Do Kwon: from full moon to LUNA’s eclipse

May 17, 2022

9 min

Who is Do Kwon? The creator of Terra Luna, inspired by decentralisation and determined to improve the concept of ‘money’, conceptualised the algorithm that links LUNA to the UST stablecoin. As idealistic as it is practical, his goal of spreading cryptocurrencies globally may explain the birth of Terra Luna. However, the attempt to tie each DeFi project to its 1:1 reproduction of the dollar may have failed: we observe the dawn and possible sunset of LUNA and its inventor, Do Kwon.

Who is Do Kwon

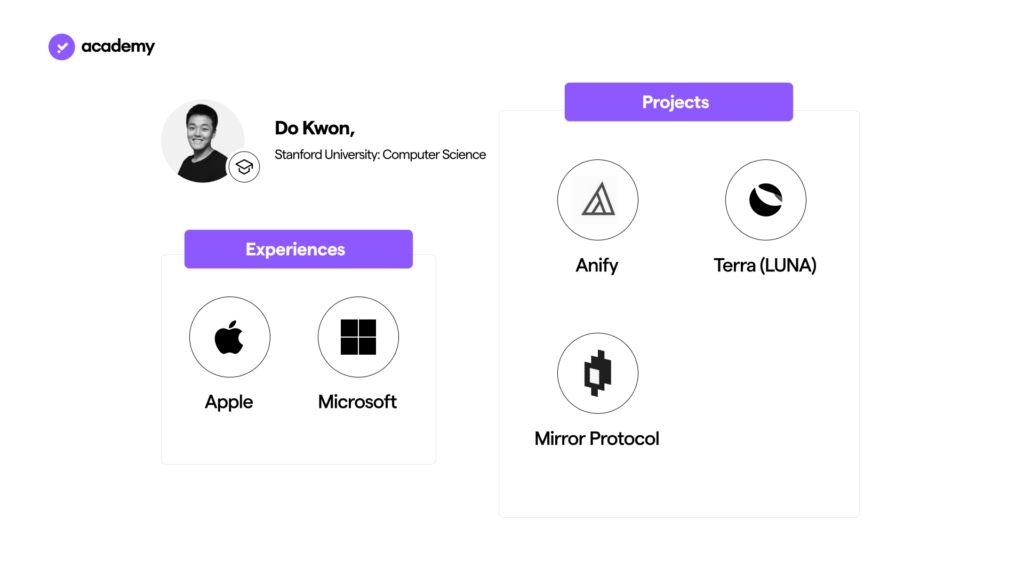

Do Kwon is an entrepreneur originally from South Korea and he is best known for founding and creating the Terra (LUNA) crypto ecosystem.

Kwon’s education is very prestigious: he studied in the United States and graduated in Computer Engineering at Stanford University in San Francisco. This enabled him to create an excellent business network, which was useful for his future entrepreneurial career. During his life, he spent some time in Canada and worked as a programmer for multinationals such as Apple and Microsoft.

Not immediately interested in the cryptocurrency industry, he nevertheless explores fundamental concepts for DeFi cryptocurrencies: in 2016 he founded Anify, a start-up for scalable, secure and accessible Peer-to-Peer (P2P) communication solutions. During this experience he became passionate about decentralisation and registered several patents in this regard.

In January 2018, he finally entered the cryptocurrency sector and, thanks to the solid experience he gained, founded Terraform Labs together with Daniel Shin and Nicholas Platias with the aim of creating a stablecoin payments network.

How Terra Luna was born

During his time at the Anify start-up, Kwon turned problems that emerged into opportunities. The young cryptocurrency industry needed to find consistency between the continuous price growth and the usefulness of its technology: only through this mix would mass adoption be possible. How was Terra Luna born? For this very reason: to create a stablecoin payment ecosystem that was easy to use, accessible and usable by anyone, both online and offline.

A bit of luck then brought Kwon together with Daniel Shin, who in the future would create South Korea’s largest e-commerce business. The entrepreneur was looking for new opportunities in the technology sector and realised the potential of the idea, so he decided to help Kwon launch the Terra Luna project.

Chai: Terra’s first app

The first dApp to be developed in the Terra ecosystem was Chai, which initially started out as an e-commerce, with the particularity of being able to handle all payments natively in crypto. Basically, anyone could make or receive payments in any fiat currency, convert it to stablecoins and finally exchange it for their local currency. The platform’s service fees were purposely set to zero and transactions executed in UST, the algorithmic stablecoin of the Terra platform.

The aim was to provide end consumers with a kind of ‘decentralised bank’ that supports popular payment systems such as credit cards, bank accounts, PayPal and, of course, cryptocurrency wallets. Decentralisation, which is important in the project, is reflected in the fact that no trust is required to execute exchanges: buyers and service providers do not verify each other’s profiles, but delegate this process to the smart contracts of the dApp.

After the Chai project spread, it became independent from Terra in terms of governance and internal economics; however, users continued to associate the innovation with the Terra Luna crypto ecosystem.

Terra’s mission and the centrality of stablecoins

Who is Do Kwon, if not his ideas and motivations? With Terra, Kwon starts from the premise that blockchain technology is certainly revolutionary, but as it has evolved, it has strayed from its original noble goals: mass adoption and improvement of the concept of currency.

The majority of crypto projects focus on the technical improvement of the blockchain, such as increasing scalability or adding new functionalities, Terra on the other hand aims high and strives to improve ‘upstream’ the monetary system and the general functioning of currencies. Its programme can be summarised in these points:

- Mass adoption – effectively using cryptocurrencies in everyday life, through Chai;

- Staking – for this purpose, the Anchor Protocol was devised, based entirely on Terra, which enables the receipt of rewards for stablecoin deposits. Here, the best staking functions are integrated with those of DeFi cryptocurrencies, such as in the possibility of obtaining loans or providing liquidity. The governance token associated with the protocol is the Anchor Token (ANC);

- Participating in DeFi – Mirror Protocol provides synthetic assets in a decentralised environment accessible to anyone. Users can, therefore, buy or sell these synthetic assets as if they were the originals, without the usually limiting requirements or barriers to entry.

These three pillars make up the foundations of the Terra Luna crypto ecosystem, just as everything revolves around the UST stablecoin: a new way of understanding the concept of ‘currency’, much more evolved, flexible, sustainable and powerful than the traditional one.

The multi-chain future of cryptocurrencies

The main reason for Terra Luna’s ecosystem to focus on compatibility with other blockchains is its very high specialisation.

Simply put, each blockchain has unique characteristics and specific functionalities, and these mean that each protocol can compete in performing a certain functionality better, while ignoring other aspects. For example, Ethereum is excellent at managing complex smart contracts, while Fantom (FTM) offers very high scalability; however, imagine the advantages that could be gained by exploiting both solutions.

In fact, the development of the Terra Luna ecosystem was designed from the outset to be compatible with as many protocols as possible: to date, the network has more than 100 projects, focused on the most diverse needs a user might have.

Similarly, the project started with the aim of becoming a multi-chain ecosystem: the goal is to gather the potential of different blockchain architectures. In this regard, developers are making Terra’s stablecoin increasingly compatible with other DeFi projects.

The fact of integrating with other projects, in addition to technical advantages, offers greater democratisation and decentralisation to the ecosystem, as one is not forced to use solutions developed by a single entity, but rather healthy competition is encouraged within the entire crypto ecosystem, which can result in ever better solutions.

Moon eclipse: the failure of UST

In May 2021, Do Kwon was investigated by the U.S. Securities and Exchange Commission (SEC) because he appears to have engaged in fundraising through the unauthorised sale of a security, specifically Mirror Protocol. The investigation is ongoing and unrelated to Terra Luna, although part of its network.

However, this was only the beginning of the difficulties: a year later, the entire Terra-Luna universe may have come to an end, following the collision of its two satellites: LUNA and UST. The dynamics are still unclear, but let us try to summarise the events that led UST to lose its dollar trajectory and LUNA to collapse under its own inflationary weight.

Beyond the theories about what happened, let us rely on irrefutable facts: Terra Luna’s algorithm causes the capitalisations of LUNA and UST to influence each other, so that the supply of the former constantly adjusts the price of the latter. We have already explained this dollar-anchoring mechanism: in short, when Terra Luna’s stablecoin exceeds the unit price, a dollar of LUNA is converted right into a UST, so that the value of USTs decreases by increasing their number. Similarly, the algorithm sells one UST for one dollar of LUNA when the price of the stablecoin falls below one unit, so as to recover the value of one dollar for the increased scarcity (increasing, however, the supply of LUNA).

This algorithm has always been the crux of the system, but unfortunately it proved to be fallible. The general downward trend of the crypto market in May 2022 put the LUNA-UST balance in trouble, in addition to direct hostile actions: a person, whose identity is only a guess, would have borrowed a large number of Bitcoins, then converted part of them into UST. Having done so, he would have sold the remaining BTC together with the newly obtained stablecoins: this would have caused the failure of the algorithm, which would have been forced to put a large number of LUNA into the market in an attempt to recover the UST unit price.

The attack, in addition to causing the ‘depeg’ of UST from the dollar and the depreciation of LUNA due to hyperinflation, also affected Bitcoin, a ‘defence’ for Terra Luna: Do Kwon, precisely to avert the extinction of his ecosystem, had long been hoarding BTC in the coffers of the Luna Foundation Guard. His extreme anti-crisis plan was to lend these Bitcoins, at a favourable price, to centralised exchanges to provide liquidity to the BTC-UST pair, in an attempt to absorb the ‘sell off’. However, events led to a fall in the price of BTC, which had already been hit hard in the previous weeks, so that Do Kwon’s attempt was thwarted at the time of the collapse.

Do Kwon will now face his toughest challenge: restoring trust in the ecosystem and restoring authority to its creation. A mission worthy of a ‘crypto hero’, but a technological feat nonetheless: innovation proceeds by failure, only then will the best solutions find a chance to emerge. Will Terra Luna be able to rise from the ashes, will Do Kwon lift the fortunes of his idea? Impossible to predict, revolutions always bring unknowns, so stay up to date!