How to save money: a guide for everyone

October 26, 2023

10 min

How to save money is a common question for everyone when purchasing goods and services. Perhaps you too are looking for ideas for monthly savings, perhaps applicable every day. This guide is just the thing for you: you will find tips, tricks and methods for saving money, following practical ways, within everyone’s reach!

How to save money: the 50 30 20 rule

In times of economic hardship, dominated by inflation and uncertainty, it is a common tendency to wonder how to save money. To cope with rising prices, in fact, it is useful to think of a monthly savings plan, to be followed day by day. If you don’t know where to start, read this step-by-step guide: discover methods, tips, ideas and tricks for saving money, whatever budget or goal you have.

First of all, to understand how to save money, it is necessary to keep track of your income and expenditure for at least 30 days. To calculate monthly earnings, consider your last pay slip or freelance fees, as well as profits from investments or other sources of income. On the other hand, to quantify your expenses, if you pay in cash, keep your receipts, while for card or debit cards, just consult your bank‘s app.

To understand how to save money, therefore, you should classify your expenses and put all the information into neat tables (use Excel or other spreadsheets). There are several ways to divide monthly costs, the most common distinguishing between ‘fixed‘ and ‘variable‘, but you can also group them by ‘theme‘ (house, health, food, etc.), or separate essential expenses (rent, bills, primary goods) from non-essential ones (leisure, entertainment, hobbies, etc.).

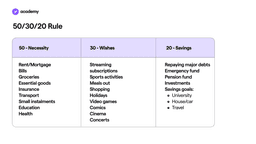

The first method of monthly savings is to divide consumption between necessary and ‘extra’. This is the 50 30 20 rule, as defined by Elizabeth Warren, US senator and Harvard professor, in her book ‘All Your Worth: The Ultimate Lifetime Money Plan’, co-written with her daughter Amelia Warren Tyagi. In a nutshell, to explain how to save money, the authors use a fairly simple system: after taxes, one should spend 50 per cent of one’s monthly income on necessities, 30 per cent on satisfying one’s desires and the remaining 20 per cent on saving.

NB:

Some ‘wishes’ may represent necessities, such as gym membership as part of a rehabilitation/care pathway

The 50 30 20 rule, therefore, provides guidance on how much to save per month: one fifth of one’s income should be saved, but to achieve this, one must have clear goals. To define them, we can apply the method S.M.A.R.T, devised by the psychologist Edwin Locke, according to which a savings goal should be:

- Specific: as precise and detailed as possible, if it is too vague it will be difficult to understand how to achieve it. ‘Buy a car’ is not a specific goal, instead ‘buy a $40,000 Tesla model 3’ already gives concrete indications. Furthermore, it can be useful to break it down into several steps, in a sequence of tasks.

- Measurable: quantifying a goal helps us define the path to reach it, in practical and numerical terms. In the case of savings, it is easy, just calculate your monthly budget, so that you can estimate how much you could achieve after a year or more.

- Attainable: every goal, however challenging, should be attainable. A difficult but realistic goal is motivating; balance and determination are needed.

- Relevant: only results that are important to us motivate us to commit ourselves;

- Time-bound: a goal can be short-term or long-term, but time limits must be imposed. Setting deadlines, always reasonable ones, is crucial in planning savings.

These rules, when applied to the 50 30 20 method, can suggest how to save money and achieve your goals. However, if you still do not know what to allocate your savings to, you could first try to repay any debts so as to eliminate the burden of interest rates. Then, you could create an ‘emergency fund‘: in practice, a sum that can cover at least three months of essential expenses, in exceptional cases such as the loss of a job. Another good idea to start with is to set up a pension fund, in short a form of supplementary pension, when you no longer have the income from employment.

Other ways to save money

Having made the necessary calculations and defined the objectives, you can then begin to apply the 50 30 20 rule, but to understand how to save money, it is equally important to monitor results over time. Income varies, as do costs, so we may have to adjust the ‘weight’ of the three sections: in some periods it is impossible to allocate only 50 per cent to necessary expenses, just as capital is likely to ‘leftover’ on more fortunate occasions. Consider the 50 30 20 rule as a kind of guideline for monthly savings, around which you can ‘swing‘. Relying on percentages also does not necessarily result in saving a fixed amount of money each month.

On the contrary, if you were to follow the ‘zero-based budgeting’ method to save money, you could plan every single expenditure, so as to keep the savings constant. In this system, in fact, the difference between income and expenditure must always be zero: necessary and non-essential costs are estimated in advance, so that the sum needed to cover them is already set aside at the beginning of the month. In this way, you can calculate the actual savings: if the figure does not correspond to the desired one, you can intervene on the costs in advance. Even in this case, however, unforeseen events must be taken into account, so accept a certain margin of error.

A concrete solution, to apply this saving method, is suggested by Dave Ramsey: at the beginning of the month, withdraw your entire budget, split it into several envelopes, according to purpose. In this way, you cannot materially spend more than you have in cash. In order to plan how to save money, as an alternative to envelopes, you can open different accounts for fixed expenses (and taxes), leisure and savings, so as to favour the effect of ‘mental accounting’ as explained by Richard Thaler.

Tips and tricks for saving money

Whatever method you choose to save money, there are always useful tips and tricks. In any case, reducing non-essential expenses is the easiest way to increase savings, even if we know that it is not necessary to zero them out. Fun and pleasure are key to maintaining balance, as The Shining confirms: “All work and no play makes Jack a dull boy” .

Limiting waste where possible, however, can be a good way to save money:

- Reduce the number of meals away from home, prepare lunch (or dinner) to take to work or school.

- Schedule one day per month (or week) with ‘zero expenses‘. It is an exercise to find free alternatives. For example, fill your water bottle at home, or find free events for entertainment.

- Subscribe only to the streaming platform you use most often, or where you know the content you are interested in will be published. Share your subscription with your friends or family if possible.

- Don’t make impulse purchases: waiting 48 hours to see if you really need it is a good trick to save money. Black friday and cyber monday, in this regard, are a very powerful psychological lever to induce buying. Try to tame your emotions and choose wisely, it is also a law of behavioural finance.

All these money-saving tips should be applied gradually: forcing yourself to become a ‘money-saving guru’ right away may have the opposite effect, because failing to apply each trick could lead to giving up altogether. Making small but steady progress is perhaps the best advice for a guide on how to save money.

Fun Fact

The best months to buy a car are March, June, September and December: in order to meet quarterly sales targets, dealers may offer you a better price.

Intervening on essential expenses is a bit more complex, but even here we have a few tricks for saving money. Food is essential, but deciding in advance what to eat, following a balanced food plan, can help you save money. When shopping, just stick to the list, but never go to the supermarket ‘on an empty stomach’, hunger might persuade you to buy superfluous things that might go to waste.

In general, buying online saves money, even better if it is second-hand (as on Ebay or Subito). Classic flea markets or stable second hand markets, however, are a good ‘traditional’ solution. You can also sell what you no longer use on the Internet, getting rid of the excess (decluttering).

Using public transport or a bike, looking for a roommate to pay the rent, as well as changing phone provider are other good methods. To save on electricity and gas bills, finally, the classic tips are still valid: compare suppliers, use LED or CFL bulbs, don’t leave appliances on stand-by, and use an Internet of Things smart tool to programme your home to save money.

Invest or save?

In a guide explaining how to save money, we cannot ignore the inflation factor: when prices rise, the same amount of money corresponds to fewer products and services of lower quality. Basically, putting aside the same budget every month is not enough, because the devaluation of the currency hinders us on the path to our financial goals.

Therefore, giving up spending cannot be the only method for monthly savings: it is necessary to actively defend your purchasing power. The last trick to save, therefore, may be to generate more value from your money.

In a nutshell, part of your income could be allocated to investment, so as to generate profit and consolidate savings. Investing, however, is an activity that entails risk: there are various financial instruments, but none can guarantee certain profit. In any case, all methods to understand how to save money are certainly not ‘passive’: they require planning, continuous revision and constant fighting of emotions. Saving is the first step in money management, perhaps the most complex, but crucial to achieving financial independence.