What is Yield Farming? Liquidity Mining, Staking and Lending compared

June 9, 2022

10 min

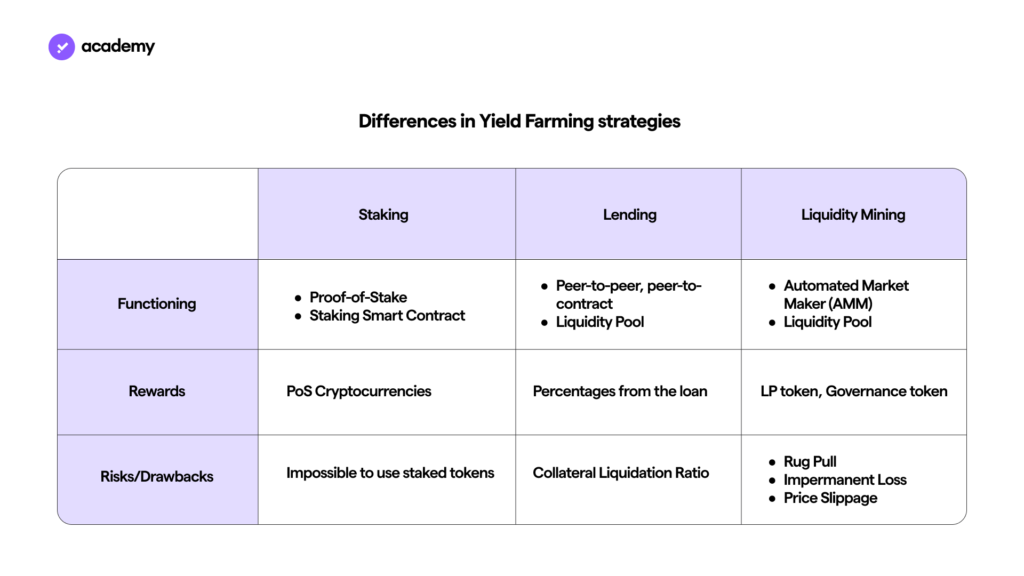

Decentralised Finance (DeFi) is anecosystem of modular protocols, a puzzle of possibilities for complex outcomes. Passive strategies areamong them: moving and locking your funds in some services can generate rewards. You may have already understood what Yield Farming is, a combination of activities such as staking, crypto lending and liquidity mining for crypto rewards. So, let’s find out what yield is and what the difference is between Yield farming, staking and other DeFi strategies.

What is Yield Farming: combined passive strategies

If you use the Young Platform exchange, you already know that participating in promising projects is a possibility, the results of which, however, are susceptible to your strategic choices and the poor predictability of the market.

Yield Farming

Yield Farming encompasses all instruments and activities that make it possible to reap frequent profits through the use of crypto-assets outside of trading. It is a typical service of DeFi, decentralised finance.

Although there are different versions of staking, crypto lending and liquidity mining, it is in their coordinated use that we find the true definition of yield: switching from one strategy to another, or employing them simultaneously, is what really explains what is truly behind Yield Farming.

Yield Farming vs Staking

The efficiency of Yield farming depends, therefore, on the alternating or combined use of options characterised by higher incentives: The APY* (Annualised Percentage Yield) measures the reward of a DeFi solution. This definition highlights an important aspect: the rewards generated are added to the initial token amount each time, resulting in the so-called ‘compound interest‘*.

Yield Farming is ‘modular’ just like DeFi: for example, tokens received from liquidity mining can be staked, just as the staking reward can be lent. Let’s go in order: by defining each of these activities, we get the full picture of Yield Farming.

Staking

Staking is a financial term unique to cryptocurrency markets. It consists of keeping one’s cryptocurrencies locked in a specific network in order to obtain rewards in return, in the form of cryptocurrency. Only some cryptocurrencies, which have a particular blockchain, support staking.

First of all, staking is the possibility of freezing cryptocurrencies based on Proof-of-Stake (PoS) blockchains in special wallets or smart contracts. In exchange for holding your cryptos, you get potential validation rewards. The PoS consensus mechanism underlying blockchain validation will distribute incentives according to different factors, just as there are different forms of PoS, depending on the blockchain concerned. However, they all generate some kind of reward: without performing any costly actions. As opposed to Proof-of-Work, you will be rewarded for contributing to the security of the network.

Ultimately, what is the difference between Yield Farming and staking? Staking is a form of Yield Farming, as the commitment of validators is generally incentivised in proportion to the stake. However, farmers usually move their funds around, looking for the best APY: staking, on the other hand, involves immobilisation and is therefore the least dynamic form of Yield Farming (short of Tezos‘ Liquid PoS or Fantom‘s liquid staking).

The minimum number of tokens to be staked can also be a barrier compared to other forms of Yield Farming. Being an autonomous validator requires 32 ETH for ethereum 2.0, and Avalanche demands 2000 AVAX: these are hefty sums, and are not necessarily accessible to everyone. Although there are more viable alternatives, such as DPoS, other Yield Farming strategies are not so demanding: let us understand, in this regard, what crypto lending is.

What is crypto lending?

Crypto lending is a similar concept to lending in traditional finance, but has different requirements and incentives, especially in DeFi. Trust between the parties is essential when it comes to lending: a bank needs to check your profile before granting the loan.Then, based on certain criteria such as risk level and creditworthiness, it will determine the fee, interest rate and maturity. The crypto world has similar centralised entities, which fall under the so-called CeFi sector but, unlike banks, they act as intermediaries between lenders and borrowers. However, peer-to-peer, or rather peer-to-contract, DeFi solutions also exist.

How does crypto lending work in Decentralised Finance (DeFi)? Liquidity Providers (LPs), the lenders, send their funds to smart contracts, called liquidity pools, which act as ‘containers’, from which the borrowers will then take sums in line with the collateral provided, paying a percentage to the LP. The elimination of the middleman makes DeFi lending an agile option for borrowers, as well as a yield farming opportunity for lenders. MakerDAO, Aave, Compound and Fantom provide this possibility.

However, the value of the collateral committed must exceed the amount borrowed, a necessary security measure. Even with overcollateralisation, however, there are certain risks: the committed crypto-asset could change in value over time, as it is subject to volatility, thus losing proportion to the loan. Therefore, the smart contract could sell your collateral to make up for this price difference. Preventing this has a cost: adding more cryptocurrencies as collateral so as not to break the ‘liquidation ratio‘. Read more about MakerDAO’s lending solution, based on the DAI stablecoin.

Decentralised crypto lending has a higher degree of complexity than centralised crypto lending or staking, as well as higher risks. The farmer has to monitor multiple platforms in order to allocate his tokens where they will have the highest yield, thus continuing to transfer them. The management burden, however, can be lightened by a DeFi service: for example Yearn Finance, the protocol (in beta) that optimises APY* by automatically choosing the best decentralised lending option.

Liquidity mining: how it works

Liquidity mining is the most recent form of Yield Farming, which exploded in the summer of 2020 with Compound, and is often used as its synonym.

So, here’s how it works. The LP deposits funds into a liquidity pool (as in crypto lending), which will be used by a decentralised exchange (DEX) for its Automated Market Maker (AMM), i.e. to provide liquidity for token trades between users and smart contracts.

Liquidity pools usually contain 2 different tokens or more (e.g. USDT and ETH), so as to represent a pair: they may have equal weights (50/50, as in Uniswap), or different proportions (as on Balancer).

LPs, in return, receive fees generated by transactions plus LP tokens, which correspond 1:1 to the liquidity that an LP has deposited, thus representing the LP’s share of a certain pool; in this way, the LP is in control of the deposited funds, which can be withdrawn as needed.

Thus, AMMs do not store the funds (they are non-custodial), which instead always remain under the direct control of their providers. LP tokens, however, do not only certify the ownership of liquidity: all those that comply with e.g. the ERC-20 standard can be used for staking or crypto-lending within the Ethereum ecosystem, thus multiplying the yield. The same thing is possible on blockchains that have developed these services. That’s what Yield Farming is: ‘compounding economy’.

In addition, LPs could also obtain new tokens: Compound, for instance, distributed its governance token (COMP) as a liquidity mining incentive. These tokens could later also be subject to crypto lending or staking.

Yield Farming: advantages and disadvantages

As in any aspect of finance, decentralised or otherwise, there are risks associated with liquidity mining and, more generally, with Yield Farming: even the best smart contracts on a technical level may have bugs, exposing them to potential hacks. DeFi is extremely new, so many dapps haven’t had time to carry out software audits yet.

Given the modularity of the protocols, and considering that most of them are based on the Ethereum standard, if one of the features needed for the farming strategy fails, then the whole system could be at risk. The interconnectedness of the building blocks, for which cryptocurrencies are often called ‘money lego‘, opens up endless possibilities, as long as they do not make the ecosystem fragile.

Triple-digit APYs* could then be masking a scam: promises of incredible profits from so-called meme-tokens, with names of animals or food, raise thousands of dollars then quickly lose value. Or, in the worst case, developers steal the cash from the pools, selling the tokens and then disappearing with immense capital: a fraud called ‘rug pull‘.

Then, there are other volatility-related disadvantages, primarily impermanent loss: here’s an example to understand what this consists of. An LP provides liquidity to the ETH-DAI pool, dividing its funds equally between the two elements of the pair. Suddenly the price of ETH rises: this gives arbitrage opportunities to traders, who can buy ETH, in exchange for DAI, at a lower price than the market price. This ‘discount’ will be applied until the pool returns to equilibrium, i.e. with an amount of DAI reflecting the real price of ETH. Following the event, an LP will have more DAI tokens and less ETH, a slight difference from when it was deposited: this is because LP tokens entitle it to a fixed percentage of the pool, which now counts less ETH and more DAI for the price change. By withdrawing the funds from the liquidity pool, this potential loss would then be realised: pure holding would have returned a higher premium! The concentrated liquidity of Uniswap’s V3, however, protects against this risk.

Finally, there is the price slippage factor: the difference between the expected price of a transaction and the price at which the transaction is actually executed. This phenomenon firstly affects traders carrying out swaps between tokens, in the absence of liquidity that can meet trading volumes, but it could also damage the liquidity provided by LPs. In times of high volatility, LP cryptocurrencies could be sold at prices below the real one, precisely because of the occurrence of price slippage: this would wipe out part of the LPs’ incentives, similar to the impermanent loss. However, Curve finance’s DEX algorithm or Uniswap’s V3 guarantee minimal ‘slippage’ in price.

In conclusion, the advantages of Yield Farming solutions have to be compared to the disadvantages just outlined: passive strategies still have a degree of risk, even though they exclude trading. Evaluate the authority of the instruments and always keep in mind the volatility of cryptocurrencies.

*The terms APY, APR and compound interest used here are also used by DeFi platforms for communication efficiency and simplification, however, the currencies or tokens used in these (unregulated) protocols are not to be considered financial instruments. The risks of these decentralised applications or protocols were also emphasised. In general, Young Platform articles are to be considered purely informative and do not constitute financial advice.