Cardano vs Polkadot: Ethereum’s heirs face to face

June 28, 2022

10 min

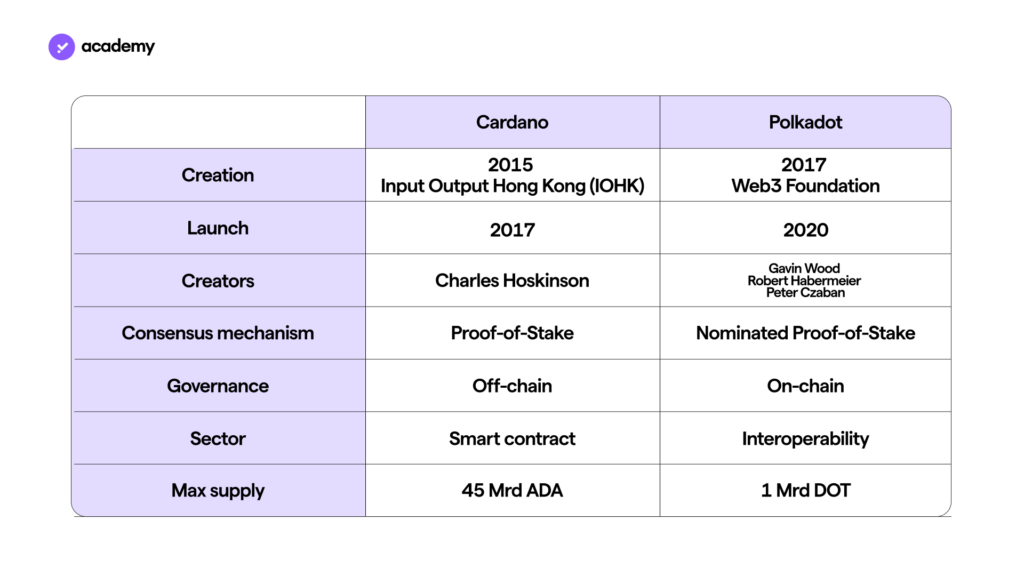

Polkadot and Cardano were created in opposition to Ethereum, in an ideological as well as a technical sense. Despite similar motivations behind their creation, these two proof-of-stake cryptocurrencies followed different paths after their release, distinguishing themselves in various aspects. Let us therefore discover the difference between Cardano and Polkadot, in particular by comparing their structures, scalability, consensus mechanisms and governance processes.

Polkadot and Cardano: Ethereum’s ‘daughters’ compared

The origins of Cardano (ADA) and Polkadot (DOT) are similar. Their creation followed the exit of their respective creators from the Ethereum Foundation, due to disagreements with Vitalik Buterin.

If you look at the story of the man who is changing the world, you will notice that Charles Hoskinson abandoned the Ethereum project in 2015, because he disagreed with the decision to make the foundation ‘non-profit’. Soon after, he founded a company called Input Output Hong Kong (IOHK) which eventually founded Cardano, a blockchain with meticulously researched ‘peer-review’ development.

The heated debate between the eight Ethereum founders initially spared Gavin Wood, but only briefly: in 2016, through the Web3 Foundation, he created Polkadot, a cryptocurrency to answer the questions left unanswered by Ethereum. In fact, Wood was disappointed with the ETH protocol, which was unable to deliver on its development promises, and went so far as to call its governance a ‘technocracy‘ due to the excessive importance of the few figures on the team. Polkadot, on the other hand, is a ‘blockchain of blockchains’ based on aggregation, sharing and interoperability, guaranteed by the help of parachains.

The different focus of the two projects gives us a first clue to the differences between Cardano and Polkadot, but it is now time to get to the core of the argument.

Polkadot and Cardano’s blockchain

A good place to start is by comparing the skeletons of the two blockchains, the basic architecture of how they work and the foundations behind the two technological solutions. Let’s find out what the building blocks behind Cardano and Polkadot are:

Cardano is a blockchain built on 2 ‘layers’ of software,

- The Settlement Layer (CSL): where peer-to-peer transactions take place. All information about wallets and their balances is contained here;

- The Computation Layer (CCL) is the operational part of Cardano, consisting of a set of protocols. It deals with the management of the various smart contracts, security and the generic operating rules of the entire infrastructure. Advanced functions are also implemented in this layer.

The functioning of the Polkadot blockchain is based on three elements:

- The Relay Chain: this is Polkadot’s main chain, or Layer 0, where validators certify transactions; these guarantee the security of the entire blockchain by adding the newly created blocks.

- Parachains and Parathreads: a parachain is a Layer 1 blockchain that exploits the security and core technology of Polkadot to create a large ecosystem populated by different use cases and solutions. To obtain a place as a parachain, alongside the Relay Chain, a project must win an auction where participation is highly coveted. A parathread, on the other hand, is a chain that can rely on Polkadot for a shorter period, in any case not permanently;

- Bridges: this component is very important, it allows communication with other protocols outside DOT, integrating them into the ecosystem. Other blockchains are the main candidates, e.g. Bitcoin and Ethereum already have their own bridge.

Now that you understand more behind the functioning of Cardano and Polkadot, it makes sense to wonder how the two projects make their respective solutions usable and achieve such wide adoption? This question can be answered by starting with the scalability aspect. Let’s go more in depth in our comparison between Cardano and Polkadot.

Scalability: is Cardano or Polkadot faster?

What does scalability mean? Basically, it is the ability to improve a network’s performance, or at least to maintain it stable. In the face of this are the challenges of an increasing number of users and, in the case of a blockchain, intensified transactions. Thus, a blockchain is scalable when it is able to handle an ever-increasing volume of transactions, without the network’s activity being congested, i.e. hampered by slowdowns and increased fees.

A measure of scalability, therefore, is the number of transactions per second (tps):

- Cardano (ADA): Cardano’s first testnet demonstrated its ability to process around 257 tps. However, on the 13th of September 2021, the Alonzo update opened up smart contract functionality for Cardano, including Hydra, a layer 2 scalability solution based on stacking pools. In a nutshell, each ‘pool’ represents a ‘head’ of the Hydra, capable of processing 1,000 tps. The first objective will be to guarantee a confirmation time for transactions of less than a second. The launch of Hydra is expected in late 2022, at the same time as the start of Cardano’s ‘Basho’ phase.

- Polkadot (DOT): Polkadot has an advantage over Cardano in terms of speed thanks to its parachains. In fact, although blocks containing transactions in DOT are added to the main blockchain (Relay chain), their validation can be carried out in parallel by parachains, thus ‘lightening the load’ of the main network. The increase in the number of parachains, therefore, will lead to an exponential growth of tps. However, Gavin Wood himself already stated in 2020 that “even without parachains or multithreading, [Polkadot] can process with a speed of more than 1,000 tps” even though the addition of other blockchains to the Relay chain will produce “perhaps 1,000,000 tps”.

The future of both blockchains looks promising, but will they be able to compete with the theorised 100,000 transactions per second of Ethereum 2.0? Will the ‘merge‘, which will definitively transform ETH’s consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS), render Cardano and Polkadot’s solutions obsolete? The future will decide, but, speaking of consensus mechanisms, they too are an important scalability factor.

The number of transactions per second that a network can process is strictly dependent on the type of consensus mechanism on which block production is based. Proof-of-Stake, in theory, should result in higher tps than PoW, which is demonstrated by the statistics just reported. However, what is the difference between the Proof-of-Stake algorithms of Cardano and Polkadot?

ADA vs DOT: Proof-of-Stake differences

The security of the Cardano and Polkadot blockchains is based on Proof-of-Stake (PoS) consensus mechanisms. In both cases, cryptocurrency staking is involved in several ways, but the two algorithms have some differences.

Cardano‘s Proof-of-Stake consensus mechanism is called Ouroboros, a name that expresses the concept of infinity: the ADA blockchain wants to achieve exponential growth. However, Cardano also cares about sustainability and ethics, as evidenced by its collaboration with the Ethiopian government. In a nutshell, Ouroboros entrusts the validation of blocks to the largest staking pools, yet also incorporates a randomness factor. In addition, each individual ADA holder can delegate his or her coins, so as to share rewards with validators.

Polkadot‘s Proof-of-Stake consensus algorithm, on the other hand, is called Nominated Proof-of-Stake (NPoS). It is similar to a proxy mechanism, but Nominators do not simply block their DOTs, but actively elect up to 16 Validators, who are then in charge of creating new blocks. Thus, it is not the size of the stake that guarantees validation rights, but the trust of the voters. Polkadot then defined precise reward mechanisms, possible consequences for unfair validators (slashing) and DOT inflation, but placed no upper limit on the number of validators: initially 20, it is expected to reach 1,000 in the mature phase of the protocol. Cardano and Polkadot both seem to be inclusive: any DOT and ADA holder can participate in various capacities in block validation.

Every blockchain, however, requires another level of ‘consensus’. We are talking about governance processes, through which the future of a protocol can be collectively decided. These mechanisms involve choices of various kinds, not just updates or additions of functionality: let us discover the difference between Polkadot and Cardano’s governance systems.

Governance: on-chain or off-chain?

The governance mechanism of a blockchain, i.e. the way decisions are made about different aspects of the project, has an important influence on technological progress. Indeed, token-holders can sometimes have a say in choices about protocol updates, allocation of funds and more; basically, this can be done in two ways: on-chain or off-chain. The first way involves the ‘signing’ of a transaction by the voter, whereas the second type of voting can take place outside the blockchain, in a variety of ways. Cardano and Polkadot also differ on this: the founders have adopted two different governance approaches for their ecosystems, but the future may bring them together.

Cardano’s governance model was created to be ‘off-chain‘ and ‘exclusive‘. In fact, at the launch of the project, ADA owners had no say: only the developers internal to IOHK and the Cardano Foundation could discuss and make decisions, engaged in the rigorous ‘peer-review‘ procedure. However, in the future, Cardano will welcome freedom of expression and scepticism. In fact, the roadmap, divided into phases, envisages one last update: Voltaire, i.e. the introduction of a voting and ‘treasury’ system, through which network participants will be able to use their stakes to decide the future of the protocol. There is currently no launch date, but it is likely that the governance mechanism will take place on-chain. In fact, there is already a DAO on Cardano, Project Catalyst, which allows the community to vote on-chain and to finance innovative projects.

Polkadot‘s governance takes place on-chain, through multiple and sophisticated voting and proposal mechanisms. The stated goal is to always guarantee decision-making power on the network to users who own the majority stake together, an important security measure. ADA token-holders collaborate with a ‘council‘ to administer the blockchain in the best possible way, through various on-chain governance tools.

Having understood the difference between Cardano and Polkadot, which solution do you prefer? These two blockchains compete for dominance, although they are still far behind Bitcoin and Ethereum. Which cryptocurrency will prove to be the much anticipated ‘Ethereum Killer‘? Our comparison between Cardano and Polkadot certainly cannot determine which code will win, but perhaps one can guess that both deserve a place in the future of the blockchain.