What’s the Order Book and how to read it?

March 21, 2023

10 min

Trading is not just about trying to predict the price of an asset, it requires knowing how to use tools such as exchanges and take advantage of all their services. Understanding how market makers work, advanced orders and how the order book works is fundamental to mastering an exchange and knowing how to choose one.

The order book: a pillar of finance

Before defining an order book and how it works, let’s take a step back to better understand the context in which this element fits in.

Crypto exchanges are those markets where cryptocurrencies are bought and sold, where demand meets supply. An exchange in particular is in charge of ensuring trade and access to liquidity even when demand does not perfectly and immediately match supply or vice versa.

In order to perform their function, exchanges may have different systems, which can be broadly grouped into two categories: order books and automated market makers.

The order book is the classic method that has always been used on the stock market, by traditional finance exchanges and brokers, and is often also adopted by centralised crypto exchanges. While order books were originally paper-based, they have now been replaced by software that updates them digitally.

Automated market makers, on the other hand, were introduced with the DEXes born in 2020, and are based on smart contracts and liquidity pools. Here, however, we will focus on what the order book is, how it works and how to read it in cryptocurrency trading.

The order book: what it is and how to read it

In any advanced trading platform, next to the price chart you can see a list of rapidly changing prices: at the top the numbers are red and at the bottom they are green.

Congratulations, you have found the exchange order book!

In the case of crypto exchanges, the trade book is a snapshot of all open limit orders for a certain pair of cryptocurrencies. Each pair represents a market: e.g. BTC/EUR represents the bitcoin-euro exchange market.

The fact that it only includes limit orders means that the book collects all open but not yet closed trading positions. It thus gives us a kind of sentiment that users have towards a market, and their reaction to price movements.

Let’s now see how an order book is organised and how to read it to understand what is happening in a market.

The items in the order book are shown in order of price and are divided into a ‘sell’ side and a ‘buy’ side. In the middle, between the sell side and the buy side, the spread is shown. Let’s look at the components of the order book one by one: what is the spread and how it is created.

The order book entries

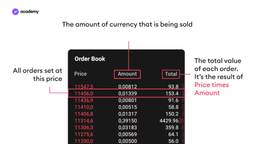

Each line of the order book consists of 3 elements:

- Price: a price at which some exchange users are willing to sell or buy, and have therefore opened orders. The price is always indicated in the base currency, i.e. the second one within the pair.

- Quantity: the sum of the order amounts set at a certain price.

- Total: The total value of the orders, which is obtained by multiplying the price with the quantity.

Example: If we take the highlighted line in the image below as a reference, we see that the amount of BTC sold at €11,456.00 is 0.01339. Those BTC usually do not belong to a single owner, but to all those who placed a limit order to sell at the price of €11,456.00. There can be two, four, ten traders. ù

The sell side of the order book: the offer

Within the order book, how to read supply and demand? Just refer to the colours.

The sell side is located at the top of the register and all entries are in red. Each line shows the sum of all open sell orders at a certain price level.

The selling prices of any cryptocurrency are called Ask prices.

They are read from the bottom upwards, i.e. starting with the cheapest price (Best ASK).

The cheapest price is always placed just above the spread. If you read the prices, you will notice that they are placed in ascending order, from the lowest price to the highest price, and are generally also executed in this order.

Sell orders (ASKs) represent the offer in the order book because they constitute the price offered to buyers of the asset.

The buy side of the order book: demand

The buy side is located in the lower section of the book and all entries are coloured green. As with the sell side, each entry indicates the sum of the amounts of all orders placed at a certain price. The buy prices marked here are called Bid prices and are read from top to bottom, i.e. starting with the highest price (Best BID). The highest price is always placed just below the spread.

The items on the buy side represent demand because they represent the price users are willing to pay to obtain the cryptocurrency.

The centre of the order book: what is the spread?

Between the sell and buy side, we find the current market price, called the mid-market price, or last price.

Next to this is the difference between bid and ask, the spread, or more precisely the difference between the best bid and the best ask: the bid-ask spread. The lower the spread, the more efficient and liquid the market of the pair we are looking at.

How order execution works

When a trader creates a limit order, it is added to the order book at the set price. At this point the user waits for the market to move towards their price and then the book executes it.

Sell orders are executed one at a time starting with the lowest, i.e. the cheapest price. Buy orders are completed starting with the highest price.

The Best ASK is the lowest price at which a cryptocurrency is sold. The Best BID is the highest price at which a cryptocurrency is bought. These are the best and most competitive prices for those who are buying and those who are selling, respectively.

As order B is completed, it moves on to the next (C), moving up the order book list. The same mechanism occurs for the order book buy list.

Example: The entire quantity of 2.51291 BTC at €11,033.9 (order A) must be exhausted first before the next price of €11034.0 (order B) can be reached.

If, however, the quantity of a certain order book entry does not meet the amount of your limit order, the book software will use the quantities of the following prices.

Example: If a user asks to sell 3 BTC, the best bid of 2.51291 BTC will not be enough to satisfy them, but the programme will also have to use the following 8 lines to match the amount, thus executing the order at an average price among those used.

So if the order book shows a possible future, what is it instead that shows us the trades that have actually been completed? Usually, you can see the history of executed orders in the trade history, as in the picture.

How to read a depth chart

The order book can also be displayed as a graph called a market depth or depth chart, which graphically represents supply and demand volumes.

The x-axis indicates the price, the y-axis the quantity. On the graph plane we find volumes in green for total buy orders, in red for total sell orders.

The areas in this chart can give us some indication of the liquidity and volatility of an asset.

- If supply and demand are equivalent, the two halves of the graph will be mirrored;

- If the asset is very liquid, due to excessive selling pressure relative to demand, the red area on the right will be larger;

- If the asset is illiquid, due to strong pressure from buyers over supply, the green area on the left will be larger.

Among the most common keys to the depth chart are the buy wall and sell wall. These indicate a build-up of orders at a certain price, and can signal impending price movements. If, in a case of strong liquidity, there are a lot of sellers at $100,700, it is likely that around this price area, it will fall sharply.

These are the basics of the order book: how it works and how to read it. You can now learn more about market makers and market takers, the real players on an exchange.