What is DeFi and are you ready for it?

July 8, 2021

8 min

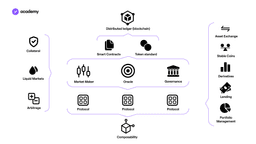

Decentralised finance, or DeFi, is the ecosystem of financial applications built with blockchain technology, by users for users.

How should we call it?

The term DeFi, short for decentralised finance, originated in a Telegram chat in August 2018 between developers and entrepreneurs linked to the Ethereum ecosystem. They were discussing what to call the movement of new Ethereum-based financial applications. Other options considered were Open Horizon, Lattice Network and Open Financial Protocols. Someone, however, said that DeFi worked well, as it sounds like “defy“.

DeFi should not be confused with embedded finance (sometimes known as invisible finance), which is a movement within traditional financial services and fintech that aims to expand access to banking and digital payments technology.

DeFi’s Features

Non-Custodial

It means that DeFi applications do not have the private keys of the users’ wallets, but each user holds their own keys and is responsible for them. This means that you are autonomous and in control of your assets, but also that if you lose your keys you lose your assets.

Open

DeFi networks and apps are global and borderless, everyone can access the decentralised financial system without having to authenticate themselves. It is the internet of money.Moreover, DeFi’s protocols are open-source, which means that anyone can see the code, inspect it, and verify its functioning.

Composable

Open-source code allows programmers to develop on top of other people’ applications, thus accelerating innovation. These applications are like Lego pieces, forming an infrastructure of services, one supporting the other. And if someone doesn’t like the way an application is built, they can copy the code and make a new one as they wish.

Decentralised

DeFi protocols are built on public blockchains such as Ethereum. These blockchains, the rails of this new financial system, are managed by thousands of nodes around the world running the blockchain software, immune to censorship or restrictions.DeFi platforms are built to be managed by a community of users, not centrally controlled. Users become owners of their financial applications; they are able to participate in major decisions, including proposing changes, and benefit from their growth. There is no authority that can take control of the funds or change the rules of the game.

Not all DeFi protocols have all these characteristics and, ironically, the decentralisation aspect is the most complex to implement. However, there are good reasons why a project may not be fully decentralised. Especially in the first years of activity, it may be necessary to centralise decisions or the management of funds in order to lay a solid foundation and increase the chances of success.

The aspect that is most commonly actually applied is openness, in fact some prefer the term Open Finance instead of DeFi.

The Origins of DeFi

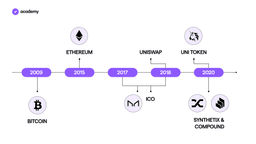

One could even argue that DeFi started with Bitcoin in 2009. BTC was the first peer-to-peer digital money – the first financial application built on blockchain technology.

The long-standing second in the market, Ethereum, is not strictly considered a DeFi phenomenon, but it played a key role in its history as it provided the coding language, token standards and framework for the development of smart contracts and dapps without which the first wave of DeFi protocols might never have arrived.

But the turning point for financial applications came in December 2017, when MakerDAO was launched.

MakerDAO is an Ethereum-based protocol that created a way for anyone to take out a loan without relying on a centralised entity. It also created a stablecoin tied to the dollar, but kept stable by cryptocurrency reserves, not fiat.

The MakerDAO lending protocol and its stablecoin Dai laid the first foundations for a new open financial system. From there, other financial protocols took off, creating an increasingly vibrant and interconnected ecosystem.

2017 was also the pivotal year for ICOs, which is the launch model behind today’s most valuable DeFi projects, such as Aave, Synthetix and Kyber Network.

The second milestone was laid by Uniswap, launched in November 2018, which allowed users to swap any token on Ethereum in a decentralised way with an automated market maker, while Synthetix in 2019 offered its first incentive programme through liquidity provision.

2020: the DeFi Summer and Winter

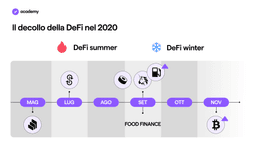

It is the arrival of Compound that separates DeFi’s backstory from its actual story.

Compound Finance, in May 2020, launches the first lending platform for generating interest. This opens the harvest season for the crypto sector, where the trending activity is yield farming: interest generation via DeFi protocols.

During the summer, the liquidity locked up in the emerging protocols increased, as did the volumes and prices of their tokens.

In September SushiSwap “stole” liquidity from UniSwap by promising rewards to those who would move their liquidity from UniSwap to SushiSwap.A few days later, the UNI token was released on the market, with an airdrop that makes the yield farmers return to UniSwap again.

After SushiSwap, a series of copycat projects appeared with cuisine-inspired names, but they were short-lived: it was Food Finance.

Also in September, the price of Ethereum collapsed, and so did the prices of DeFi tokens, being mostly based on Ethereum. Thus began the DeFi Winter, characterised by a spike in the Gas price, used to pay for transactions and smart contracts on Ethereum. This makes it very expensive to use any Ethereum-based functionality, even the simple transfer of ERC20 tokens from one wallet to another.

However, DeFi developers did not stop, new protocols were created, also driven by the challenge of finding a solution to the Gas problem. Liquidity locked in protocols such as UniSwap and SushiSwap also surged and followed the bullish trend led by Bitcoin until May 2021.

Are you ready for DeFi?

DeFi is interesting and full of unexplored potential, but it is not usable by everyone yet. Here are some things to consider before learning about a project and then deciding whether to try it out. Alternatively, you can simply buy its tokens if you believe the project will grow.

Make sure the protocol is audited

Smart contracts are the heart of DeFi. Although their security standards have come a long way, many projects remain unaudited. An audit in IT is a process in which the code of a piece of software is examined with the aim of discovering any bugs, security or programming conventions violations before it is implemented. This is why it is essential to carry it out at launch and when new functionalities are developed or updated.

Hacks happen

However, it appears that most of the hacks are not related to a lack of smart contract audits, but to system cheats exploiting features such as flash loans, i.e. loans made and paid off within minutes.

According to CipherTrace, cryptocurrency-related fraud has fallen sharply in the first months of 2021, but attacks on DeFi protocols have increased. This should be read in light of the fact that these protocols are growing.

Governance and private keys

The way a project is governed is crucial. If it is partially centralised, or if access to voting is too complex, you will have to deal with the fact that you cannot contribute to any decisions. Where is the beauty of DeFi then?

Also, remember that the DeFi protocols do not store your wallet private keys for you, but you are responsible for your funds from start to finish. If you forget about the private key, forget about getting your money back.

Conclusion

Two years after Compound, there are now dozens of DeFi applications, from basic use cases like lending, trading, yield farming, to the craziest ones like derivative products, or a lottery where you can always get your money back.

Despite the cyclical market downturns and the widespread difficulty in understanding these topics, we are only at the beginning of a whole new world, which is being built one step at a time, just like knowledge.