What is Bitcoin and how does it work?

June 19, 2024

11 min

Bitcoin is the first successful cryptocurrency. Even though others, before ‘Digital Gold’, were thought of, they were either never realised or implemented but never popularly adopted. In fact, Satoshi Nakamoto, themysterious inventor of Bitcoin, was the first to really make it possible for people to exchange value without the need for an intermediary: thanks to blockchain technology. Let’s find out together, then, what Bitcoin is, how a cryptocurrency works and what Bitcoin’s value depends on.

Bitcoin: what is it and how did it come about?

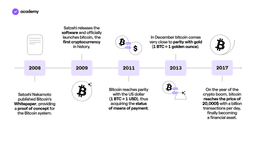

To understand what Bitcoin is and how it works, you must first understand its history. Let us start with the genesis: behind the pseudonym Satoshi Nakamoto, lies the extraordinary inventor of Bitcoin. In 2009, the person or group behind the pseudonym launched the cryptocurrency in response to the financial crisis. A project based on blockchain technology, capable of opposing the centralised and unequal global monetary system.

To this day, Nakamoto’s true identity is still unknown, although there are suppositions and a few self-proclaimed figures. We are not even sure whether the ‘creator of Bitcoin’ is rather a group of computer scientists or a single individual: a desire for anonymity that is not surprising. After all Bitcoin is a network of peers, no one exclusively owns its cryptographic code, not even the creator. Satoshi Nakamoto, therefore, did not need to present his authority for Bitcoin to work: this is decentralisation.

The enigma surrounding his identity, however, is something of a legend: in 2008 Satoshi published Bitcoin’s whitepaper online (Bitcoin: A Peer-to-Peer Electronic Cash System), a document in which he claimed to have created a payment system that did not need banks and was capable of transcending all geographical and political boundaries. Bitcoin, in fact, is exchanged peer-to-peer (p2p) and its security does not need the authority of third parties, as it is based on a cryptographic protocol. Moreover, its issuance curve follows an anti-inflationary algorithm: Bitcoin is designed to preserve its purchasing power over time, but its value will in any case be subject to the market, as we shall see.

While creating Bitcoin, Satoshi Nakamoto made use of already known concepts and technologies: cryptography, blockchain, the mechanism for validating transactions (Proof-of-Work), and even the very idea of ‘cryptocurrency‘ was not new. However, Nakamoto had the merit of combining and realising them. But where did these ideas originate?

Bitcoin: what is Cypherpunk?

Many concepts central to Bitcoin were developed by an online community: the Cypherpunks, a group of digital privacy activists led by figures such as Timothy May. As part of their mission, they wanted to create digital money that was as anonymous as cash. In fact, several experiments with digital currencies were already circulating on Cypherpunk mailing lists in the 1990s.

Adam Back, a British researcher, created hashcash: the mechanism for producing blocks, called Proof-of-Work, which later became a central component of Bitcoin. Another digital currency project, called b money, was conceived by a computer engineer named Wei Dai. In 1998, Nick Szabo sent his digital money project, called Bit Gold, to a small group of enthusiasts, including Wei Dai himself and Hal Finney. They tried to create a working version of it: Bit Gold was the closest attempt to Bitcoin, a scarce digital token, like gold, that could be sent electronically, without having to go through a central authority such as a bank.

The first people Satoshi Nakamoto emailed the Bitcoin white paper to were Mr. Back and Mr. Dai, perhaps in gratitude for their research. In addition, the recently deceased Mr. Finney helped Satoshi improve the Bitcoin software in the autumn of 2008, before it was released publicly.

The beginning of an era: the genesis of Bitcoin

The first block of a blockchain chain is known as the Genesis Block, and Bitcoin’s block marked the beginning of an era: created on 3 January 2009 at 18:18, its cryptographic reference code (hash) is known to all network participants as a starting point, a so-called ‘secure root’. In fact, each block is immutably linked to the first through the hash function, so as to build an eternal history of Bitcoin transactions, contained precisely in the blocks.

Satoshi decided to emphasise the historic event of Bitcoin’s birth by writing a message within the only transaction in the first block:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

The sentence refers to the headline of an article in the Times of 3 January 2009. At the time, in fact, we were still in the midst of a financial crisis and, with this comment, Satoshi Nakamoto wanted to state his motivations for creating Bitcoin, etching them into the genesis block. The sentence condenses Bitcoin’s antithetical stance to the current financial system, while at the same time representing a kind of manifesto: it ushers in the birth of an alternative monetary policy.

Bitcoin: what is a cryptocurrency and how does it work?

Bitcoin, acronymically referred to as BTC, is the first successful blockchain-based currency and the first successful application of this revolutionary technology.

Bitcoin is a cryptocurrency and, as such, has a monetary value, like any fiat currency. Unlike the latter, however, Bitcoin circulates in a decentralised system that does not require intermediaries, such as banks. The issuance and security of cryptocurrencies, in general, is programmed and controlled by cryptographic systems and algorithms called consensus mechanisms.

What is the value of Bitcoin?

The value of Bitcoin was not established at the moment of its creation, nor can it be actively regulated by governments or central banks. The fluctuation in the value of BTC depends essentially on trading volumes, i.e. on how much people and institutions buy or sell Bitcoin. Like any scarce commodity, the more people want to buy it, the more its price should rise. The law of supply and demand therefore drives its price.

However, for Bitcoin and other cryptocurrencies, you could recognise an intrinsic value, independent of the market factor. We are talking about the value and potential of the underlying technologies: cryptocurrencies are programmes developed on blockchain, and from the latter derive their advantages, namely cryptographic security, decentralisation and programmability. A currency for all controlled by none.

Indeed, being based on codes and algorithms, the functioning of cryptocurrencies depends on a predetermined logic. Bitcoin responds, in short, to a complex ‘set’ of conditions and automatisms, from which its use cases are derived. This has another valuable implication: subject to agreement between network participants, in a process called governance, the logic of cryptocurrencies can be adapted to new needs, precisely because of programmability.

Returning to Bitcoin’s tokenomics, Nakamoto set a maximum of 21 million Bitcoins, certainly divisible into smaller fractions (the minimum unit is called a ‘satoshi’ and corresponds to 0.00000001 Bitcoin), but with the idea that the low availability would guarantee greater stability to its value.

Bitcoins are produced and distributed as a reward for those (called miners) who keep the blockchain secure. However, the issuance of BTC has a particular pattern: every four years approximately, starting in 2009, the reward halves, according to an algorithm called Halving. Starting with a reward of 50 BTC per block, it is estimated that the last fraction of Bitcoin will be distributed in 2140. This system should, theoretically, counter Bitcoin’s inflation.

Despite the hype around Bitcoin as a potential means of payment of the future, in certain market scenarios many have considered it a safe haven asset, supported by the fact that it shares some characteristics with gold, such as scarcity: this is why it is also called ‘Digital Gold‘.

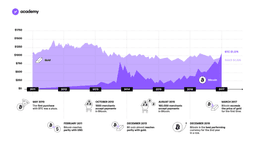

How has Bitcoin’s value evolved?

Bitcoin went from being a simple concept, outlined in Satoshi’s White Paper, to becoming a real currency. These are the most important stages in its history:

Bitcoin, however, in order to establish itself in the macro-economic context, will first have to achieve mass adoption. Its aims will not be met if it continues to live in the niche of ‘early adopters‘. Its spread, however, needs regulation first and foremost: clear laws that match the blockchain’s innovation. Indeed, cryptocurrencies cannot be treated in the same way as any other currency, given the characteristics just presented. New international agreements may free Bitcoin from prejudices, mainly due to a lack of knowledge of the technology. However, in South America and other territories under pressure from US dollar inflation, Bitcoin has already been purchased as a national reserve, thus making the cryptocurrency a legal tender.

Fun Fact

The first purchase in Bitcoin took place on 22 May 2010 and saw the exchange of 10,000 BTC for two family pizzas. Laszlo Hanyecz paid, in fact, about $40 in Bitcoin at Papa John’s pizzeria, Florida: since then, every 22 May is celebrated as ‘Bitcoin Pizza Day’.

In any case, it is important to emphasise that the value of Bitcoin has not drawn a steady arc of growth, but rather an oscillation between bear markets and bull markets. Volatility has often characterised the price of Bitcoin, between exciting highs and lows. However, Bitcoin’s price trend does not have to be a mystery: there are several tools to monitor it, such as supports and resistances or trendlines!

Bitcoin: what is long-term management

Of all cryptocurrencies, Bitcoin is the longest-lived. Its network has remained online and operational 99.98% of the time since its conception more than 10 years ago. Bitcoin is the only cryptocurrency to have a similar history: its code has proved an impregnable fortress for hackers, even when its value would have made an attack extremely profitable. This is certainly a fact: Bitcoin’s algorithm is secure.

This sentiment has since been reflected in the value of Bitcoin: while initially a subject of speculation, its technology has led some ‘holders’ (BTC holders) to see it as an instrument with potential in the medium to long term. The increasing adoption and use cases will stimulate the integration of Bitcoin and the real economy. This is likely to influence its value in the long term.

Bitcoin: the new Internet

To talk about what Bitcoin is is to address one of the most interesting technological innovations of the last 20 years. The change brought about by Bitcoin is by many compared to what the internet brought about at its birth..

Bitcoin is mainly known as cryptocurrency, but it is much more than that. To claim that Bitcoin is just a virtual currency would be like saying that the internet is just e-mail exchange. In fact, the applications of blockchain and cryptocurrencies, of which Bitcoin is an example, have gone as far as defining a new era: the Web3

If the Internet has democratised access to information, the dissemination of data and the possibility of access to knowledge, Bitcoin has democratised access to financial resources, the exchange of money and the transparency of information, challenging the current global financial system.