DYdX: what it is and how it works

July 26, 2023

8 min

DYdX is a decentralised exchange that allows users to trade derivatives. Let’s find out what it means and how its token works to answer the question ‘what is dYdX?’.

What is dYdX?

Before you can truly understand what dYdX is, it is essential to know the meaning of these 3 concepts:

- DEX

- Margin trading and leverage

- Derivatives

A DEX is a decentralised exchange, i.e. blockchain-based and functioning via smart contracts. It basically does not support the use of fiat currencies and requires autonomy in the custody of assets, in other words it is non-custodial.

On dYdX it is possible to do margin trading, which is a trading mode that uses leverage. In a nutshell, leverage allows you to multiply the capital that you can use for a trade, with the aim of multiplying your possible gains, but you also risk multiplying your losses.

Lastly, derivatives: on dYdX you can trade a specific type of financial instrument, perpetual contracts. These are derivative contracts, i.e. instruments that replicate the performance of another underlying financial instrument. The most popular example of a derivative are futures, but unlike them, perpetual contracts do not have an expiration date.

A trader using a perpetual can bet on the price going up or down, keeping the position open as long as they want and as long as they have sufficient collateral to cover the risk.

Derivatives are the perfect instruments for margin trading as they allow for more trading terms than would be possible with the pure underlying.

For example, with a perpetual of BTC you can also bet on the price dropping with 2x leverage, whereas by trading BTC directly I have to follow the market by only betting on the rise and can only use the capital you actually hold.

This makes direct BTC trading more limited in strategies, but also safer and less risky.

So that’s what dYdX is: the first decentralised exchange for leveraged trading of cryptocurrency-based perpetuals.

How dYdX works

As seen in the previous paragraph, defining this protocol in turn requires many definitions, yet we have only skimmed the surface of dYdX: what is it on a technical and practical level? Let us look at its technological solution and how it works.

It is very difficult for a blockchain to achieve maximum decentralisation, scalability and security at the same time. In DeFi applications, there is another problem: maintaining composability and compatibility as well. In the case of dYdX, its developers have chosen to sacrifice precisely these aspects, in order to maximise performance and decentralisation. Let us see how.

DYdX is based on Starkware, an Ethereum Layer-2 on which a DEX-specific ZK rollup has been programmed. Starkware is thus optimised according to the needs of dYdX: the rollup does not support other applications and is not compatible with EVM, i.e. the Ethereum development environment. In return, the safekeeping of funds is handled on Ethereum, as is the final recording of transactions.

Beware, however, a change is just around the corner: version 4 of the protocol (currently under public testing) will move operations to a native Proof-of-Stake blockchain, the dYdX Chain, with the aim of decentralising DEX operation to the maximum.

It is important to note another peculiarity of dYdX: unlike other popular DEXs such as UniSwap or Curve, it does not rely on an automated market maker (AMM) to facilitate trading.

Instead, the platform uses a traditional model that combines the order book with an order matching system to meet the expectations and needs of professional and institutional traders.

To ensure a high level of liquidity to trades, dYdX also encourages the provision of liquidity by professional market makers in the liquidity pool.

So how do you use dYdX? First, traders need to deposit collateral in USDC. The amount required depends on the size of the position and the level of leverage the trader is using. Once a position is opened, users can profit if the price of the underlying asset moves in the direction of their trade.

DYdX, however, is not only a DEX, but also a decentralised lending platform: it allows lending and borrowing cryptocurrencies and also offers a flash loan option.

History and governance of dYdX

Before we find out what DYDX, the protocol token, is, let’s retrace our steps to get to know the team and organisations behind it.

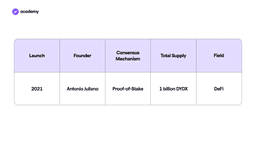

DYdX is the brainchild of Antonio Juliano, a former software engineer at Uber and Coinbase. The inspiration came right here, where some of the most important people in the industry had been guests. Thus, listening to the speeches of Vitalik Buterin and the founder of Polychain Capital, Antonio started thinking about how he could contribute to DeFi.

So he founded dYdX Trading, a company that launched the first version of the protocol on Ethereum in July 2017. The first funding rounds came from none other than A16z and Polychain Capital, later joined by names such as Three Arrows Capital and Paradigm.

In April 2021, the Layer 2 version was released to the public. In the same year, the creation of the dYdX Foundation was announced, with the aim of starting a path towards the total decentralisation of the project.

While the Foundation manages the project funds and guides the governance towards the transition to a DAO system, the development team under the company dYdX Trading is also working on decentralising the order book and order execution process at the technical level.

The protocol DAO will be divided into sub-DAOs with different responsibilities. Next in line are the Grants and Operations sub-DAOs, which will respectively be responsible for managing funding for community members contributing to the project, and for creating an operations manual for the launch of future sub-DAOs. After that will come the ‘finance and treasury management’, ‘growth’, ‘risk management’, and ‘community’ subDAOs.

Fun fact

dYdX owes its name to a mathematical formula used to calculate the derivative of a function. In general, it is used to calculate the rate of change and is applied in physics and engineering, but also in finance. It is used, in fact, to calculate the risk and return of an asset.

At this point, we are missing only one element to get a complete picture of what dYdX is: its token.

DYDX: tokenomics and use cases

If dYdX is a DEX, what is DYDX? Like many DeFi tokens, it is an ERC-20, created on 3 August 2021 and released via a major airdrop a month later.

The remainder of the supply is planned to be released gradually over five years (until 2026).

According to the Tokenomics, this is the initial allocation:

- 27.7% to investors

- 25.0% to trading rewards

- 15.3% to employees and consultants of dYdX Trading and the Foundation

- 7.5% to the Airdrop

- 7.5% to liquidity providers

- 7.0% to future employees and consultants

- 5.0% to the Treasury

- 2.5% to the Liquidity Staking Pool

- 2.5% at the Safety Staking Pool

As the distribution suggests, the token has multiple roles within the ecosystem, and as many use cases. The main one is to facilitate community participation in project governance. DYDX also constitutes rewards for staking, trading, providing liquidity, and grants a discount on trading fees based on the amount held.

What is dYdX then? It is certainly a cutting-edge protocol, rich in functionality and utility, thanks to a specific mission on which it has focused all its forces: decentralising the exchange of derivatives.