis. Bitcoin’s principle consisted of a new economic model, based on P2P money exchange, without the mediating authority of banks or other centralised entities. However, today Bitcoin is considered by many to be a store of value instead, given the small amount of transactions per second it can process. Today, the Lightning network (LN), a layer 2 update of Bitcoin, seems a to be suitable solution for the low tps. The LN, however, was only invented in 2016. Before ideas about solving scalability problems via additional layers was commonplace, it was all about forks, such as the project of Bitcoin Cash.

Fun fact

There is another attempt, predating Bitcoin, to create a decentralised digital currency: Bit Gold, proposed by Nick Szabo in 1998. Although the project was never implemented, the American computer scientist is often associated with the pseudonym Satoshi Nakamoto, although Szabo denied the coincidence.

What is a hard fork? How Bitcoin Cash was invented

Many Crypto Heroes, inspired by Satoshi’s work, created new blockchain projects, sometimes by modifying Bitcoin’s own code, thus creating new versions of the first ever cryptocurrency. This process, made possible by the open source nature of Bitcoin, is called hard forking.

A hard fork is a software update in which a blockchain is integrated with completely new features, or simply modified within its existing parameters, making it incompatible with the previous version. In essence, two parallel networks and two cryptocurrencies are created, each with its own peculiarities and rules of operation. The splitting block on the old chain becomes the genesis block for the new blockchain.

Usually, the success of a hard fork is dictated by how many miners or validators migrate to the new network and thus how much is actually utilised. It may happen that the old blockchain is completely abandoned, that a community splits between the old network and the new one, leaving active traffic on both networks, or that the new chain is never really exploited.

Bitcoin has been forked several times, but only a few have survived, and actually adopted by people and organisations.

The main solution to Bitcoin’s scalability, until around 2018, seemed to lie in reprogramming of the protocol, and in particular the modification of the storage space that each block could provide. Before the SegWit update, Bitcoin blocks could contain information totalling 1 Megabyte (MB): a space for few transactions, albeit immune to spam and DDos (Distributed Denial of Service) attacks.

Despite several attempts, the most successful Bitcoin hard fork is definitely Bitcoin Cash (BCH), which originated in 2017 from Bitcoin’s block number 478 558.

Bitcoin vs Bitcoin Cash: which one is more decentralised?

The starting point of the comparison is ideological: both Bitcoin supporters and Bitcoin Cash innovators believed that their protocol was the best, or at least more consistent with Satoshi’s original mission. On the one hand, Bitcoin Cash’s 8MB per block would have made Bitcoin more scalable, a true means of payment (hence the name ‘Cash’), but would it have respected the sacred commandment of decentralisation?

Those loyal to the original BTC code claimed that increasing the block size of BCH would increase the cost and computational power required to run a node, so as to further centralise the mining process. Simply put, storing and securing a blockchain with larger blocks would have been a barrier to autonomous miners, who would have been forced to join together in mining pools or cede control of the network to private entities with more resources.

However, it is important to remember that Bitcoin‘s network, years later, is no longer so decentralised. Although bitnodes.io claims that Bitcoin has around 15 000 nodes, this is not a reliable measure of the distribution of the hash rate. In fact, most of these nodes are hosted in a few large mining pools: the bitcoin production is currently equally centralised.

Quantifying this aspect of Bitcoin’s decentralisation is possible thanks to a factor called the ‘Nakamoto coefficient‘: it measures the number of entities that, together, would reach 51% of the hash rate, so as to be able to impose their control over the blockchain. For Bitcoin, according to coin.dance, the sum of the computing power of only 4 mining pools, on average, would have this power. Surprisingly, for Bitcoin Cash, the collaboration of more than 10 mining pools would be required. It, therefore, seems that Bitcoin Cash is even better than Bitcoin in terms of decentralisation.

Technical comparison between Bitcoin and Bitcoin Cash

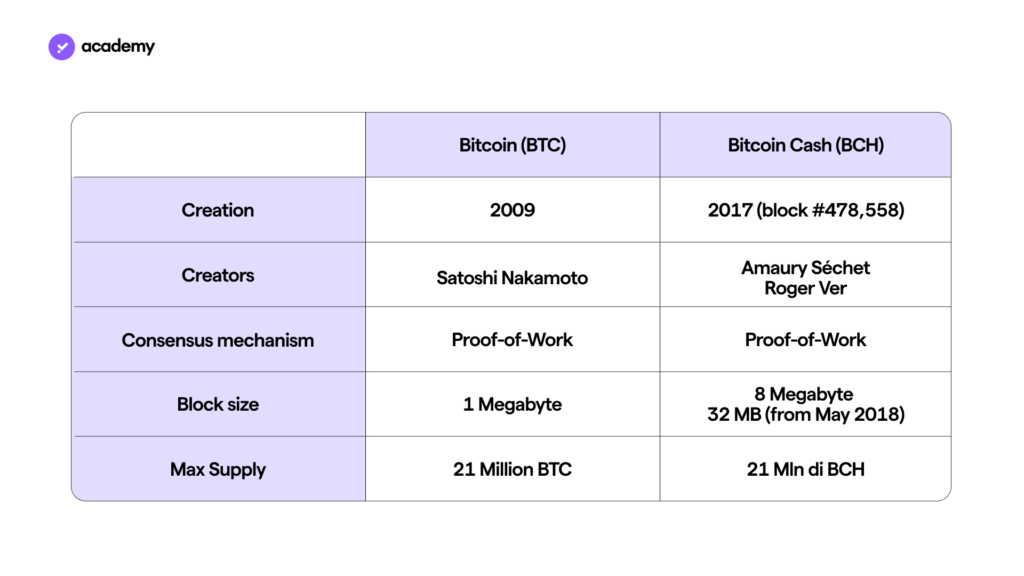

Beyond philosophical comparisons, we can understand the difference between Bitcoin and Bitcoin Cash mainly by looking at their technical characteristics:

Size of blocks/transactions per second:

- Bitcoin (BTC): each block could originally contain information up to a maximum of 1 Megabyte; however, the reorganisation of the soft fork SegWit increased the effective block size (some calculations estimate it to be as much as 4MB). In any case, the time per block set at 10 minutes does not allow Bitcoin to exceed 5/7 transactions per second.

- Bitcoin Cash (BCH): the hard fork increased the ‘block size’ to 8 MB, however in May 2018 a second update increased it to 32 MB. Considering that, again, one block is produced every 10 minutes, Bitcoin Cash should support around 150 tps. However, the average size of the blocks created is often less than 32 MB, as not enough transactions are produced to ‘fill them up’, so the number of tps is also drastically reduced, essentially due to network inactivity.

Transaction fees: larger blocks can accommodate more information, so that the cost associated with validation can be spread over several transactions.

- Bitcoin (BTC): fees are generally higher, as a result of the smaller block size and greater network activity of Bitcoin (compared to BCH). Miners receive highly variable fees, in addition to rewards per block, but usually higher than USD 1, up to USD 10 at times of peak congestion (as in July 2021);

- Bitcoin Cash (BCH): the hard fork was created precisely to promote the mass adoption of cryptocurrencies as a means of payment. The aim of Bitcoin Cash, in fact, would be precisely to support everyday transactions. Indeed, the fees are less than a cent, given the larger block size but also the lower activity of the network.

Smart contracts: privacy and tokens. Sharing a similar basic code, Bitcoin and Bitcoin Cash do not differ much in their possibilities for developing smart contracts. They are both limited in terms of DeFi, but this has not ruled out solutions for privacy and token issuance.

- Bitcoin (BTC): Bitcoin’s Layer 1 is not suitable for building all the applications necessary for decentralised finance (DeFi), which motivated Vitalik Buterin to create Ethereum. However, the Taproot update has expanded the possibilities for the development of smart contracts and some believe it is possible to delegate this function to a Layer 2. In fact, there is already a solution for issuing tokens on Bitcoin: the Omni Layer, a platform for creating ‘tailor-made’ cryptocurrencies, from which the Tether stablecoin (USDT) was also born. CoinJoin, on the other hand, is a tool for privacy on Bitcoin: it obscures senders and recipients of BTC transactions.

- Bitcoin Cash (BCH): smart contract languages exist to build simple dApps on Bitcoin Cash, such as Cashscript. In fact, thanks to the latter, tools have been implemented such as: CashShuffle, a protocol that brings together and ‘shuffles’ different transactions (shuffling) in order to prevent blockchain explorers from tracking them, and CashFusion, a privacy protocol similar to the former that allows the value of exchanges to be hidden and prevents their reconstruction. Furthermore, on Bitcoin Cash there is also the Simple Ledger Protocol (SLP), which allows the issuance of tokens and NFTs, just like the ethereum standard.

Beyond the differences between Bitcoin and Bitcoin Cash, according to the vision of the communities and the technical substrate, it is the use of people that will determine which is the ‘best Bitcoin’: adoption and use cases are the real strength of a cryptocurrency, utility is what makes a project a revolution.