Crypto Governance: On-chain and Off-chain

June 24, 2021

9 min

In the world of cryptocurrencies, we hear a lot about governance. Some have a philosophical approach to it, while others have a technical or managerial approach. In all cases, the governance topic is of central importance to the entire sector, as it affects the success and adoption of blockchain technology.

What is Governance?

Governance

The set of principles, rules and procedures concerning the management and governance of a company, an institution or a collective phenomenon.

Among the many elements that make up the foundations and functioning of a cryptocurrency, one of the most important is certainly the governance system.

The philosophy behind the governance system in the world of cryptocurrencies is the decentralisation of the entire decision-making process, i.e. each person entitled to vote can express their intentions in a totally ‘autonomous‘ manner and therefore without the need for the action of third parties. Over time, different approaches and methodologies have developed, each with specific and often opposing characteristics.

The role of Governance in a Crypto Project

Governance plays a key role in the whole life of a Blockchain & Crypto project, because the decisions taken by the community heavily influence its future. A vote can affect both the microenvironment (e.g.: funds to be allocated to R&D) and the macroenvironment (e.g.: new functionality or long-term goal).

Good governance, like that known in business, is the key to increasing the probability of success of any project in the crypto world.

Stakeholder

Anyone directly or indirectly involved in a project or in the activity of a company.

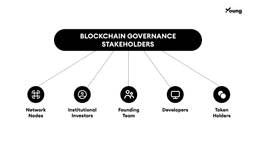

The Project’s Stakeholders

The targets of governance are the stakeholders, i.e. the different subjects who have a specific interest in the organisation. Normally the stakeholders are very numerous, each one has specific ambitions and it is very rare that they coincide.

In an organisation operating in the crypto sector, the following stakeholders are usually present:

- Project developers – these are the programmers who follow the development of the project and the protocol from a technical/IT point of view. Generally, their interest lies in purely technical aspects.

- Network nodes – are those people who provide their hardware/money to help validate the blocks on the Blockchain. Their interest is partially remuneration and maintaining the integrity of the network.

- Investors or token holders – they can be early-stage investors or simple investors who hold the tokens of the project in their portfolio. They generally have economic ambitions.

- The founding team of the project – these are the people who own the organisation and/or are the creators of the project and are key to the decisions and development strategy. Their main interest is in maintaining the original idea of the project and growth in the long term.

The primary objective of the chosen governance system is therefore to satisfy as best as possible the various and multiple interests at stake, while at the same time maintaining the original nature and sustainability of the project, especially that oriented towards the long term.

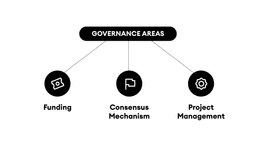

Governance Areas

The stakeholders we have seen in the previous paragraph operate together in 3 macro areas of governance:

- Funding – concerns any choice related to the administration of available funds, obtaining them and distributing them over the various operational areas.

- Consensus mechanism – the objective is to get all nodes to agree on the overall state of the system at any given moment in time by trying to converge the different visions of each.

- Project management – this is mainly about coordinating the development, assigning tasks and following the project roadmap.

These 3 functional areas are very similar to those that can be found in any traditional company, in fact, they encompass almost all the primary business needs. The decisions taken in each functional area form the medium to long term strategy. It is therefore clear that these three areas assume a very important strategic role for the organisation.

The correct governance mechanism guarantees a solid foundation necessary for the functioning of the organisation, and the simultaneous development of these areas theoretically guarantees the absence of any imbalances.

On-Chain vs Off-Chain Governance

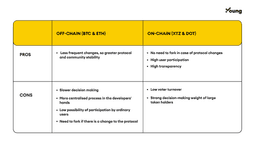

On a purely technical level, governance models can be divided into ‘on-chain’ and ‘off-chain’.

- On-Chain – In this type of governance, rules are written directly into the blockchain protocol and decisions are made through automated voting.

- Off-Chain – a model that replicates traditional corporate governance, where decisions are made outside the blockchain, through discussions and mediation between the interests of the parties.

Projects using on-chain governance include Tezos (XTZ), where users with a certain amount of Tezos can express themselves through a vote in practically all decisions. This is why Tezos is referred to as the project’s governance token.

Token holders who do not want to or cannot open a node can also easily delegate their vote to bakers.

Polkadot (DOT) on the other hand, uses several on-chain governance tools. Generally, however, the proposals are made by the public or the council, and the voting is done through a referendum where DOT token holders can vote. DOT, among its other functions, is also Polkadot’s governance token.

In this case, since the protocol is on-chain, if changes to the code or protocol were to be voted on by the community, they would not require a fork of the blockchain.

Governance Token

Governance tokens are usually the project’s backbone cryptocurrency and allow their holders to help shape the future of a protocol. Holders of governance tokens can influence decisions about the project, such as proposing or deciding on new feature proposals and even changing the governance system itself.

There are pros and cons for each governance mode, e.g. some possible criticalities of on-chain governance are the low turnover of voters and the strong decision-making weight of large token holders with a consequent possibility to manipulate the vote.

As far as the off-chain governance model is concerned, some examples are Ethereum and Bitcoin, both currently based on the proof-of-work algorithm. In particular, Ethereum in the near future will completely switch to the Proof-of-Stake algorithm and consequently, the governance model will be radically changed.

The main disadvantages of the off-chain model are the slowness of decision-making, the fact of having a relatively centralised process, the limited possibility of participation by ordinary token users and the need to fork the blockchain in case of protocol changes.

DAO (Decentralised Autonomous Organisation)

It is an organisation whose activities and executive power are obtained and managed through rules codified with Smart Contracts.

Automated Governance: DAOs

Organisations that adopt a fully autonomous and decentralised governance model are relatively new in the cryptocurrency sector, but have recently experienced considerable success and development. DAOs are totally independent even from the founding team as there is no central system in place to verify decisions. This function is carried out by the smart contract, which is normally public and verifiable by anyone. This is why organisations adopting the DAO-based governance system enjoy strong decentralisation and very high autonomy.

A successful case of the DAO is the Dash project, which has developed an increasingly refined decision-making mechanism over time. The system is currently based on ‘masternodes‘, i.e. nodes controlled by users who hold a minimum amount of Dash. Through these nodes, the community’s proposals can be voted on, but not only that, they also ensure the proper functioning of the blockchain itself.

MakerDAO, on the other hand, is the protocol at the base of the DAI stablecoin, and its peculiarity lies in the various possibilities that users have if they possess the MKR native governance token. Its governance is already on-chain, however, MakerDAO will officially become a DAO when the Foundation dissolves in January 2022.

DAO projects in recent years have attracted a lot of interest from users but also from big investors, maximum decentralisation is one of the big promises that these kinds of organisations aim to offer.

Conclusion

In order to fully understand the cryptocurrency sector, it is necessary to know the almost infinite facets of individual projects, and to do this a good starting point is certainly to delve into the governance of the projects that you find interesting. Behind a well-articulated governance system hides a lot of work both from a technological point of view but also from a philosophical and organisational one.

Assessing the governance of a project is also an important aspect of fundamental analysis, which, together with technical analysis, is the study needed to support any investment or purchase.