Hayden Adams and Uniswap: the DEX revolution

July 20, 2022

10 min

Decentralised exchanges (DEX) are the cornerstone of DeFi, the foundation of many blockchain projects, essential for distributing tokens and raising liquidity. DEXs are in fact exchange (swap) platforms for cryptocurrencies, administered impartially by algorithms and smart contracts, as well as being one of the first forms of decentralised application (DApp). Let’s find out, then, how Uniswap, one of the first and most popular decentralised exchanges, came into being, and who Hayden Adams, its resilient creator, is.

Who is Hayden Adams: unstoppable, just like the blockchain

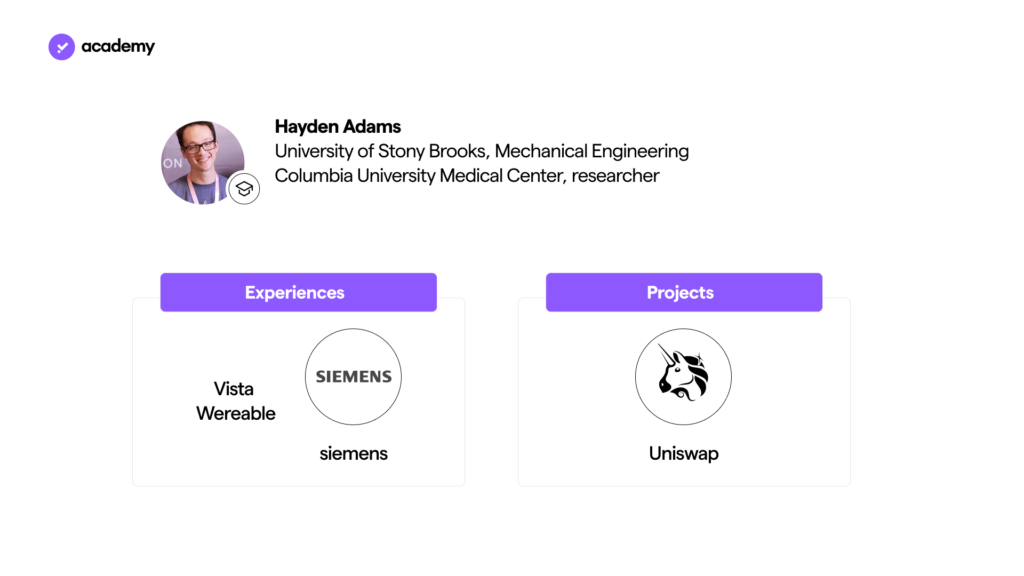

A highly specialised education is the first answer to the question of ‘who is Hayden Adams?’. In fact, the young man from New York earned the title of mechanical engineer at Stony Brooks University. This career seemed to suit him, so much so that after briefly designing wearable devices for Vista Wearable, he was hired by Siemens.

However, his study of fluid dynamics was ‘unfortunately’ very short : in July 2017 Hayden was fired and forced to return to live with his parents, dejected and uncertain about the future.

Against all expectations, this defeat was his chance for redemption. To understand how Uniswap, the mother project of decentralised finance (DeFi), came into being, we need to delve into Hayden Adams’ feelings of failure.

Where to start? The idea of a decentralised exchange with automated market maker (DEX with AMM) did not spring up overnight: its innovation was, rather, the product of a collaboration, with the participation of the wider Ethereum community.

Disappointed by his dismissal, Hayden called his friend Karl Floersch, a member of the Ethereum Foundation (EF), for comfort. The latter, unexpectedly enthusiastic, commented: “this is the best thing that could have happened to you! “, advising him to start writing codes for smart contracts.

Hayden, confused by Karl’s enthusiasm, saw programming as too far removed from his background, but was convinced by the characteristics of the blockchain: unstoppable, peer-to-peer and shared, with no central authority. So, buying some cryptocurrency, he spent the next two months studying Ethereum and the Solidity programming language.

Having measured himself against ‘simple’ codes for token smart contracts, Hayden wanted an application challenge, so he asked for advice again. Karl, this time, suggested that he develop a suggestion from Vitalik Buterin, the founder of Ethereum: implementing an AMM in a DEX, based on the example of the prediction markets of Gnosis and Augur .

This led to the formulation of the Uniswap smart contract for the exchange of cryptocurrencies, based on the x*y=k curve: thanks to the liquidity provided, at that time, by only one Liquidity Provider (LP), anyone could convert Ether (ETH) into ERC-20 ethereum tokens, according to the pairs available in the prototype decentralised exchange.

How Uniswap came to be: meeting Vitalik

Adams’s personal learning experience soon became a serious attempt to build a decentralised application (DApp) in accordance with Ethereum’s values:

- trustless: no need to place trust in a centralised entity;

- permissionless: open to all;

- resistant to censorship.

Uniswap wanted to be a virtuous example of an Ethereum project. Thus, on the strength of the initial proof-of-concept, Hayden travelled to attend all the Ethereum 2018 events (such as Devcon 3) to engage with the community: he found enthusiasts extremely welcoming, just like the open source and permissionless codes.

While evaluating similar DEX projects, such as EtherDelta, he discovered the need for an intuitive interface: he hired Calill Capuozzo to take care of the user experience (UX) of Uniswap. At the same time, Hayden added several ETH-ERC20 pairs and the possibility of having more than one Liquidity Provider (LP) to the DEX smart contract.

Proof of Concept (PoC)

Proof of Concept (PoC) is the first form of a project, a prototype built to assess its merits, and possible limitations, and the merit of funding. It simulates the operation of an application or system to demonstrate the basic idea.

However, in April 2018, he began to come to terms with unemployment: the profits that had sustained him up to that point, from the ETHs he had initially purchased, were all but wiped out by an 80% collapse in the crypto market. Yet it was at that very moment that he chose to take an act of faith in his project: he used the last of his savings to fly to Seoul, where the 2018 Deconomy would take place.

Without a ticket, Hayden tried to sneak into the conference and was promptly rejected. Luck, however, did not desert him: he met Karl, who introduced him to the prophetic Vitalik Buterin, who, with disarming ease, read the entire code of Uniswap ‘version 0’ on his phone, before advising him to apply for funding from the Ethereum Foundation. The application for $50,000, plus the cost of an overhaul of the code, was sent shortly thereafter. With a bit of luck and a lot of effort, this is how Uniswap came to be.

Through a series of other events, such as Edcon 2018 and NYC blockchain week, Hayden presented and developed his AMM demo, which was always positively received for its respect for Ethereum values. Material help was not long in coming: the offices of Balance, an ethereum wallet startup, hosted Hayden, inviting him to share his progress weekly, and founder Richard Burton personally funded his efforts. However, he was not the only one: MakerDAO also frequently welcomed him to its NY office. This constant immersion in stimulating environments accompanied Hayden to his well-deserved reward: the EF accepted his grant application!

From V1 to V2: DeFi summer and Yield Farming

The formalised model of Uniswap refined the code and passed several security checks before being ready for launch, scheduled for the last day of Devcon 4, in Prague. Perhaps out of superstition, Hayden showed the finalised smart contracts to Vitalik. The creator of Ethereum, however, managed to find an error (repeated 20 times) in the word ‘recipient’: it had been misspelled as ‘recipeint’! Buterin’s contribution was crucial, especially considering that the name Uniswap was his idea. Initially called Unipeg, he suggested a name more consistent with the function of DEX, to make crypto-swaps. Who created Uniswap? Hayden Adams, but perhaps we should also recognise the merits of Vitalik Buterin.

On the 2nd of November 2018, Uniswap V1 went online. Hayden proudly tweeted: 30 thousand dollars flow into the pools of three tokens, all from one provider. The following night, however, he did not sleep for fear of a hack: the protocol, despite testing, could have hidden vulnerabilities, thus exposing him to theft. On the second day, he turned down the proposal of a million-dollar deposit, which would have exacerbated his concern: it was not yet the time for large volumes.

Uniswap began to be enriched with solutions, such as analytics on uniswap.info that allow monitoring statistics such as: the Total Value Locked (TVL) in the protocol, trading volumes and the most used pools. In this interview, Hayden celebrates precisely the contribution of the community, which was able to build similar tools on its own, calling it ‘the user-generated content of finance’.

Total Value Locked (TVL)

Total Value Locked (TVL) is the sum of the funds deposited by users in a decentralised finance protocol (DeFi). These funds can be used for various functions: staking, lending, liquidity mining, general yield farming.

DEX Uniswap, over time, gathered more and more liquidity: MakerDAO also transferred its pools from Oasis here. The growth of the project, however, needed more developers and funds, so Hayden organised a seed round of almost $2 million. This led to the update of the 18th of May 2020: V2 which corrected some bugs, improved code quality and introduced oracles. As Hayden predicts, they will be the key to coordinating the DeFi ecosystem, rather than bringing external data on-chain, at the stage when most cryptocurrency exchanges will take place in a decentralised manner (i.e. in DEX).

Uniswap, by potentially supporting all kinds of tokens, directly benefited from the ‘DeFi summer‘, the incredible market growth in the summer of 2020. Especially so if we think of the explosion of Yield Farming: providing liquidity to pools in exchange for rewards is a key activity in Hayden’s DEX.

From V2 to V3: the governance of UNI

We already discussed the ‘vampire attack’ event in another article, but let’s briefly summarise it here: in September 2020, the AMM SushiSwap copied the UNI V2 code, incentivising users to transfer cash from Uniswap through discreet rewards, so as to fill the pools of the new DEX. A legitimate move, given the open source nature of the code, but Hayden admitted he had always been suspicious of the promoter’s intentions: Chef Nomi. SushiSwap’s leader ran an aggressive campaign on Twitter, asserting the need for DEX to have distributed governance among the community.

The launch of the SUSHI governance token, designed precisely to make Uniswap obsolete, accelerated the release of the UNI community token, in spite of Sushiswap’s plans: on 16th of September 2020, an airdrop distributed 150 million UNIs among 500,000 accounts.

Fact

In October 2020, trading volumes on Uniswap exceeded Coinbase’s monthly volumes for the first time.

Finally, we come to V3 of Uniswap. On the 5th of May 2021, concentrated liquidity, range orders and flexible fees were introduced. These innovations added efficiency to capital, but the real achievement, for Hayden, lies in the guarantee of expressiveness: liquidity providing has been professionalised, Uniswap allows complex ‘non-fungible’ strategies to be adopted according to one’s own forecasts. On Uniswap, it is possible to create tailor-made swap curves for each pair, without having to aggregate solutions from different DEX: the future will not see more AMMs but new approaches to swaps directly on Uniswap.

V3 thus preserves the values of Ethereum, and is protected by a 2-year software licence (expiration: 01/04/2023), so that the ecosystem develops ‘in house’ before competitors can copy the code. Although more cautious, the project remains consistent with its principles: the validity of this licence is, however, subject to the decisions of Uniswap’s governance. Hayden also planned to add scalability to the functionality of Uniswap V3, relying on Layer 2 solutions from Optimism and Arbitrum and Polygon.

Uniswap’s founder expects a ‘non-volatile’ future for crypto: mass adoption will narrow the price range, so that even passive LPs can receive rewards, without necessarily customising strategies.

Hayden’s vision will lead, so he hopes, to a fairer financial system that emancipates more people by redistributing wealth. However, it is not a certainty: rather a reality to be built on Uniswap, which could provide nearly $3 billion in funding through the Uniswap Grants Program. Hayden only needed 50,000 dollars, plus some ETH.