Axie Infinity is a blockchain-game, a videogame based on cryptocurrency technology. The game combines the element of metaverse with DeFi, in a Play-to-Earn model. Lunacia is the name of this virtual world, where you can collect, grow, fight and exchange crypto-monsters for rewards. The game economy is powered by ERC-20 and NFT tokens: every character, environment and game item is “non-fungible” and your fun will be rewarded. So let’s find out how to earn and play on Axie Infinity.

How and why was Axie Infinity created?

Web 2.0 gaming, hosted by online platforms, consoles and clients, offers its assets (graphics and 3D objects) to players, but they don’t actually own them and can’t use them outside the game.

Imagine if tools, skins or characters were exchangeable for real money: this is the concept behind Crypto Kitties, among the first examples of NFTs and blockchain games. Collectable kittens that, combined through a smart contract, generate other ERC-721 tokens based on a “genetic” algorithm.

The idea of giving users back control over their game progress, making it monetisable, inspired the creators of Axie Infinity. In fact, at the end of 2017, the team of Sky Mavis, a Vietnamese start-up, was formed precisely by playing with CryptoKitties: the goal of Aleksander Larsen (COO), Nguyen Trung (CEO), Anh Ho (CTO) and Jeffrey Zirlin became to educate on the potential of blockchain technology, while having fun. Dieter Shirley, creator of the ERC-721 standard and CTO at Dapper Labs (the company behind Crypto Kitties) was among the first to support this strategy: “Using games and entertainment to convey the values of decentralisation to billions of users”.

Play-to-Earn (P2E) has become the fundamental mechanism in the construction of DeFi video games such as Axie Infinity: built on Ethereum, it rewards the players’ entertainment as they contribute to the growth of the ecosystem: This makes them masters of their achievements and the economy thus created.

By playing a P2E, users can earn cryptocurrencies and NFTs: Sky Mavis has designed custom tokenomics for Axie Infinity, which leverages community growth to increase demand and thus the value of its tokens. These are NFTs but also two ERC-20s: AXS and SLP, the former being the basis for staking and governance, which we will see later.

In reality, Axie Infinity is rather a Pay-to-P2E: the “earning” is only possible once the first 3 pets, called Axies, are purchased, which are needed to perform any action in the game. So let’s find out what they are, where they “live” and why we should “raise” them.

P2E, GameFi

Play-to-Earn is the term used to describe many games on blockchain that are based on the principle of ownership of game assets and include DeFi or yield farming features. GameFi is the combination of “gaming” and Decentralised Finance (DeFi) and is a term often used as a synonym for P2E. GameFi, however, is better suited to refer to the micro-sector of the market that produces P2E games.

Axies and Lands: how Axie Infinity works

By downloading the Mavis Hub launcher or the mobile version of Axie Infinity, you can get to know the Axies, the little monsters that inhabit the fantasy universe of Lunacia, where they share environments called Terrarium. These creatures are distant relatives of the “pocket-monsters“: Pokémon and Tamagotchi. With the former they have in common collectability, characterisation by classes, statistics, special moves and an adventurous experience; while the possibility of looking after and growing little creatures is taken from the Japanese pocket game.

These two inspirations accompanied Sky Mavis all the way to the “Origin Presale”: 3112 cute little animals were adopted, in NFT format (token ERC-721), from February to April 2018. Although not much could be done about it initially, the Axies already had a certain complexity. Each NFT, in fact, had some metadata: class, body parts and “genes”.

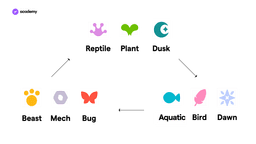

The 6 normal classes (Aquatic, Beast, Bird, Insect, Plant or Reptile) and the 3 secret classes (Dawn, Sunset, or Mechanical) are characterised by different strengths and weaknesses. Not only that: each Axie has been equipped with 6 body components, namely back, ears, eyes, horns, mouth and tail. The resulting combinations of non-fungible animals are almost infinite, making each NFT truly unique. What’s more, ¼ of the original Axies have “mystical” body parts, i.e. very rare occurrences (there are only 3 characters with “special” backs, horns, mouths and tails).

Active since May 2018, the “breeding” function introduces us to the Axies’ latest feature: genetics. Each little monster has a legacy of traits to pass on to its offspring: each body part is phenotyped by three genes, one dominant, one recessive and one minor recessive. Thus, with decreasing probability, the characteristics of the parents will be passed on to the pups: the new Axies, after hatching the eggs (which can also be purchased), will be larvae and then original adults. However, the mystical parts are not inheritable and each pair can have “only” 7 offspring: an anti-inflationary measure for this NFT “species”.

In January 2019, a quarter of the available land plots (tokenised in NFTs) were sold during the first “Land Sale” and, in December 2019, the marketplace was released where players could finally trade Axie, Land and other in-game items. The possibility of creating a metaverse of NFT components was already concrete, so much so that Sky Mavis formed partnerships with Decentraland and Sandbox. What’s more, MakerDAO created special NFTs for Axie Infinity users who generated DAIs, as well as rewarding Axie coaches who excelled in the game’s first season with 1000 DAIs.

YGG: scholarships for Axie Infinity

Finally, along with the marketplace, the first version of PvP was released: each trainer deploys 3 Axies to face other players in turn-based combat. So, these harmless little animals turned into warriors in the DeFi video game: let’s find out how Axie Infinity works.

PvP

Player versus Player is a common mode in video games, especially online. It can be competitive, giving rise to leaderboards, as well as a version of the game to face your friends, so you can compare each other’s progress. Some video games make PvP a competitive activity, creating “eSports”.

Thanks to the Origin update, since April 2022 you can play Axie Infinity for free, that is, with 3 standard (non-exchangeable) Axies already assigned. However, to earn rewards you will always need to buy 3 NFTs: in fall 2021 this could come to cost over a thousand dollars, a barrier to entry for many players. Thus, a “guild” was born to make Axie Infinity accessible: the Yield Guild Games (YGG).

YGG is a DAO that lends NFTs for DeFi video games. Its purpose is to allow users to play the game in exchange for a percentage of the rewards received from Play-to-Earn. So-called “Managers” entrust YGG’s “treasury” with their NFTs (e.g. Axies). Non-fungible tokens borrowed by players receiving the “scholarship” are drawn from this treasury.

Those who access the scholarship will learn how to optimise their Yield, i.e. the profit from Play-to-Earn games like Axie Infinity, and give part of their earnings to the Managers who are the original owners of the NFTs used. This economic model is absolutely “win-win”, as the Managers, as liquidity providers, receive percentages from the loan of their NFTs. The “students” in return earn money by playing and studying how blockchain and DeFi work.

YGG has since expanded its offering to other blockchain games, structuring itself into subDAOs specific to DeFi video game or geographic location. In fact, there is a distinct localisation of players: 40% of users connect from the Philippines, where monthly profit from Axie Infinity has exceeded the national minimum wage.

AXS and SLP: how to earn money on Axie Infinity

The secondary market for buying and selling NFTs (Axies, Land and items) is not the only profit opportunity for Axie Infinity players. In fact, the ecosystem has a multi-token economy based on the ERC-20 standard. Let’s go back to breeding for a better understanding: generating new Axies costs a commission in Axie Infinity Shard (AXS) and Smooth Love Potion (SLP).

SLP tokens can be earned by winning battles in the PvP Arena or participating in the PvE Adventure, and are exchangeable in some DEXs. SLPs intended for Play-to-Earn are infinite, but are burned by an algorithm every time an Axie is created through breeding.

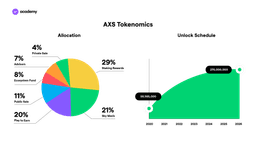

The tokenomics of AXS, on the other hand, are more complex: it was deployed in June 2020 through a private pre-sale and then in October through an IEO for public sale. The maximum supply is 270M, and will be fully issued by 2026. In addition, 21% has been retained by Sky Mavis, although the majority has been locked in for 4.5 years. In addition to percentages for advisors (7%) and ecosystem funds (8%), allocations for P2E and staking rewards are important.

54M AXS will be won as rewards from:

- Fighting in the arena and winning clashes (example: Season 21)

- Winning tournaments

- Caring for and interacting with your Land

- Using the marketplace

- Breeding Axies

These P2E rewards will be allocated from Community Treasury, where 4.25% of the marketplace fees and breeding fees are channelled. This fund will soon be governed by the token-holders as AXS will have a governance function. In 2022 it’s still limited to voting on minor issues. However, as early as September 2021 it’s possible to lock AXS into the staking dashboard: more than 78M tokens have been reserved for staking rewards, which will be released over the course of 5 years.

Ronin’s harakiri: from hacking to decentralisation

Axie Infinity’s smart contracts are primarily based on Ethereum. However, to make the application more scalable, Sky Mavis designed an Ethereum “side-chain” to house the entire game system and related functionalities.

This supporting blockchain is called Ronin. It has been in test-net since 2020, and adopts the Proof-of-Authority consensus mechanism: a solution that allows Sky Mavis to choose which nodes will certify transactions associated with the entire environment. PoA, despite the unwavering trust in the chosen validators, makes Ronin extremely closed and conservative, contrary to the common concept of participation in DeFi. However, in order to overcome this limitation, Sky Mavis CEO Trung Ngyugen admitted that the team is considering replacing PoA with dPoS (Delegated proof-of-stake), once a solid base of security for the project has been achieved.

Ronin has already done so in a sense: it has released the RON governance token (January 2022) that also supports staking and will serve as a means of payment for the blockchain.

However, the Ronin Bridge, which is used to transfer ETH and ERC-20 tokens into Ronin Wallets, was attacked on 23 March 2022: more than USD 600M (173,600 ETH and 25.5M USDC) was stolen through hacked private keys, with which two withdrawals were forged. The sidechain is administered, as mentioned, by only 9 nodes: at least five signatures would be needed to authorise deposits and withdrawals. In fact, the hacker managed to uncover five private keys: four from Sky Mavis, and one from Axie’s DAO, the community-controlled organisation that, through the distribution of AXS, will receive complete governance control.

The flaw was discovered only a week later, when a user was unable to withdraw 5000 ETH. This led to chain reactions, such as a 20% loss in the price of RON. At the beginning of April, the FBI acknowledged that the hacker group Lazurus (North Korea) was responsible for the attack. However, Sky Mavis promptly responded by reimbursing users for the stolen funds, partially covered by a $150M investment round organised by Binance, and by taking steps to improve security measures.

In fact, a $1 million bug bounty was set up to reward “white hat” hackers for discovering more vulnerabilities, and the number of PoA nodes was increased from 9 to 11, with plans to reach 21 and 100 in the long term.

In the case of GameFi, a greater degree of decentralisation of the network might have prevented such an incident, but there are so many factors at play. DeFi knows that technological innovations are not enough: tests and disclaimers can never be too many.

The conditions for improvement are there, and with its fascinating combination of genetic principles and complex tokenomics, this DeFi metaverse still has a lot to say.