What is a Cryptocurrency Exchange?

April 29, 2022

7 min

Just as fiat currencies have a market, the forex market, where they can be traded and converted, cryptocurrencies have a market and a place where they can be exchanged too. Of course, we mean “place” in the virtual sense, as we are talking about a website or an online app.

There are mainly 3 types of markets on which cryptocurrencies can be traded:

- Brokers: financial intermediaries, who sometimes also support transactions between cryptocurrency markets and investors. Brokers do not trade cryptocurrencies per se, but CFDs, i.e. a derivative contract that takes its value from the cryptocurrency it refers to, according to prices set by the broker.

- Cryptocurrency exchanges: These platforms facilitate the buying and selling of cryptocurrencies based on daily market prices. They are mainly divided into centralised exchanges and decentralised exchanges.

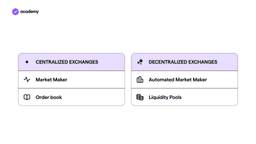

- Centralised exchanges (CEX): are overseen by a company that helps ensure that customer registration and buying and selling activity goes smoothly. They usually allow buying and selling both with euros or other fiat currencies and with cryptocurrencies. Here, it is usually easy to deposit and withdraw money with a bank account or card.

- Decentralised exchanges (DEX): these are not supervised by any third party or company, they are open-source and their operation is automated. DEXs also often require more technical expertise and in-depth knowledge of cryptocurrencies. They do not support fiat currencies and do not allow withdrawal and deposit via traditional payment systems.

Centralised Exchanges

Centralised exchanges are the easiest way to buy and sell cryptocurrencies.

Since 2010, centralised exchanges have evolved in terms of security, service and usability.

By working with regulators, enhancing security and improving the user experience and product, CEXs have played an important role in developing public and institutional trust in blockchain technologies and cryptocurrencies.

They are excellent starting points for those who have never invested and do not know cryptocurrencies in detail. Their use is very basic, buying and selling operations are simplified and they offer custody of both cryptocurrencies and fiat currencies.

With these platforms, it is possible to deposit, trade and withdraw in fiat currencies as well, so access to the service is easy for anyone. This is not possible on decentralised exchanges.

Memo

If you choose to store your cryptocurrencies on an exchange, it will store your private keys and keep your funds safe. This means you don’t have to worry about losing your wallet or private key.

Although decentralised exchanges have also grown a lot since 2020 in terms of volume and technology, they’re still a small part of the crypto market. As of March 2021, 92.8% of volumes are traded on centralised exchanges, which corresponds to approximately $1.44 trillion. The main problem with DEXs remains that they do not support fiat currencies and the banking system.

Regulation and Security

Centralised exchanges are subject to the regulations of the jurisdictions in which they operate, although these can vary considerably.

Initially, not all centralised exchanges were concerned about complying with anti-money laundering regulations or security practices such as identity verification. That’s a reason why bitcoin has been linked to illicit activities.

This scenario is typical of a disruptive and niche new technology. Within a few years, however, the world began to discover the immense potential of blockchain and digital assets, allowing the industry to mature rapidly.

In recent years, it’s the minimum requirement for centralised exchanges to work closely with and comply with the regulators in their locations. If a centralised exchange does not require identity verification before buying, it means it is not compliant and could be a scam.

Exchanges that prioritise security and compliance with anti-money laundering regulations have helped revamp the image of bitcoin and cryptocurrencies in general. Cryptocurrencies are thus proving to be a relevant and enduring part of the global economy.

How a Centralised Exchange Works

Centralised exchanges usually facilitate the buying and selling of cryptocurrencies in two ways:

- By matching supply and demand

- By providing deep liquidity for order execution

These are two sides of the same coin, in fact, the higher the supply and demand, the deeper the liquidity and the easier they are to meet.

This is ensured by two main components:

- The order book

- Market makers

The order book is a snapshot of supply and demand on the exchange, representing all the prices at which users are willing to buy and sell a certain quantity.

The exchange fills orders at the best possible price off-chain, i.e. not on the blockchain. This allows transactions to be executed faster and the execution price to be set.

Market makers, on the other hand, allow for the presence of numerous buy and sell orders, and consequently for there to be more liquidity in the exchange market. Market makers are companies or organised entities that facilitate trading on an exchange as they are always willing to buy and sell the required cryptocurrency.

How to use cryptocurrency pairs

On any exchange, you can trade with pairs, which means comparing one cryptocurrency to another, crypto or fiat. Each pair creates its own market, for example, if you select the EUR-BTC pair you will see the price of bitcoin in euros and the order book for this pair will be a list of all the orders from users who want to trade bitcoin for euros. In this case, the euro is the base currency, i.e. the one against which the prices of all others are compared.

Cryptocurrencies can also be converted into other cryptocurrencies, and for this, you will use for example ETH-BTC or USDT-BTC if you want to trade with the dollar price.

However, not all possible combinations of cryptocurrencies are available on exchanges. This is due to the fact that there is actually not enough demand on the market to convert e.g. Polkadot into BAT with the DOT-BAT pair, because very few people in rare cases would need to do just this conversion.

Instead, it is more common to find a cryptocurrency paired with Bitcoin, Ethereum and some stablecoins. Popular or fiat currency pegs provide an excellent basis for various trading strategies.

Would you like to learn more about this topic? We have an article that might interest you.