What are Safe-Haven Assets, and is Bitcoin one?

July 15, 2021

10 min

By its very nature, our economic system is cyclical.This is why economic crises, recessions and recoveries occur periodically. So what should we do during the most difficult times? Many people turn to safe-haven assets.

What are safe-haven assets?

A safe-haven asset is a financial instrument that is expected to maintain or even gain value during periods of economic crisis.

When stock markets fall, investors typically turn to other assets.

This type of asset is either uncorrelated or negatively correlated, with the economy as a whole, which means that in the face of a market crash its performance may stand out.

Typical features of a safe haven asset are:

- Liquidity: the asset must be easily convertible into spendable money at any time.

- Functionality: the asset must have a use case that will continuously provide long-term demand

- Limited Supply: the growth of supply must never exceed demand

- Certainty of demand: the good is unlikely to be replaced or become obsolete

- Permanence: the asset should not decay or be damaged over time.

- Trust: if there is a widespread opinion that an asset is a valid safe haven, it will continue to be such.

Not all safe-haven assets will have all of these characteristics, so it is up to each individual to decide which is the most suitable asset for the current period and the type of crisis ahead.

In fact, all crises are different, as they have different causes, are the consequence of their era and therefore affect different markets, as the exceptional COVID-19 crisis pointed out. So what may have been considered a safe haven in one market crisis may not be so in the next.

Gold: every rose has its thorn

Gold is the most illustrious safe-haven asset, and its reputation as a store of value has lasted for centuries. So how does it meet the criteria of a safe haven asset?

- Liquidity: It has a very liquid market and is easily tradable

- Functionality: whatever form it takes, it has a precious metal in high demand as an underlying asset

- Limited supply: as a rare metal, its supply is limited and cannot be manipulated

- Certainty of demand: gold has been considered valuable for centuries and therefore in demand

- Permanence: gold can deteriorate in unfavourable conditions, but it is stored properly

- Trust: gold has been used as a safe haven asset for at least 20 years

Perhaps the strongest example of gold as a safe-haven asset was after the 2008 global financial crisis. The influx of investment drove up the price of gold by almost 24% in 2009 alone and continued this upward trend in 2011.

Many consider the decision to buy gold to be a behavioural bias, based on gold’s history as a store of value, almost as if there were a collective memory of the Gold Standard. As a matter of fact, since gold has historically been considered a safe haven asset, when there are signs of a significant stock market crash, investors swarm to the precious metal.

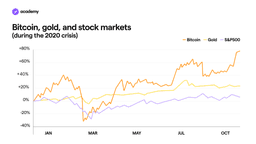

The only time even gold followed the rest of the market down was at the start of the 2020 pandemic. This gives a sense of how bewildered investors were by totally new conditions at a global level. However, its -2.74% return still outperformed equity markets and other commodity sectors, such as energy.

What About Crypto-Gold?

There are many ways to buy gold, but not everyone knows that it is also possible to buy it in the form of cryptocurrency. More technically, these are stablecoins, cryptocurrencies that are pegged directly to the price of gold.

One example is Pax Gold, an ERC-20 token, which is a cryptocurrency based on Ethereum.

Pax Gold is backed by reserves certified by the London Bullion Market Association and London Good Delivery. In the British capital, bars of about 400 ounces each, at least 99.5% pure, each with a serial number and weight, are stored in high-security vaults. Thanks to these reserves, it is always possible to convert Pax Gold into physical gold or euros.

Buying gold in this form is convenient because it is accessible to anyone even for small amounts, transactions are based on the blockchain, and it allows you to diversify your crypto portfolio and monitor it on the same platform.

Fiat Currencies: a complicated history

Other popular safe-haven assets in history are the legal tender currencies of certain states, notably the US dollar, the Japanese yen and the Swiss franc.

- Liquidity: very high, as it can be easily spent anywhere and in demand

- Functionality: high, as it is adopted by one or more states

- Limited supply: not limited, but can be manipulated by central banks

- Certainty of demand: historically rooted

- Permanence: paper money can be damaged, but also exists in digital form

- Trust: trust in the government and the central bank is very high if they have a stable political system, monetary reserves, and high creditworthiness.

These characteristics do not necessarily apply to the US, Japan and Switzerland for the whole duration of their history and future, indeed the dollar for example has been particularly challenged by Trump’s policies. Before relying on this type of safe-haven asset, enquire about the actual stability of the government behind it and assess the historical context.

The same considerations made about gold also apply to fiat currencies: it is possible to include this safe-haven asset in your portfolio in the form of cryptocurrency. This type of stablecoin is pegged to the dollar price in most cases. Some stablecoins are backed by fiat reserves (USDT and USDC), while others are kept stable by an algorithm or by other cryptocurrencies (DAI).

Bitcoin: safe haven or enfant terrible?

Whether or not bitcoin is a safe-haven asset is a controversial question. However, there are some aspects that bring it closer to this definition:

- Liquidity: Bitcoin is easily spendable and convertible into fiat currency, and has a very liquid market as the most popular cryptocurrency.

- Limited supply: bitcoin has a maximum supply of 21 million coins, and maintains a balanced and predetermined inflation trend.

- Permanence: being digital and cryptographic, bitcoin cannot spoil or decay, as long as the internet persists.

- Certainty of demand: as a high-tech currency, bitcoin is anything but obsolete. It has maintained its dominance in the market since its beginning.

As for “Trust and Functionality”, these aspects take a long time, and Bitcoin is barely 10 years old.

For the same reason, bitcoin is still very volatile, and is therefore not suitable for preserving value in the short to medium term. If a safe haven asset is meant to protect capital, bitcoin does not currently guarantee this kind of stability. The characteristics listed above, however, denote a relevant potential as a safe-haven asset according to experts in the sector.

None can tell Bitcoin what to do: good or bad?

Bitcoin has another aspect that makes it similar to a safe-haven asset: it is not correlated to the market and the economy cycles. Perhaps even less so than other safe-haven assets.

Also by definition, it is decentralised, so governments have no power over its operation. However, political moves such as declarations by the SEC and bans by some states can still affect its demand in the market.

The aspect of independence from governments is a double-edged sword because it also means that it is unregulated and therefore in the common mindset less trustworthy because governments cannot do anything to “save” bitcoin, and they do not have bitcoin reserves to do that.

It is true that bitcoin also suffered the March 2020 crash, just like gold, but it is also true that within a few days it resumed a meteoric rise that has taken us through a whole year of pandemic. This does not make it a safe haven asset, but it is not to be underestimated either.

Institutional adoption and accumulation by, for example, MicroStrategy, Square and, temporarily, Tesla had indeed a big impact. The rapid gains enabled by Bitcoin have attracted the attention of many investors who have turned to cryptocurrencies, while gold has temporarily remained on the sidelines.

Conclusion

As a rule, investors are able to absorb losses in times of crisis by allocating part of their portfolio to safe-haven assets. However, when faced with completely new economic crises such as the one in 2020, some safe-haven assets may temporarily drop in value.

We can therefore choose either gold, currencies or any other type of financial instrument that meets the requirements we have mentioned.